It has been said the past repeats over and over and only the minor details are different. It has also been said those who don't understand history are doomed to repeat it.

Ironically both of those things are usually said in hindsight as if to say 'I told you so' by those who told you nothing at all. For that reason I'm going to show you how our recent past may mirror what's happening today in the world of cryptocurrency so you can decide for yourself.

The tech boom of the late 90s was the beginning of the internet. What we are seeing now is the beginning of the internet of money. We're going to look at the first for clues to how the second may play out. We may or may not get the individual players right but what we're looking for is the overall paradigm.

One of the biggest high flyers of the tech boom was Amazon. Amazon drew everyone's attention. It offered convenience people hadn't experienced before. But people often had to wait a while for their goods to arrive. Eventually they changed their processes and delivery times were dramatically improved. When the bubble burst Amazon remained. Today it's one of, if not the, biggest player in many of its markets.

If we had to pick an Amazon a likely choice would be bitcoin. Sure, it has some capacity and delivery issues but all it needs to do is agree on changes and it's good to go.

Around the same era we also had Barnes and Noble. Going into a physical store the first time was quite the experience. Compared to previous bookstores it was huge. It was quiet. They let you sit and read the books if you wanted to. And they had a coffee bar. Barnes and Noble stock steadily rose and they were considered a major contender and then it peaked and their stock now trades about where it started. Barnes and Noble was a classic Mid Cap.

Perhaps the Barnes and Nobles of cryptocurrency are the Litecoins and the Dashes, among many others.

Books-A-Million was a holding company that decided to copy Amazon. They were great. I used to buy books from them at as little as 10% of retail then mark them back up for a quick profit. Their shares rocketed from 50 cents to $3.50 in a year. Then back down again. Then back up again. Then back down. BAMM was a microcap and acted like one. Of course the tech boom saw many others.

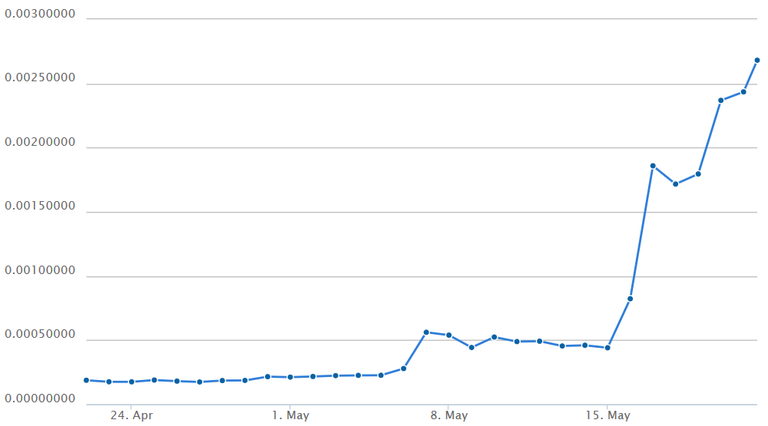

Our most micro of microcaps in the crypto world currently are the likes of Bitbean and Bytecoin, the difference being we're seeing increases of 200-300% not in months or years, but in days or even hours. Crypto has a lot of microcaps and timing is everything.

The one thing I can tell you with certainty is the current boom in cryptos will unfold quite similarly to the previous bubble. What I can't tell you for sure is which player is which. Innovation in cryptos is quite rapid and prospects change dramatically in minutes upon a news announcement and/or GitHub release, and sometimes upon nothing at all. As in the previous tech boom it is important to remember the quality of a product and its near to medium term financial prospects are often completely unrelated.

As an example I own a little Bitbean. The QT wallet synched from scratch in under an hour. When I received my first transaction I thought it wasn't working and quickly grew frustrated - until I realized I was waiting hours for a transaction that'd already gone through in seconds. Turns out Bitbean is exactly what I felt bitcoin failed to deliver. I'm not saying Bitbean is really the Amazon because the one that's the most awesome isn't always related to who wins the game even if it seems it should be. What I am saying is bitcoin should get its act together and emulate upstarts such as Bitbean. If they don't, the upstarts just might prevail.

That brings us to the Darth Vader risk - that Ethereum is Walmart. What we're seeing in cryptocurrency is free markets, innovation, and competition at its best. Ethereum is backed by big corporate interests and they hate that. If other cryptos aren't careful they could wake up one day to find Ethereum has patented every kind of electronic transaction conceivable and they've been outmaneuvered. When people finally break free to freedom, open markets, and competition, the corporate bastards do their best to resurrect the chains. If we can be sure of anything it's that this time will be no different.

So there you have it. Now you have the overall model of what's going to happen with cryptocurrencies. As to the details of which player is which I've given my input but the reality is you're on your own.

To quote Will Rogers:

'You pays your money and you takes your chances!'

The above is not financial advice, it's personal experience for entertainment purposes only. Experiences may vary. Actual financial advice should be obtained only from a registered financial adviser.

The difference with bitcoin, altcoin, crypto, tokens is that they are far more radical than the internet and computers.

You talk about a bubble : when that bubble bursts the money falls out. Crypto is very different - it changes the atmospheric make up; the way oxygen and pressure interact. It defines what money is and to who. It defines the very thing you are judging the bubble by.

Bitcoin may often be judged by its value against fiat. but it has far more value distinct from it.

My use of 'bubble' was neutral with no negative connotation. My intent was only to point out with any truly revolutionary idea the cycle of resistance, acceptance, and adoption is typically the same.

well said