This week has been full of exciting developments for crypto...unfortunately it seems, market traders didn’t get the memo. With the expectation that a bull run was looming beyond the 2018 NYC Blockchain Consensus event, crypto enthusiasts were confounded to see the marketcap fall below $400 billion even with the attendance number being 3x what it was last year.

At the conference was Tom Lee of Fundstrat who offered up one perspective on why the market didn’t follow the prospective path experts presumed it would. Calling the market dip a “Consensus sell-off” Lee suggests that, “The “Blockchain: good, crypto: bad” mentality must be broken to allow for a rally in price”. He continued with the prediction that “a conclusion must be reached on a regulatory framework, from institutional regulatory parties like the SEC, and that a cultural buy-in must occur by the institutions themselves” in order for this to happen.

Another attendee shared their opinion of the conference sighting a number of reasons why “Consensus Sucked” in the 2018 Consensus Reddit.

Posting as “Korgijoe” the user points out that the conference setup and staff was “disorganized and ill-informed” even going as far as to say “It was embarrassing for crypto.” When describing the atmosphere during the 3 day event Korgijoe wrote “The whole presentation vibe was, let’s bend over backward for bankers and discuss how we’re going to do it” questioning whether bankers and institutions could have been targeted a different way suggesting, “If the suits are here, let’s discuss using their money to lobby Congress in favor of crypto instead of shorting the market.”

If you didn’t get a chance to check Consensus out this year and are curious what all the hype (or lack thereof) was about take a look at this overview below covering the 3-day event.

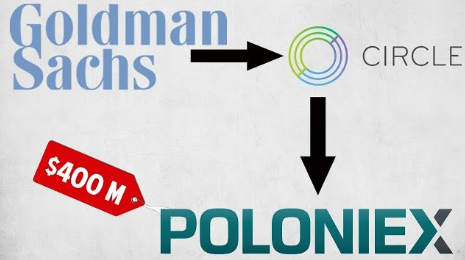

While Consensus may have turned out to be more of a matador this year than anything else this is but only one show in a season of many. This week a number of high profile business’ like Amazon and Goldman Sachs announced their plans to incorporate blockchain technology and/or digital currencies into subsidiaries AWS and Circle respectively while Facebook announced the implementation of a blockchain committee to their business plan tasked with researching risks and benefits related to the technology. What are the details pertaining to these new avenues?

(Image Credit)

Last Friday Social Media Giant Mark Zuckerburg announced that despite the company’s recent decision to ban all crypto related ads within their platform, Facebook has instituted a committee to examine how to “best leverage blockchain across facebook”. Led by the former CEO of Paypal who currently heads the FB Messenger team David Marcus, the committee will also include other e-marketing giants such as James Everingham of Instagram and Kevin Weil. While this might seem like a welcome opportunity to bridge the gap between crypto and Facebook’s two billion users, according to Coindesk “The immediate reaction on Wall Street was harsh: Facebook's shares fell 4.5 percent.”

Why such a drastic movement?

(Image Credit)

Perhaps it was in response to the memory of Facebook’s first cha cha with digital currency-Facebook Credits, an in-game currency that failed to catch on lasting only about 2 years. Or, was the drop in response to Zuckerberg’s revelation (also Friday) that users will soon see changes to their news feeds and "can expect to see more from your friends, family and groups" and "less public content like posts from businesses, brands, and media." One Coindesk writer surmises that “It was a predictable response: if Facebook will no longer curate new feeds to emphasize strong, ad-attracting content, then revenues, and returns to shareholders, will decline.”

While this may not seem like the smartest move made lately by the social media mogul perhaps they are trying to rectify the diminishing relationship with their consumer. For one take on how blockchain technology might help Facebook accomplish this check out this token solution theory by Michael J. Casey, senior advisor of blockchain research at MIT's Digital Currency Initiative. For now, according to Cheddar “It will probably be several years before a Facebook money becomes a reality, and —fortunately—they probably won’t have an ICO.”

(Image Credit)

This week Circle, a subsidiary of Goldman Sachs and owner’s of popular crypto exchange Poloniex announced that they have received funding in the amount of $110 million from BItmain and will be releasing their own coin “Circle USD” as early as this Summer. The coin, tied 1:1 with USD will be a price-stable cryptocurrency similar to other fiat based digital currencies like TrueUSD, BitUSD and the most widely used, USD Tether. Co-founder of Circle Jeremy Allaire states in an interview with Brave New Coin that, “Other USD tethered tokens...lack financial and operational transparency, and have been built as closed-loop ecosystems and closed proprietary technologies.” Circle, worth about 3 billion already claims that the Circle USD coin will be more transparent than traditional USD anchors and will operate within federal guidelines.

Within the past year USDT has indeed been embroiled in a number of controversies. First, questioned about their lack of transparency regarding where funds were being held backing the tether in circulation, the coin was then scrutinized further by the crypto community as their partnership with audit company Friedman LLP dissolved amid accusations that the currency was not backed by an asset at all, or at least not one that would amount to the huge number needed to cover the tether in circulation. While this was a huge hit to the reputation USDT had been working hard to build, within a few weeks our team here at IDC had found evidence in a blog post shared by Bitmex that the assets belonging to USDT may have been found in the budding “crypto utopia” of Puerto Rico.

While the controversy surrounding USDT has seemingly died down in the last few months, the security blanket Circle USD’s transparent policy would give investors does look quite attractive. Coupled with the promise to meet banking regulations, Circles coin also seems more handy for storing profits until ready to offload them to a bank account as a number of banks are unable, or unwilling, to deal in cryptocurrencies. As of now we’ll have to wait to see if this new “stable coin” will be the solid bridge between banking and crypto that investors are still searching for. Will you be keeping your fingers crossed??

Perhaps some of the biggest and most exciting news this week in the crypto-world is the announcement that the Amazon’s Web Services (AWS) platform has partnered with ConsenSYS to bring the crypto community the Kaleido Blockchain Business Cloud. This “all in one platform” has been designed to take the “ prerequisite of deep blockchain knowledge out of the hands of users... simplifying enterprise use of the technology.”

A May 15th AWS blog post about the partnership states Kaleido supports a number of “first of its kind capabilities” including being the “first “dual mode” use of Ethereum” and is compatible with a number of “native AWS services”.

Steve Cerveny, Enterprise Lead at ConsenSys and Founder of the Kaleido says the platform “pulls together—in a simple, cohesive, and unified way—the right experiences and tools” to help business’ who want to utilize blockchain technology but don’t know the fundamentals of cryptography. According to the APN blog, users will be able to access Kaleido from the AWS store where they can then customize their experience and the specifications of their project with relative ease producing an “enterprise ready blockchain network in minutes.” While this is not the first actual blockchain solution published on the in the AWS marketplace as noted by Investing.com Kaleido looks like its going to hold up well as it enters the competition.

Available in Beta you can check out here or watch the videos below to gain a deeper understanding of what each partner brings to the table as this newly formed system attempts to streamline blockchain experiences for the everyday business.

Since Amazon purchased www.amazonbitcoin.com 3 years ago consumers have questioned when the retail giant would bite the theoretical bullet and get into the blockchain game. In November last year the company teased its crypto hungry audience when it purchased the domain names:

‘amazoncryptocurrency.com,’

‘amazonethereum.com,’

and ‘amazoncryptocurrencies.com’

but as of yet nothing crypto related has materialized on them. This new partnership however seems like a bold indicator that Amazon is indeed feeling out the crypto market...what will their grand product be?

Comments?

°Br¡tT^N¥° (@TheJadeCrow on Twitter)

Coins mentioned in post:

WARNINGCONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment! - The message you received from @jihad420 is a

For more information, read this post:

https://steemit.com/steemit/@arcange/phishing-site-reported-postupper-dot-ml

If you find my work to protect you and the community valuable, please consider to upvote this warning or to vote for my witness.

Congratulations @idcinc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP