Understanding how whales fluctuate the market will allow us To make better decisions.

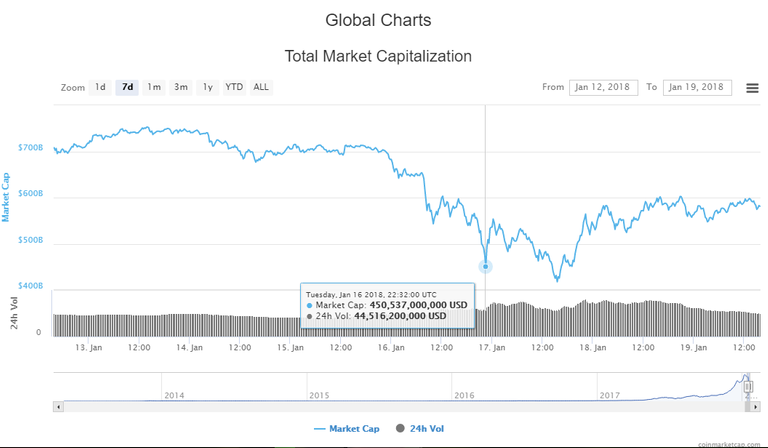

Let us look at this chart.

-bitcointicker.co

-bitcointicker.co

When making trading decisions, we don't only look at the price but also the volume. When the whales move things, There's usually a huge volume. So after keeping the price low for quite some time they gradually will cash-in, then the price gradually runs upward. People then like they traders will come in and start cashing in, further increasing the price. When they meet profit targets, they cash-out big-time, then the price plummets big time. We see this happening all the time.

I'm not saying that this is always the case. But I don't need to worry about what will happen next whenever I see a gradual price drop. This price drop will probably trigger a high-volume selloff from a whale.

The further explain this, Generally speaking, whenever the prices go below pre-set thresholds, whey will start selling.

-bitcointicker.co

-bitcointicker.co

Looking at this chart we see huge price drops. Right between January 16th and 17th. Who else could it be? Although this massive sell-off is typical to that of what happens in January, I can't think about any other possibilities. It must be a whale or a group whales making their move, cashing out their profits. From a hindsight, it was a wise move! They knew that the price was not going to get any higher, so they cashed out and further reduced the price, then it cascaded down with more and more investors selling off their coins to prevent further loss.

This is where day traders should act really quickly. When the whales sell off and cause the price to dip you need to be ready to sell since there is, of course, no way to foresee exactly when it's going to happen. But you need to wait for the rebound when the price goes back up. that's usually the time to sell, before it goes back down again even lower. I'm not saying that this is what's happening all the time but, of course, we’re observing what happened from a hindsight. It’s over now, so we are sure about what actually transpired. Now, other traders might have different interpretations. So far that's the only explanation I can think about. feel free to comment below.

Strategy: Be one with the whale.

I’m not saying that this is what everyone should do everytime, but I'm trying to hold for a minimum 2-3 months. Most of my investments are for one year. Buy and hold. -Become one with the whale. It's a marathon, not a sprint. Sell to buy next, then, buy, buy, buy. You know the daily fluctuations remind me of what the company or the coin means to me. It’s so much less stressful to invest based on the fundamentals of the company (after doing research), rather than just seeing whether we're going to the moon with this investment or not.

Always be ready to sell once whales jump in. If I see one of my coins jump 50+% in a couple of hours, I have my finger on the trigger (the sell button). It's good advice I got from a friend. Maybe don't be so greedy, trying to get 10 to 15 times gains. Maybe we take 50 percent gains. Now, another question is: Are these regular whales or something on government? Is it related to BTC futures which ended on the 18th? Finding out who the whales are may be the best way to manage expectations. Who knows? Please share your ideas. That's why exactly we're in this community.

-coinmarketcap.com

-coinmarketcap.com

Let’s look at this chart this time. You can see this market moved a lot a few days ago. How much time did it take to plunge the charts? After that is where you can see a huge increase in market volume from $417B to $564B. -That’s $147B in less than eight hours!

This market moves like that. Extreme volatility (big waves) are usually found where whales make their move. You can sleep while it’s on a low and it’s mooning when you wake up. Or, you can sleep on it while it’s moon and lose money before you wake up. That's why if you're in it and we talk about long-term strategies, we’re like being in a low, but what could it be like in a year? If you if you listen to the Ripple CEO or anybody out there in the mainstream media talking about cryptocurrency, some say that we’re in the early innings of this thing. It’s just the beginning. It’s a long-haul. Just keep this in mind, especially new investors. I hope you will also share your strategies and additional ideas on how to be ‘one with the whale’. We can’t fight whales or front-run them most of the time. -We have to wait for their move then ride the waves.

Please upvote, resteem and follow me, thank you.

Again, I'm enlightened. Keep'em coming 👍

Resteemed!

Couldn’t agree more, if you’re looking yo day trade you need to be watching the market every minute of every day in markets with such volatility such as crypto. However like my self, these price points are only the beginning n these fluctuations aren’t so big when looking at yearly time frames

Right. I can see patterns year after year though we're dealing with bigger volumes of movement nowadays. Thanks for reading and for your comment.

i usually buy after the whales pull out.. extremely low prices and everyone wants to stay away.

E.g: BNB : binance coin was around 20+ dollars it plummeted to around 9-11 dollars but is up to 14-15 today

resteemed

Thanks!

good information about altcoin

that is great work

carry on

Thank you.

informative!

Steem Bot Tracker websitevote for @yabapmatt for witness!You got a 27.65% upvote from @postpromoter courtesy of @hiroyamagishi! Want to promote your posts too? Check out the for more info. If you would like to support development of @postpromoter and the bot tracker please

I just saw you in you tube, galing. I'll watch the others after this comment.

Great read..those whales and manipulators can 've very dangerous when they want to be. Watch out for them and dont be fooled. Keep up the good work

Good commentary! Sharing my thoughts (and a repost of mine) - Is BTC price impacted by CBOE and CME Futures expiry dates? Keep an eye on Jan 26th!

Interesting theory here a friend shared with me around the recent dip in BTC which coincided with CBOE futures expiry dates and possible coordinated sell-off by whales to bring BTC's price down to required levels for profits.

-Huge sell-off lowered BTC's price to profit 'short' futures positions

-Lowered price allowed for additional institutional/whale buy-in post the expiry dates for quick gains short-term

-With Jan 26th CME futures expiring on Jan 26th, do we think the same thing could happen (contracts are 5x bigger!!!)?

I see couple options (not financial advice):

-HODL! -> Play it safe

-Sell profits and if sell-off happens, buy back in at lower support levels (~8k) -> Roll the dice on your gains

-Sell profits and some original investments, buy back in at lower support levels (~8k) -> Feeling a bit riskier, but higher risk = higher reward

Welcome thoughts/opinions?

Here's the analysis shared:

https://www.tradingview.com/chart/BTCUSD/E25dvVua-BTCUSD-Potential-new-low-on-26th-of-January/

Credit - Nico.Musselle on TradingView and my friend Jess G for sharing

Very informative. I appreciate the drop of knowledge. I don't have that much power but you still got my vote.

What do you think will happen over the next 48 hours with the end of this round of the CBOE's BITCOIN futures? I thought for sure we would be all red today. Whales going to dump tomorrow?