Elliot_Waves

Elliot's index or waves are very important in determining and predicting the course of the currency based on an analysis of the behavior of a group of traders for many years ...

And the founder of this theory, the genius Ralph Nelson, where he discovered in 1920 that there is a path followed by the financial markets in the movement is more like a circle of a few steps.

This circuit is constantly being repeated and it has been discovered that the influence of investors on external influences such as some news, newspapers or reports is reflected repeatedly on the graph, and on the upward or downward movement of the market and that the movement on the patterns are divided into the so-called waves, Which we spoke about in the name of Elliott Wave Theory.

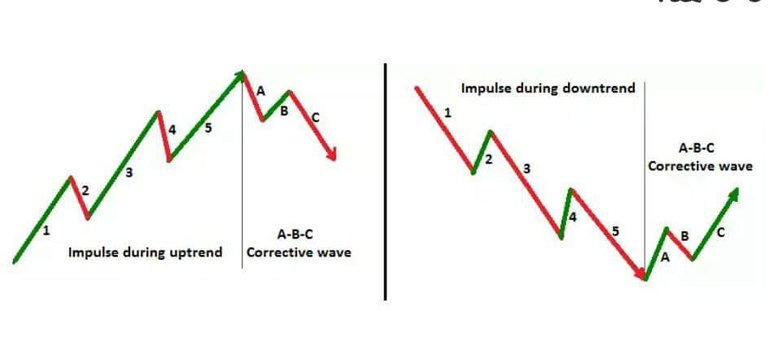

- Five wave modes and three corrective

Elliott found that the market moved in 8 waves, the first five waves and the last three corrective waves (ABC).

This theory can be used on traditional currencies, digital currencies, bonds, gold or oil.

First Wave :

The digital currency makes its first move up and this is often done by a significant number of traders (we will say that entering these categories for real reasons) for example because prices have reached low levels (study session) and are considered suitable for purchase at the moment Traders lead to the high price of this currency.

second wave

At that point many of the traders who entered the first wave began to feel that the current price exaggerated so they started to take profits, causing the currency to fall. But the price did not drop to the starting point, and then started to complete his bullish journey.

Third Wave

These are often considered to be the most long and powerful waves. The currency has caught the attention of many traders who want to enter into a trade. This causes the currency to rise higher and higher and this trend often exceeds several resistors.

Fourth wave

The wave in these traders to profit again, and this is because of the price of the currency for traders to become high or exaggerated, and also to the fact that many traders are waiting for the currency to decline slightly to do purchase it again.

The 5 wave

At this point many traders are entering the currency, and this is because of the hysteria of continuous price hikes. People continue to buy for reasons other than objective, and at that stage the price is very exaggerated and decline becomes just because of the time that sellers will begin their tour and do pal ABC.

And ABC is a corrective price movement after reaching the highest level when the fifth wave is achieved ...

If we have used in this article is an example of a rising currency to explain the theory of (Elliott) waves, it does not mean that the theory does not apply to the falling markets on the contrary, it applied the theory of Elliott Wave in both markets, both the ascending or descending ...

In the annexes you will find images of Elliott waves, in emerging and falling markets.

As well as download these waves on the statement of the currency bch / btc, which exploded recently price of $ 300 to exceed $ 950 ....

Currently we have Nmodj currency xrp / btc is still the third wave ....

USF_belfakir

Sorry for the weakness of language

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/cryptocurrencies/@achraf-semlali/waves-elliot

Good short summary. I'd be happy to see some follow ups with even more detail if you're up for it.