Although Bitcoin was the “firstborn” in the cryptocurrency world, it faces serious competition from Ripple and Ethereum, as per Bloomberg Intelligence analyst Mike McGlone warned. On top of that, it's also 'threatened' by its own siblings (forks).

As more and more people trade and use cryptocurrencies, it's natural for networks to get clogged as they struggle to adapt to the demand. Whichever coin gives the most utility value should win, but it's still a game of popularity.

Analysts say that Bitcoin was the first cryptocurrency but it risks being overtaken by newer, faster ones like Ripple and Ethereum as we have discussed before. The problem with bitcoin it's like A.O.L. It's a first born and it's getting old. All the new ones are coming and transacting faster with their new and improved generation 2 3 or 4 technology. Now, bitcoin is becoming the old dog. The thing is, not everyone understands the differences among the technologies used behind new Altcoins. That’s why popularity is still beneficial for Bitcoin. Almost everyone knows it and it’s the pioneer in the crypto space. Its uses for main transactions across platforms. However, with things like Ethereum Ripple and all the other Altcoins in the market, there is so much competition not to mention now that we already have a few forks from Bitcoin.

Mr McGlone compared bitcoin to tech company AOL which was overtaken by competitor Google. Source

Is it possible for any of these Bitcoin forks to overtake Bitcoin?

Lets compare them starting with their current prices and technological aspects as of the beginning of the year 2018.

Bitcoin

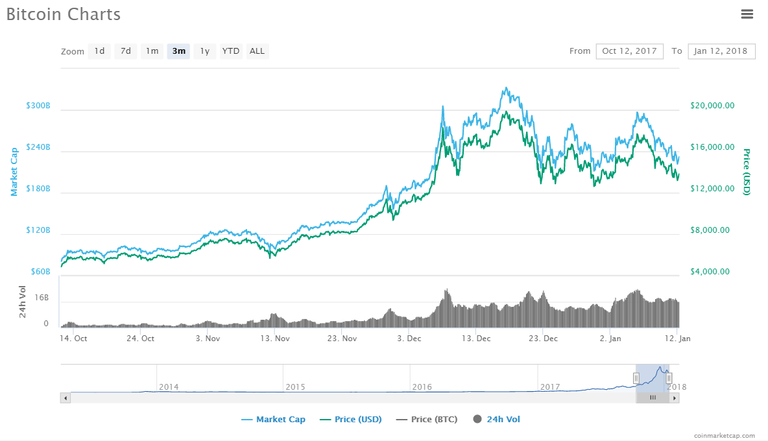

[As of January 12, Bitcoin is at: $13,750.80 USD (1.42%)]

It suffered a major setback from January 16 onwards along with most altcoins.

The blockchain on which Bitcoin is built serves as a distributed, cryptographically signed ledger that makes it possible track and verify payments without any centralized authority. The ledger is maintained by computers performing computations that eventually generate more bitcoins. The same distributed cryptographic approach can be used to verify all sorts of transactions.

Source

The problem is it’s extremely slow. Visa can process 1700 transactions every second but bitcoin can process only seven. That’s why it has a problem with scalability and transactions take about 10 minutes or even hours to process.

Bitcoin Cash

[As of January 12, Bitcoin Cash is at: $2,519.89 USD (1.16%)]

Here are the differences between Bitcoin and Bitcoin Cash:

Bitcoin Cash is a different story. Bitcoin Cash was started by Bitcoin miners and developers equally concerned with the future of the cryptocurrency, and its ability to scale effectively. These individuals had their reservations about the adoption of a segregated witness technology, though. They felt as though SegWit2x did not address the fundamental problem of scalability in a meaningful way, nor did it follow the roadmap initially outlined by Satoshi Nakamoto, the anonymous party that first proposed the blockchain technology behind cryptocurrency. Furthermore, the process of introducing SegWit2x as the road forward was anything but transparent, and there were concerns that its introduction undermined the decentralization and democratization of the currency. Source

[As of January 12, Bitcoin Gold is at: $218.28 USD (0.88%)]

While it was created using the same technology, bitcoin gold differs from bitcoin cash in certain ways, including its distribution.

Differences include:

The bitcoin gold cryptocurrency is set to be created in advance (prior to the code being open-sourced to the public). About 1 percent of the total cryptocurrency tokens mined before the blockchain goes public will be used to pay the bitcoin gold development team.

Once this distribution is over, the team claims it will launch the cryptocurrency so that users can redeem their coins. Of course, while it aims to become the de-facto version of bitcoin, others might consider bitcoin gold an "altcoin" – the term has long been used to denote any cryptocurrency launched using bitcoin’s existing code, but that has an alternative market or use case.

Who is behind bitcoin gold?

The team which started the hard fork seems to be a small group, comparatively speaking.

Hong Kong-based LightningAsic CEO Jack Liao, who's an outspoken critic of the state of bitcoin mining, first broached the idea of bitcoin gold back in July. His company LightningAsic sells mining equipment, including GPUs, the type of computing hardware bitcoin gold is supposed to rely on. Source

Why they all seem to be founded in good intentions, the advantage of having many choices is that people can use altcoins for faster transactions and these new currencies provide new investment opportunities. Overall, the hard forks, at least in my opinion, did not adversely affect bitcoin being the 'first-born' and still the most popular of all cryptocurrencies.

Please upvote, resteem and follow me, thank you.

Great post!

I think the chance that Bitcoin is overtaken is smaller than most people think. The technology is actually only a small part of why Bitcoin has it's value. The real value for Bitcoin comes from the security of the network (which is secured by the high token value and hashpower making it super expensive to attack), and the network effect of Bitcoin. By the last part I mean: the community, amount of service providers, development and adoption.

The network effect is probably the largest factor actually. No other competitor has the kind of network effect that Bitcoin has. Especially the newer altcoins have a laughably small community compared to the Bitcoin community. Even Ethereum, big as it may be, has a much smaller network effect and is pretty much only popular among crypto-enthusiasts. The mainstream is not even aware of something like Ethereum, let alone Bitcoin Gold.

This is also why I am doubtful that newer competitors like RaiBlocks really stand a chance. Yes it's perhaps vastly superior to Bitcoin for peer to peer payments... but who is using it except a few handful of speculators and enthusiasts? It took 9 years for Bitcoin to gain the network it has now, something like Raiblocks would be hard pressed to catch up to that level in time.

I'm of the opinion that a faster blockchain doesn't matter either. What it comes down to, is the fact it's decentralized. How quickly or how often you 'save' to the blockchain is really irrelevant, as long as it's trustworthy. I think Lightning network, which 'bundles' transactions and periodically updates the main chain, will probably create a situation where transactions are free or nearly free. On that note: Bitcoin transaction fees are currently down to mere cents per transaction.

I myself am wondering if there is any reason for many altcoins to survive, if Bitcoin fixes the scaling issues. I think Bitcoin Gold has more to fear from Bitcoin than the other way around.

Interesting post and comment !

I think its important to understand too, that whats the most important is the underlying technology and end use of the crypto. That is going to determine its survivability.

In the case of Bitcoin, the Lighting Network is a game changer as it solves one of Bitcoins biggest problems and allows for micro transactions to be handled efficiently. And the current scale of Bitcoin's network is incomparable to its forks. I believe that once the gold rush on the crypto exchanges is over, you will see the best technologies survive. And I doubt there will be any surprises.

i agree. i think making analogies to older tech versus newer tech in social media or e-mail companies are not valid, in the same way i think it's not valid to draw analogy to the behavior of a normal stock. Bitcoin is best positioned for further adoption. It's really its own thing.

Very insightful ideas! Thank you for your comment.

Although new coins are coming in cryptocurrency but Bitcoin is still to remain the king of all currencies. Ups and downs in value of the coins is part of the business.

That makes sense! Thank you for your comment.

Thanks for the good comparison post!

I think Bitcoin will stay king for the next view years and if Bitcoin crashes (for real, not the „normal 50% dips) all other Cryptocoins will die along with it. The reason is that Cryptocurrency is still not really mainstream and if Bitcoin dies they also will. Bitcoin is such a big brand.

Bitcoin is changing its protokoll slowly and making shure the inplemented things work out in the long term, which is good. Increasing the blocksize and/or the blocktime isn‘t a longterm solution.

That's really encouraging! Thank you for your comment.

Great post!

Everything is about motivation. If you want to grow a business, let benefits abound. The drop in value of a few days back really affected Bitcoin and its making other coins take over quickly

It is true that for example ethereum is a way better coin than bitcoin. But if you ask someone who is not really into the cryptocurrencies space: do you know what cryptocurrencies are? They will probably only know one currency which is bitcoin. Because there is so much hype around it. So I don't think ethereum or ripple will overtake bitcoin although they are better coins.

35.46% @pushup from @hiroyamagishi

This post has received a 19.52 % upvote from @booster thanks to: @hiroyamagishi.

This post has received a 22.06 % upvote from @boomerang thanks to: @hiroyamagishi

Bitcoin is the base of the crypto. It will go up and down but it will be the most stabilised coin in the market for the next years i think.

@hiroyamagishi hope to get upvote and resteem from you sir from cebu city phils. You're post is worth reading. :)

Nice and insightful article. I really think some of the new upcoming alt coin have the ability to outgrow bitcoin. I really wish for that to happen soon.

We are living in the era of cryptocurrency :)

Bitcoin Cash is my favorite!~

The market is big enough for peaceful coexistence of bitcoin and Bitcoin to Cash, and for many other currencies, including such unusual decisions as Bitcoin Gold. In traditional monetary circulation there are different denominations of banknotes. Same with cryptocurrencies can be created in various denominations. Besides advantages of currency there are many other currencies, and, consequently, an unlimited number of design options. Cryptocurrency will develop in a similar scenario.