As promised in the introduction, I would share some market gaps. I frequently think of market gaps, more than I can bring to life myself, therefore I’d like to share them with you and you can make the best use of it. Although not all ideas are cryptocurrency related, this one is. This is my own idea, only the pieces of information are gathered from different websites as referred.

As the market of cryptocurrencies is growing, the market around cryptocurrencies will be growing as well. It’s like the Olympic games, if they come to a city, then you know that demand for related services like flights, hotels, food and local transportation will grow. You only have to think of the related services to find potential ideas. A few tags about cryptocurrencies are money, security, mining and investments.

So a related market would be the safe cold storage of cryptocurrencies, this is done by companies like Ledger and Trezor and they are very successful.

Another related market is the mining hardware, and this is why the stock of AMD has shot up since 2016.

A market not yet served (or at least limited) is Cryptocurrency Tax Advice. This becomes increasingly relevant, because the amount of money involved is growing at a fast pace. There are/will be some serious investors interested in running a cryptocurrency portfolio. They will search for a reliable place to trade and a reliable method to store, but what’s this reliability worth when they don’t know how their trades are taxed? Of course, there will be many people that consider cryptos as a black market, but as the market matures, people will want to declare their full wealth to avoid penalties.

If you want Cryptocurrency Tax Advice, where do you go? Your exchange? They will not make any statement and if they do it’s unreliable. Blogs? Same problem with reliability. Your tax authority? They have figured now how to tax Bitcoin, but what about the other 1000 of cryptocurrencies? And how to determine if someone is a private trader or professional trader? And is interest earned on crypto’s considered to be income? Tax authorities are endlessly flabbergasted with these questions.

That’s why a Cryptocurrency Tax Advisor is a real market gap. Such company serves both investors as tax authorities because both are not sure what’s wrong and right, it’s all to be discussed and agreed upon. Such advisor can collect rules of common practice and centralize all conclusions of tax authorities to make good advice. They could also provide or help investors with producing year end statements. In the end, the tax authorities just want to see income and wealth. A one pager with reliable numbers would be in the interest of all. I’m not sure if an international TAX advisor is realistic, because the rules are so different by country. It could be one company with local branches, but probably smaller national TAX companies work just as well.

For investors, the advantage of this company is that it’s less prone to market movements, because independent of market going up or down, everybody needs to make a TAX filing at the end of a year. Unless the market really disappears, but I don’t believe that will happen in a foreseeable future.

So now a few questions from a business plan perspective:

What does it require?

It needs people with knowledge and experience in tax regulations and pretty good understanding of cryptocurrencies. The Cryptocurrency Tax Advisor needs to speak local language and English for bridging between authorities and investors. Negotiating skills are required to collaborate with local tax authorities.

How does it compare to other markets and what’s the market size?

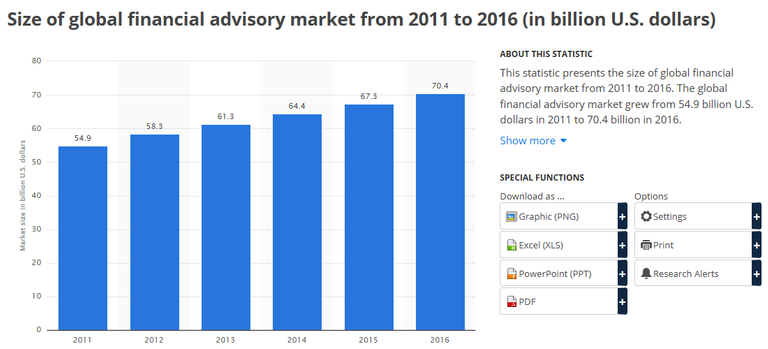

As this is a new market, there are no statistics available. To define the market we have to see what it compares to. Currently, tax advise is part of financial advise, not to be confused with investment advise. The firms offering these services usually have other services as well including accounting, insurances and financial planning. This list shows the usual suspects. As we can see in the grapgh from statista, the global financial advisory market had a market size of USD 70 Billion in 2016. So let’s make an assumption that 10% of the financial advisory companies revenues is allocated to Tax advise, then global tax advise would be a USD 7 billion market. Cryptocurrencies will only be a small part of this, but particularly when new things are new, advisory will be sought after. Let’s take the assumption that the questions related to cryptocurrencies would be between 1% and 5%. Then the global market for Cryptocurrency Tax Advise is worth between USD 70 and USD 350 million.

