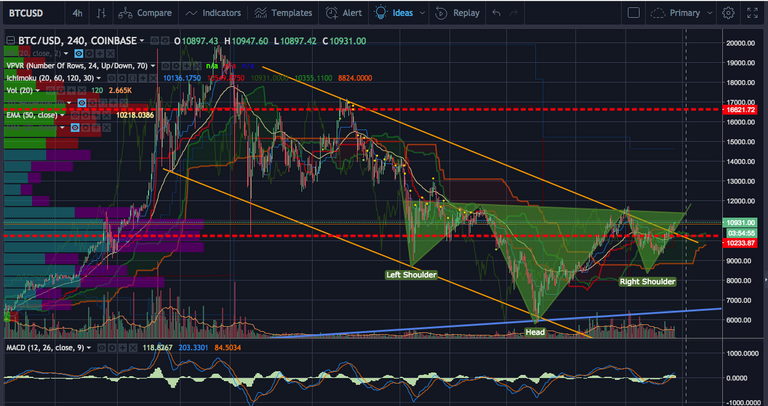

I've been patiently watching Bitcoin's action through it's down trend channel for a few weeks now. Today, it climbed above the top of the downtrend channel and closed a few candles outside it on the 4 hour chart.

For the first time in a long time, we're beginning to see several bullish indications.

- Volume is beginning to climb

- We're above 60+ day downtrend channel

- we're out of the green Kumo cloud, but still mostly a neutral territory in my book.

- MACD is showing bull signal and above the midpoint and spreading somewhat.

- RSI is climbing towards 75%

- OBV is steadily climbing.

We are also on our way to completing the right should of the inverse heads and shoulder, which is a bullish pattern, should it complete.

What I'm looking for at this point is for the bottom dotted red line to become support while the price continues to move into the apex of the wedge outlined in the top chart. All in all, things are looking up and we just continue to watch and gauge closely. If we complete the inverse heads and should and we break out of this wedge, then we're looking at a longer range target of around $16k USD, which is where the next bit Volume Pressure bar lives (the horizontal volume bars on the left).