Exchanges are Charging Altcoins Over $200,000 Per Listing

New coins are struggling to get listed and build themselves from a grassroots level, with listing fees easily reaching over $200,000 USD.

While high fees might be less of an issue for large multi-million dollar ICO’s, more community centric altcoins are struggling to find the cash. This seems to be one of the main hurdles for community coins to get off the ground, and has flow on implications to what these projects can achieve. If these ‘community’ coins are spending all of their pre-mine and capital on simply getting listed, where is the capital left for innovation?

And I’m not even talking about a listing on Binance or Bittrex. I mean your exchange that historically catered to smaller cap coins, like Cryptopia.

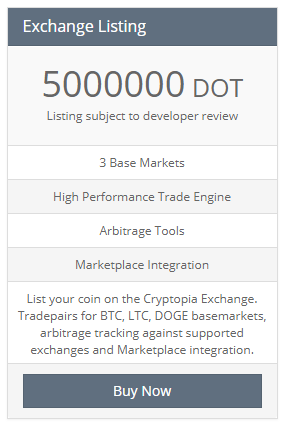

Right now, it costs 5 million ‘Dotcoin’ - Cryptopia’s native currency - to get a normal listing on Cryptopia. Based on current Bitcoin to Dotcoin prices – that is well over $200,000. And the worst part is that new coin developers feel obliged to pay it, as the community demands to see ‘Exchange Listing’ as a milestone to be achieved for new projects as soon as possible.

Cryptopia Listing Fee - Equivalent to Over $200,000 USD

Shortage of Exchanges in 2017

There continues to be a shortage of quality exchanges. I don’t begrudge exchanges for charging hundreds of thousands as this is what the current supply/demand balance allows. For these exchange owners, if people are willing to pay it, why wouldn't they charge it?

However, the community as a whole is negatively impacted by these high listing fees. We see pre-mines go up and existing exchanges falling short of user expectations due to increasing demand for their services.

Repeatedly, I’ve had problems with exchanges in registration, wallet addresses incorrectly syncing and expensive withdrawals. And these problems go all the way to the big exchanges, like Binance who recently limited their registrations as they were unable to cope with demand. This also led to some people 'selling' their Binance accounts, which is a whole world of security risks in itself.

New Exchanges in 2018

Thankfully, there should be some reprieve by mid-2018. New exchanges are popping up and should help share the load and increase competition - thereby (theoretically) reducing the cost of listing.

Many of these upcoming exchanges have or will go through an ICO process and create their own native token to try to replicate the success of Binance Coin, where token holders had an extra incentive to see the platform succeed due to their own investment in the platform.

On top of this, many of these platforms are trying adding to their service offer, through such features such as coin recommendations, research analysis and other tools you may expect through a more typical financial advisory service.

To highlight a few – Cobinhood, Trade Token and Coin Lion have or will all be released in 2018, with great prospects given the demand for coin exchanges.

Trade Token, Coin Lion and Cobinhood - all new exchanges for 2018

By mid-2018, I think we'll see more choice and higher quality exchanges with functionality that mirrors the mainstream financial services sector, to the benefit of all users of these services.

Coins mentioned in post: