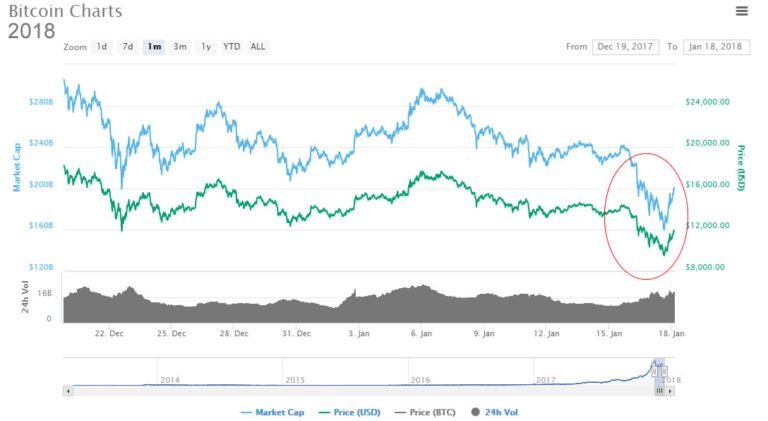

With more people entering the crypto markets than ever before, the seeds of fear, uncertainty, and doubt has a greater impact on price volatility. Newbie traders jumping in and out on the whims of social media hype, and then panic selling, causes what happened over the past couple of days. However, looking at historical crypto charts, this January dip is nothing new.

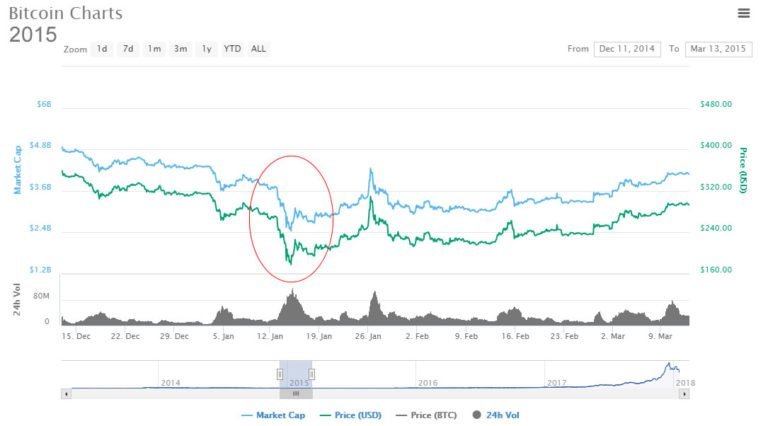

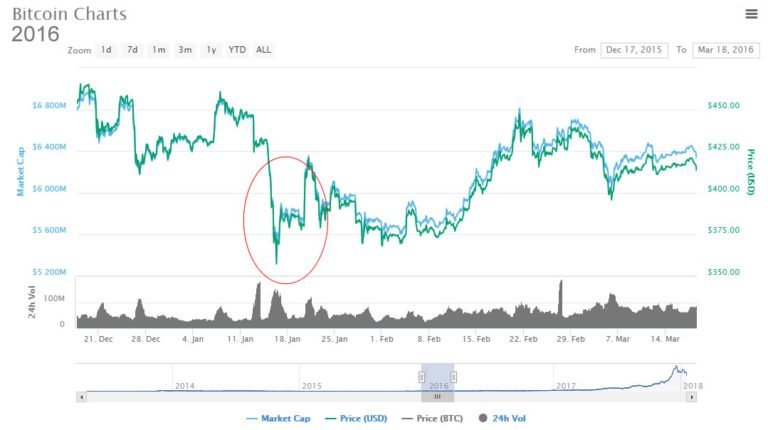

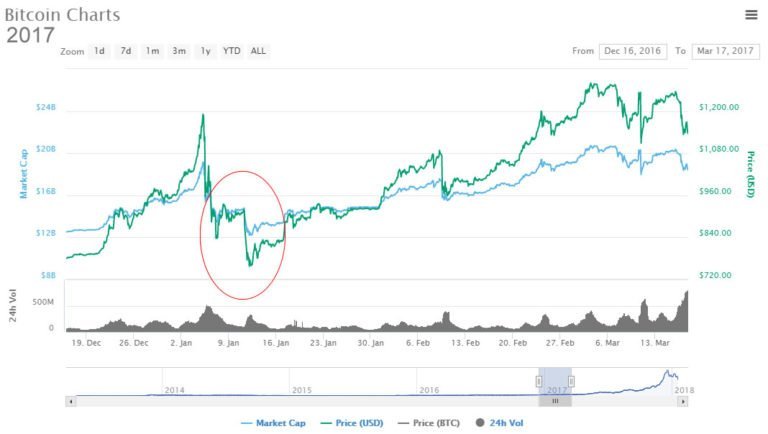

Look at the historical charts, they further proved the point. Overall, the January drop is normal. It is not a time to panic. You should hold your cryptocurrencies, if not buy more on the dip.

There are a number of reasons why the markets crash in January, and many originate in Asia where the bulk of crypto trading occurs. According to Coinmarketcap, which no longer includes South Korean exchanges, the total market capitalization of all cryptocurrencies fell from $750 billion to $420 billion in four days. At the time of writing, they have since recovered and are on the way back up again, currently sitting at a total of $575 billion.

Reason #1: A lot of the impetus for crypto price action comes from Asia where the news has not been good in recent weeks. China is constantly trying to quash the entire industry, and South Korea just can’t make its mind up with regulatory hype and clampdown fearmongering emerging on an almost weekly basis. The FUD is as infectious as the FOMO, and panic selling over the past few days has sent all coins into freefall, with some losing as much as 40%.

Looking back on historical Bitcoin charts reveals that a January selloff has happened before, several times in fact. Bitcoin is the gold standard for crypto, and a lot of the altcoins did not even exist back then.

Reason #2: It has been speculated that one factor causing this is the Chinese Lunar New Year, which usually falls in February. It is a time of year when people take time off work and travel to visit family, and for this, they will need fiat, not crypto. Since nations in Asia are responsible for the lion’s share of crypto trading, it stands to reason that this could contribute to the annual selloff.

Reason #3: Another factor could be the end of the tax year approaching where investors are planning to pay their annual taxes. Again this has to be done in fiat, not crypto. While not the only catalyst, it could have some influence over price action.

Reason #4: The ending of the first ever Bitcoin futures contract may also have contributed to traders shorting the asset. Once the big players, such as CBOE and CME, get involved, smaller markets can be manipulated by the institutionalized investors, and we could see more of this action until things stabilize.

Reason #5: As more new and inexperienced traders enter the market, these chart oscillations will amplify. Only when they realize that this is a natural cycle and crypto is not dead will things settle down a little. Since total market investment in cryptocurrencies has jumped over 2500% in less than a year, we are still at very early stages of what could be a game changing industry.

Congratulations @harry-yuan! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @harry-yuan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!