Let's face it. With 1.5+ billion in USDT tokens issued and no way to confirm that Bitfinex (or whoever really owns Tether) is holding enough USD reserves to honor all those tokens, we're looking at a very risky situation owning USDT in our portfolios. At best, we'll eventually liquidate our USDT, no harm done. At worst, USDT will collapse and be exposed as a scam and more than 1.5 billion in wealth on paper will vanish in a heartbeat.

So that rumination begs the question: If USDT is not the solution/answer it's touted to be, then what is? Today, I bumped into Maker (MKR) and Dai (DAI) and am reading through their white paper and starting to think through some of the passages I read there.

It's really interesting because it's a decentralized way of doing what USDT does. As they state in the opening paragraph:

Popular digital assets such as Bitcoin (BTC) and Ether (ETH) are too volatile to be used as everyday currency. The value of a bitcoin often experiences large fluctuations, rising or falling by as much as 25% in a single day and occasionally rising over 300% in a month.

The authors go on to clarify:

Maker is a smart contract platform on Ethereum that backs and stabilizes the value of Dai through a dynamic system of Collateralized Debt Positions (CDPs), autonomous feedback mechanisms, and appropriately incentivized external actors.

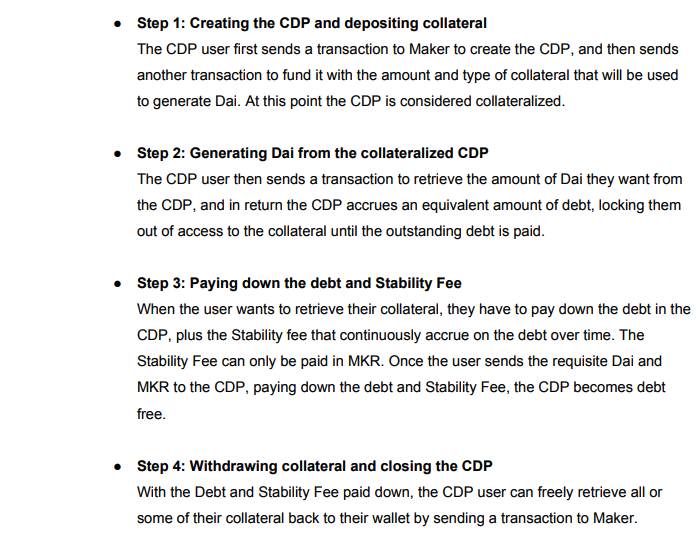

So what does that all mean, exactly? Well, the best way I found to understand it was their description of the entire user interaction with their product:

So, the first thought and question I had, was "what happens if the money you put in as collateral collapses in value? In this case, you're upside down and that's no good." I was pleasantly surprised to see that they'd thought about that and answered:

If there is a sudden market crash in ETH, and a CDP ends up containing more debt than the value of its collateral, the Maker Platform automatically dilutes the PETH to recapitalize the system. This means that the proportional claim of each PETH goes down.

But even so, how in the world can CDP in of itself keep the target price of Dai stable? Why won't people hoard or sell off massively and thus generate exactly the same volatility the rest of the market has? The answer is their Target Rate Feedback Mechanism or TRFM for short:

The TRFM is the automatic mechanism by which the Dai Stablecoin System adjusts the Target Rate in order to cause market forces to maintain stability of the Dai market price around the Target Price. The Target Rate determines the change of the Target Price over time, so it can act either as an incentive to hold Dai (if the Target Rate is positive) or an

incentive to borrow Dai (If the Target Rate is negative). When the TRFM is not engaged the target rate is fixed at 0%, so the target price doesn’t change over time and Dai is pegged.

But even that is not immune to an external attack on the ecosystem not unlike a DDoS (distributed denial of service) attack. To protect against just such an attack, this unique token has a final line of defense that cashes everyone out at fair market prices, called "Global Settlement" which is, as it should be, triggered by the holders of Maker tokens:

Global settlement is a process that can be used as a last resort to cryptographically guarantee the Target Price to holders of Dai. It shuts down and gracefully unwinds the Maker Platform while ensuring that all users, both Dai holders and CDP users, receive the net value of assets they are entitled to. The process is fully decentralized, and MKR voters govern access to it to ensure that it is only used in case of serious emergencies. Examples of serious emergencies are long term market irrationality, hacking or security breaches, and system upgrades.

Over time, Maker will add more ways to hold CDP and that will only serve to add stability and diversification to the platform. With that diversification, one other hurdle the project must overcome is CDP's how to handle positions that are growing risky or have become upside-down in collateral to debt ratio. Again, the team comes through with an automated and decentralized approach, stating:

To ensure there is always enough collateral in the system to cover the value of all outstanding Debt (according to the Target Price), a CDP can be liquidated if it is deemed to be too risky. The Maker Platform determines when to liquidate a CDP by comparing the Liquidation Ratio with the current collateral-to-debt ratio of the CDP.

There is more to this project, but the above ought to be enough to pique your interest and I highly encourage researching further and learning more! Start with their website and definitely read through their whitepaper

If there's an alternative to USDT, which I personally consider to be a complete sham that will eventually erupt into the next Mt. Gox, Maker just may be one of the best options available currently! I have more to learn, but I'm excited to have stumbled upon this project today and will be exploring further.

USDT is scary because of the lack of liquidity for everyday investors, but I don't buy into the fact that they don't have the fiat to back it up.

When Tether issues a million coins, those coins get sold on the market for (close to) a million dollars. They immediately have the fiat to back up every coin issued. Even dropping those million dollars into a regular savings account at 2% annual interest would leave them with plenty of profits to work with.

There is the potential that they invested some of their money into crypto, and lost out big when bitcoin plummeted. But unless they have an awful business model and zero oversight, one must assume that they have diversified their portfolio enough that they would have sufficient fiat to handle some withdrawls.

It's sort of the same argument as we have with fiat currency. There are not enough coins and bills in existence to cover even a tiny fraction of all the fiat currency that exists in the world, but since everyone isn't going to withdraw their physical fiat currency at once, the system carries on working just fine. The same is true for USDT. Even if they don't have sufficient fiat to back it up, it still continues to function as a currency pegged at 1USD so long as the currency's investors don't all withdraw their funds at once. The only thing that makes USDT scarier is that we don't know how much fiat they're holding, and they're less regulated than regular fiat systems.

It's a valid point and I have to assume that as long as cryptos are flying high over the ace of spades, the USDT business model will stay afloat. The biggest issue I have, and why I buy into the arguments that it's maybe not backed at all is that tether's whitepaper as well as follow up comments by the team talk about transparency and auditible records that will be regularly published for anyone to verify all claims on reserves. This has yet to happen, so until it does, it begs the question in my mind, "why not?"

@gibberishcode - They have made some efforts to provide greater transparency, example:

https://tether.to/wp-content/uploads/2017/09/Final-Tether-Consulting-Report-9-15-17_Redacted.pdf

It is concerning that these reports aren't coming out more often, but I think there might be concerns about disclosing too much information to competitors (and regulators) about where and how their money is being held.

Crypto is in an uncertain time where there's a great risk of government regulation or asset freezes for connections to illegal activities. Disclosing their banking information to too many parties could put Tether at risk.

This is similar to makers model. Except with maker, they have an auditable reserve. Tether could cash out for fiat dollars, buy lambs and have 0 accountability.

Dai also has parameters that incentivize creation and destruction dynamically, as opposed the the one way inflation process of tether creation.

Tether is a dangerous proposition and I would hate to be holding that bag,

I fear USDT, so I don’t use it. What I fear the most, is the overall effect on the cryptocurrencies market if it falls. The lack of liquidity may also attract the attention of authorities. I’ll give Maker a try.