Becoming a better investor is the same as becoming a better soccer player, tennis player, manager or doctor. You will only become better by doing it, by reading a lot on the subject and by learning from your mistakes.

Becoming a good investor has a lot of advantages. You become more relaxed, you see all kinds of opportunities others don't see and you make more money.

Let's get started.

1.What kind of investor are you?

There are numerous ways to make money on the stock market, but there are only a few ways which fit you. It is paramount to know which strategy suits you and how you can stick to this strategy consistently.

There are traders and there are fundamental investors, short-term and long-term investors, growth stocks and value stocks, trading short and trading long…

You will feel more comfortable with one strategy than with the other. If you are comfortable with a particular strategy, that will be the one to follow. You will discover that every time you adopt a different strategy, this makes you edgy and most often results in losses. So stick to your own strategy.

2.Cut your losses

Have you ever been in a bad relationship? A relationship in which you stayed because you continually asked yourself 'what if?' As soon as you ended it, you were relieved and went on with your life without looking back.

Losing positions are the same. People are emotional creatures, but on the stock market, there is no room for emotions. We tend to take our losses personally, whereas they are nothing more than examples of wrong judgment or wrong timing.

Taking a loss on the stock market is one of the most difficult things to do for an investor, but very often it is also the smartest thing to do.

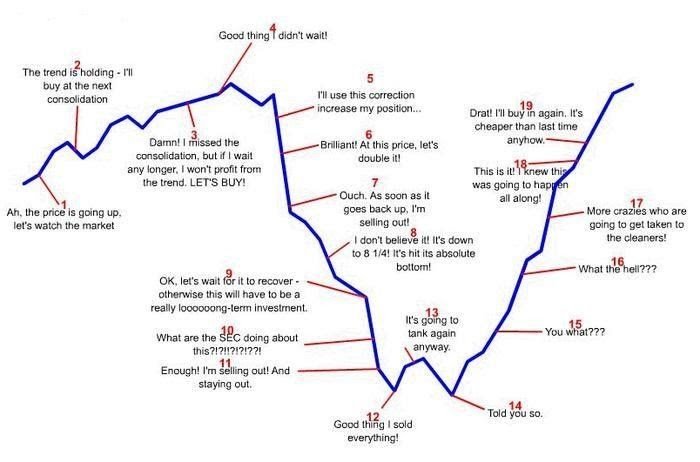

Just have look at below graph.

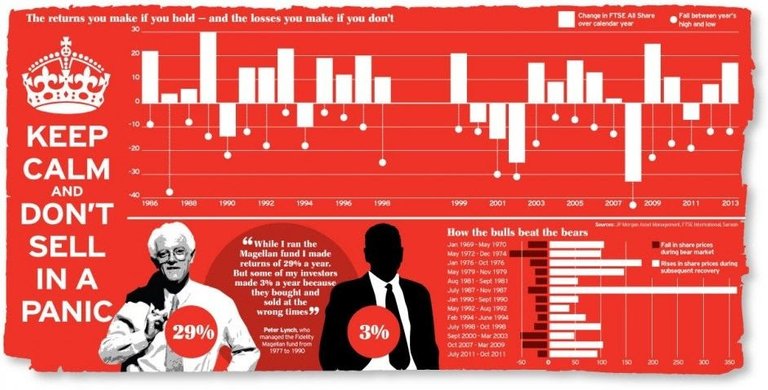

3.Never sell in a panic

Once in a while, there is panic on the stock market. As said in point 2 above, you need courage to take a loss when a stock goes in the wrong direction. But you must never sell in a panic.

As the chart above shows, at number 11, most panicking investors enter the phase of capitulation. They do everything to keep losses out of their portfolios. But very often capitulation is the beginning of the end. When you get at number 15 and do not get back into the market, your loss remains a loss. So it would have been better to stay in the market (and yes, it will hurt).

There are various ways to avoid a panic and to avoid selling at the wrong moment.

📈 Invest only in what you understand

If you don't know in what you're investing, you will never be able to understand what is going wrong in a panic situation.

📈 Know the management of the company

Management is one of the most critical aspects of a company. A good management team will be able to steer a company through a crisis, while a bad team will go under with the capitulation.

📈 Switch your computer off

Constantly looking at your computer screen when the markets are declining is very bad for your mental well-being. Often it is much better to switch off your computer and not look at the markets for a few hours or even days. Distance yourself and look at the turmoil with a fresh mind sometime later.

4.Focus

Investors get exposed to tons of information through the Internet. But too much information can be overwhelming. Although it is always useful to look at the markets from different perspectives, it is very important that you find a few good independent sources (and stick to them).

Stay focused on information which you think is important and relevant, instead of continually analyzing new information. Resist the urge of chasing other success stories (see point 1). It is better to write your own success story.

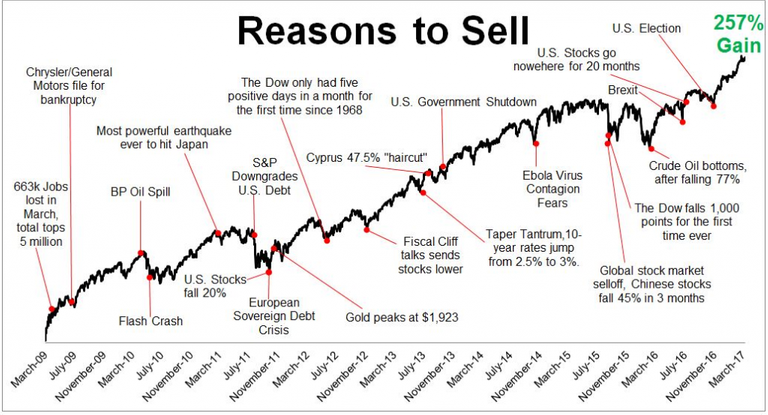

When you listen a lot to the media, you can hear a reason to buy or sell stocks every day or every week. But history teaches us that media predictions hardly become reality. The reason for a crash or a correction usually is an unexpected one, not a reason you hear about in the news or in an investment programme.

5.Keep it simple

There are so many ways to invest your money (stocks, bonds, futures, options, CFDs, commodities, real estate, interest rate swaps, just to name a few), that you cannot be good at everything. As said in point 1, limit yourself to a few market segments and a strategy that suits you best.

The next step is to keep everything as simple as possible. In the US there are more than 20,000 companies listed on stock markets (including OTC – "over-the-counter": stocks that trade via a dealer network as opposed to on a centralized exchange). Start with stocks which you think are the most interesting.

After that, you can expand your search into sectors in which you're interested. Don't start analyzing sectors or companies which you don't understand. Concentrate on what you know and what you understand.

This is a very nice and educative post man! You got my vote :D!

Thank you