Competition?

Current financial advisors including the big 4 will naturally receive questions about this. But also their experience will be limited because it’s such a new phenomenon. The big 4 prefer big customers like high net worth individuals and institutional clients, but what if regular Ronald comes in for advise on his personal cryptocurrency portfolio that has grown beyond his imagination?! Furthermore, current financial advisors might defer to specialist – and there we’re back to field 1.

What to provide?

Advise on the taxability of year end balances and income + the rules to be considered a private or a professional trader + a statement that’s generally accepted by the tax authorities.

I expect professional traders will have to keep track of every trade and private traders to keep track of their balances.

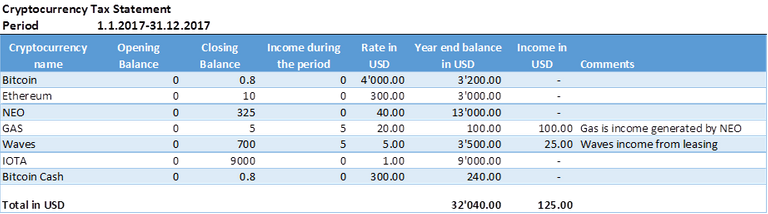

A private statement based on the shadow portfolio (follow me to get weekly updates) could look like this (Fake positions + fake prices!):

Budget

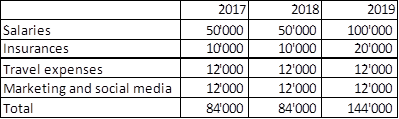

This is the beautiful thing of the service industry, other than time, it hardly requires investment to start. The company doesn’t need an office, vehicles or furniture. The only thing it needs are a website and good people. The basis of the MVP (if you don’t recognize this, read the Lean startup by Eric Ries), is the proof that conclusions are really based on conversations with TAX authorities. Like that, there will be trust that the advice is valuable and reliable. I think it needs 2 people to make sure continuity and they can have an MVP in a month time. The budget depends strongly on the salaries in a specific country, but I want to show something, so you can make your own conclusions. So you can put in any of number for salaries as you find realistic. Insurances are calculated as 20% of salaries. Travel expenses are considered to be USD 1’000 per month. Social media presence and marketing consists of website and active advertising through Google ads. Although I expect expenses to be low, I’d expect a 2 year period before being profitable and doubling the workforce after 2 years.

Timing

Start better sooner than later, because this is a market where experience pays off. Experience and reputation are the reasons people go to KPMG and PWC. Early stage Cryptocurrency Tax Advisors will have an advantage over later entrants. Even if the company wouldn’t succeed, the people will have gathered very valuable information.

Could we make a coin of it?

Cryptocurrency Tax Advise could be provided completely on a digital basis. As coins are currently created for every service, could tax advise also be squeezed in a smart contract? And what advantages would that have? Cointmarketcap currently has no coin listed that has “tax” in the name, that makes sense because who wants to buy that! The coin question opens a few other questions for me. Is it required to disclose the identity of the person requesting for tax advice? What are the risks for the Cryptocurrency Tax Advisor, not only from a legal standpoint, but also for reputation. Is advise based on factual items, or does it require a more conversational framework? I’m not cryptocurrency expert enough to determine what it requires to launch a cryptocurrency, but I think the services could be paid in cryptocurrency without the creation of a new coin.

Why do I believe in the idea and publish it anyway? 2 reasons:

-There will be only few that qualify to become a good Cryptocurrency Tax Advisor and I’m not qualified

-There’s place for multiple several Cryptocurrency Tax Advisors

If the right person would open this up in Kickstarter, I would probably invest!

I’m really curious about your opinion about this topic and I will use the result of this article to determine if I will write more of these or not.

So please, if you like it, let me know by upvoting, following and resteem.

This is a great post, and taxes are something EVERY cryptocurrency investor will eventually need to address in their respective countries.

Once site I've found helpful for keeping track of cryptocurrency asset trades and cost basis is : https://bitcoin.tax/

The site also includes a section for tax-professionals in the United States to help you properly report cryptocurrency income and capital gains. There will always be room for more though.

Thanks!