This panic-inducing news came out recently when visa canceled their relationship with a company called Wavecrest.

WaveCrest basically processes cryptocurrency transactions with fiat and help people transfer cryptocurrencies for use in everyday purchases by swiping their cards like you would any credit or debit card. When they did, it affected a bunch of different companies like CryptoPay, Bitpay, TenX, Wirex and others.

Reports say it has something to do with Wavecrest not complying with Visa terms and conditions on their operations. When Visa pulled the plug, wavecrest basically had to cancel all of the cards that were involved with it (which potentially affects around a million people outside the US). People panic when their cards unexpectedly get declined upon use on purchases. Now, their cards are invalid.

The card provider, WaveCrest, confirmed in an email to CNBC that it was required "to immediately close all Visa cards."

"As a licensed E-Money Institution, WaveCrest is required to safeguard funds to cover all of its issued electronic money and we can confirm that these funds are safe and available for redemption through other channels," the statement read. Source

Wavecrest allegedly failed to respond to certain Visa communications asking them to provide some required information, prompting the shut-down. As a result, Dmitry Lazarichev, co-founder of Wirex, said he's received thousands of calls from panicked customers. He said his company has issued some 500,000 cryptocurrency debit cards to people across the world, though outside the United States. - “All the cards were shut down in one second,” he said.

Now, people are reasonably worried that this mainstream way of using bitcoin will be gone forever. However, a statement from Visa later came out saying that their action was not specifically against cryptocurrencies but rather a result of the issuer’s failure to comply with their payment system’s safety and integrity-related policies.

A Possible Solution

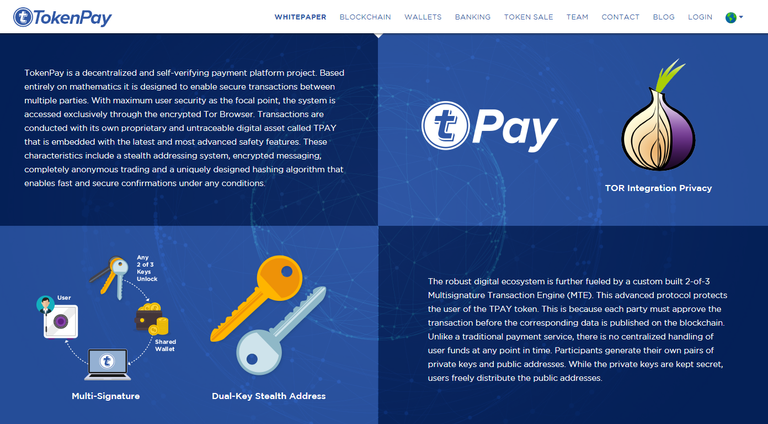

After hearing about countless hacking incidents causing chaos in the markets, Derek Capo, TokenPay's CEO came up with a new idea. He found a group of privacy driven cryptographic coders and partnered with them on a top-secret project. After a year of intense programming, they managed to create a new secure coin technology that can only be described as Bitcoin on steroids. This appeared to be a winning concept which highlights encryption and anonymity. But we need more than just a join for a game-changing solution. Perhaps the most important missing link in all crypto platforms is the ability to turn digital currencies into 'real' cash that can be realistically used for purchases without hassle. Through their international financial contacts, they have managed to locate an ideal bank to purchase.

They moved quickly to sign the necessary paperwork to begin the appropriate procedure. Rock-solid plans are now laid out for a next-generation blockchain banking and payments platform driven by an outstanding team of top industry professionals and consultants. This has been a long road for everybody who's hoping for cryptos to go mainstream and if TokenPay is the answer, we'll surely find out after some time.

Although blockchain is in a period of exponential growth and adoption, there is still a major misalignment in the so-called shift to digital currencies. The main underlying problem is that traditional financial institutions like banks and the related government policies and regulations are not in conformity with cryptocurrency trades. The concept behind traditional banks was conceived hundreds of years ago. We are in an early stage of a transition towards financial decentralization. -That's why there is resistance. The powerful and deeply-rooted institutions are not designed to transact in cryptocurrency.

Bitcoin is a cryptocurrency based on blockchain established in 2008. In just a few years, it has become a legal and a valuable commodity that can be traded on a global scale. It has great liquidity with billions of dollars worth of Bitcoin in daily circulation. This far exceeds the GDP of certain countries. Interestingly, Bitcoin's market capitalization is now more than that of Goldman Sachs and there are more than 16 million Bitcoins in circulation today.

Bitcoin is only one of more than 850 cryptos available for trade and purchase. The other coins are called altcoins. Many are derived from the Bitcoin platform. The features and practicality/usefulness of every coin vary widely depending on the underlying technology. The influence of powerful special interest groups ensures that traditional banks will do anything possible to prevent the dominance of cryptos. However, blockchain technology makes wide-adoption possible since it is mathematically fluid and operates much faster than a central bank and other regulatory bodies. Currently, there is a middle “limbo” state whereby many cryptocurrency holders are unable to use cryptos to their fullest potential. There must be a solution to this very important problem that is affecting a rapidly increasing amount of people.

Please upvote, resteem and follow me, thank you.

If Tokenpay is able to pull off the next generation block chain banking platform, it will play a major role in accelerating the widespread adoption of cryptocurrencies for transactions. The marginalised shall turn mainstream! Thank you for the informative article.

It's a pleasure. If TokenPay takes off, we might see a new top crypto. Who knows, but it seems they have prepared the platform well before the ICO.

Here is a solution:

https://steemit.com/cryptocurrency/@antikru/epayments-your-new-crypto-currency-debit-mastercard#

That's good to know! Thanks for sharing the article.

Amazing participant as we are always used to thank the participant

oww really... crypto cradit card?☺

The information is very useful .. Thank you for sharing

You're welcome!

I think that this post is very helpful for us..Thanks for sharing this information...

I say we let time decide, like always..

The world will have to adjust to this "new change".

Btw

I here here fbk is considering integrating crypto.

I personally believe it will be close to impossible to totally overhaul FB and switch to decentralized. For now, other companies do money transfers and just ask for users' FB info.as far as I know.

If we think as per digitization then its good for digital assets to find alternatives and use blockchain system to get further freedom from these banking channels.

Nice, I have 30k tokens :)

STEEM WitnessYou got a 2.43% upvote from @upme requested by: @hiroyamagishi. Send at least 2.5 SBD to @upme with a post link in the memo field to receive upvote next round. To support our activity, please vote for my master @suggeelson, as a