Blockport claims to be building "a hybrid decentralized exchange with a strong focus on user-friendliness, social trading features and building a knowledge sharing community." As described in its paper, the long term Blockport platform will include the following features:

- A semi-decentralized exchange with individual wallets where users keep their own private keys

- A user friendly interface for trading, customizable by experience level

- Social trading features where users can follow and copy other traders

- Integration with other exchanges to facilitate illiquid trades.

- A knowledge sharing compontent like Quorum

Innovation

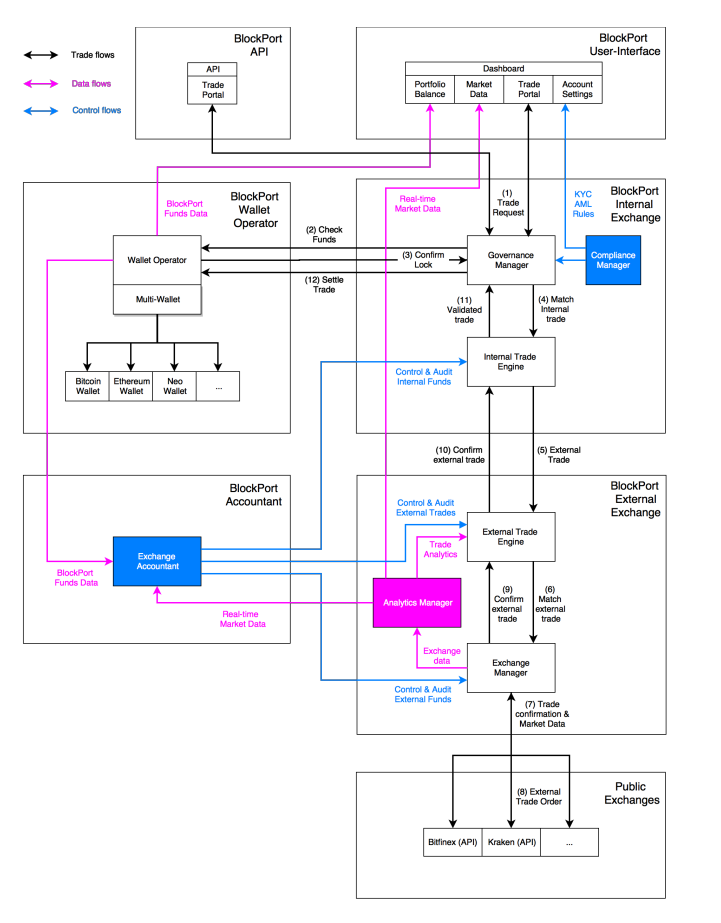

Blockport is a bold vision to tackle some of crypto's biggest issues - illiquidity, poor security, and abstruse trading platforms. As such, the core system touts the ability to interact with multiple exchanges while letting users maintain their own private keys. Users interact with a slick, user-interface (that looks very much like a recolored screenshot of Coinbase) as trades are sent to a Governance Manager that routes orders to both an Internal Trade Engine and an External Trade Engine if there isn't enough liquidity in the internal marketplace.

Blockport also introduces a feature called "social trading" which allows users to follow their favorite cryptotraders and align their portfolios to automatically follow those trades. This feature is also facilitated by the Governance Manager which automatically processes trades for followers.

The platform and the roadmap for this project is quite ambitious. While the internal/external exchange mechanism as been talked about in other projects, the social trading aspect is definitely novel and interesting.

Score: 9 out of 10

Ease of Execution

Most ambitious projects contain many moving parts and Blockport is no exception. The attempt to have a decentralized exchange and access to external exchanges and social trading and mechanisms to handle the normal slate of KYC/AML issues that exchanges normally face AND make them all work together is a monumental task with many moving parts.

To their credit, the Blockport team seems to understand this as illustrated by this very complex flow chart from their whitepaper:

What the team may have been amiss in is that without some sort of visibility on how they will get this all done and coded, outside investors have to really have faith in this enterprise to believe that this can be pulled off. For example, if users are allowed to maintain their own private wallets and trade from them, external factors like network congestion, exchange latency, and high mining fees could all make the platform practically unusable -- especially given the social trading context.

How do you treat situations where a follower would potentially spend more money on mining fees than purchasing the asset just because they decided to follow a whale that holds a very large and diverse portfolio?

Score: 3 out of 10

Adoption

Blockport isn't the first project to attempt to build a decentralized exchange so there is some baseline for evaluating adoption here. Two of the better known ones, EtherDelta and Bitshares Asset Exchange, trade at $27 million USD and $38 million USD daily volume respectively. While these numbers are nothing to sneeze at, a centralized exchange like Bitfinex boasts a daily volume of $3 billion USD.

Assuming Blockport 1.0 is on schedule for Q2 of 2018, it will still deliver without the private wallet or social trading feature, leaving it with only the external exchange feature -- it is unclear which exchange Blockport will first integrate into but there are many outstanding questions as to how this integration will work. My best estimate of adoption is low usage through 2018 until some of the keystone features get implemented and shows itself to be relatively bug free.

Like gaming, crypto trading is now somehow a spectator sport. I'm not sure if it's the legions of crypto millenials or the fact that there are just so many god damn Youtube videos of people doing crypto memes and charts but social trading could be massive draw looming in the distance. If things go well, however, there is an outside chance that this project could go viral in 2019.

Score: 4 out of 10

Riskiness

As mentioned previously, this project is big and complicated. Decentralized exchanges come with their own set of risks including AML/KYC regulatory scrutiny and scaling issues. Fortunately for Blockport, incorporating and operating out of the Netherlands will settle some stomachs as well as having some strategic partnerships in place.

As for the team, most of the team seem to have well-credentialed engineering backgrounds which will definitely help with the execution portion of this project. Clearly they are raising funds to expand the developer pool, and I won't hold the current team size against them. However, I feel like there is one thing I must say: For the love of god, talking about the co-founder's IQ and EQ in the whitepaper does not look professional whatsoever.

My biggest concern with this project revolves around the social trading aspect. While the traditional route of letting someone else manage your money is through peer-managed funds, not too dissimilar to Melonport, I understand this would be difficult combined users keeping their private keys. In many countries, a person being paid to make investment recommendations for another is called an investment adviser. Although, the relationship in a social trading context is a bit different, the substantive aspect of trading aspect is the same -- some guy makes money from making investment decisions that others follow. Depending on the jurisdiction, this guy may need professional certification or fulfillment of other legal obligations, which Blockport does not elaborate upon.

In addition, I don't know if the platform intends to inform the person being followed the extent of their following as a small trade by a trading star would have massive implications on a low volume asset. Would the person following game his followers by taking a different set of private positions through a different exchange account? Given all the allegations of market manipulation already circling within crypto conspiracy theory circles, social trading adds a dangerous new dimension to this game.

Social trading with lots of users using private wallets could simultaneously generate hundreds if not thousands of similar transactions across a blockchain, making network fees and latency a big determinant in who wins or loses from the trade.

Score: 4 out of 10

Total Score: 5 out of 10

tl;dr - Blockport is an ambitious vision fraught with risks and implementation difficulties.

Thanks, that's a very useful assessment. I hope enough people upvote you to justify the research effort.

Thanks for your support. Always happy to take suggestions and review requests as well!

i hope man this make your research good. check this . https://blog.blockport.io/blockport-announces-kucoin-integration/ blockport is doing something great again

Blockport is really something. i saw this post about them saying that BPT got promoted on premium market of kucoin. good job guys. https://blog.blockport.io/blockport-listed-on-kucoin-plus/