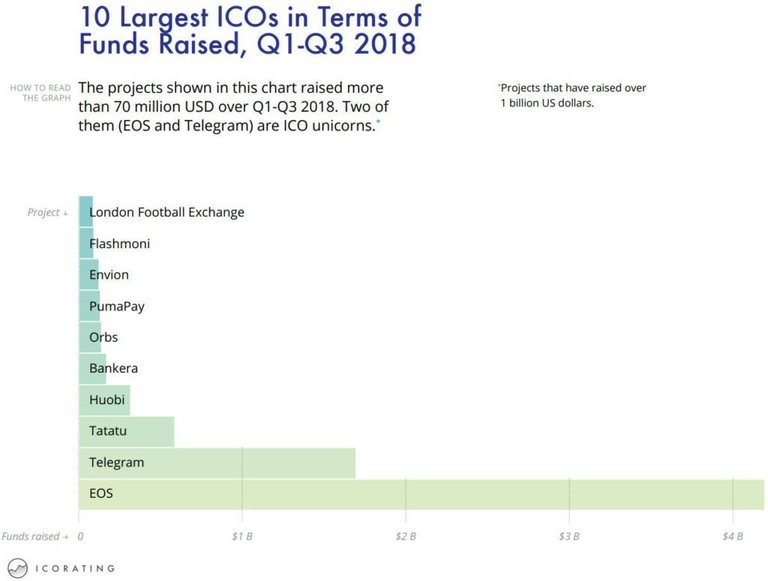

The amount of money that initial coin offerings attracted in this year’s third quarter fell significantly compared to the second quarter.

According to a report by crypto market analysis firm ICORating, the amount that was raised via ICOs from July to September reduced by 48 percent compared to what was raised from April to June this year.

During Q3, more than half of the ICO projects that were announced only managed to raise up to US$100,000 while only a tiny number got listed on crypto exchanges. Of the 597 projects which were staged in the third quarter, only 24 got listed on exchanges.

“57 percent of ICO projects announced in Q3 2018 were not able to raise more than 100,000 USD. Only 4 percent of all announced ICOs were listed on exchanges,” said ICORating.

‘Only an Idea’

ICO fundraising

The report also noted that more than three-quarters (approximately 76.15 percent) of the startups that were raising money were only armed with an idea rather than a functional product. This was an increase of 18.72 percent from the second quarter. Unsurprisingly, this category of projects constituted the highest percentage of fundraising initiatives that were unsuccessful, with 72 percent of such projects at the idea stage failing to raise more than US$0.5 million.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ccn.com/bear-effect-sec-crypto-crackdown-precedes-48-drop-in-ico-funding/