I feel like this goes without saying, but I just wanted to work this out logically. STEEM dilution is not a tax. Therefore, it is not theft. It also follows that no cryptocurrency is fiat (yet).

Taxation is theft. If you don't agree, I have written about this previously. Dilution is not a tax, therefore it is not theft.

So if The Federal Reserve has admitted under oath that inflation is theft, how then is dilution not theft?

First of all, is inflation different from dilution? I would say, it's not that different.

So if we stipulate that they are pretty much the same thing, how is it that when The Federal Reserve inflates the US Dollar, it is a tax, but when Bitcoin or STEEM dilutes themselves, it's not a tax?

It's the same reason that the US Dollar is fiat when Bitcoin and STEEM are not.

If we want to nitpick, dilution is a component of inflation. Inflation is the result of unrestricted dilution. But often, they are seen as synonymous.

Fiat?

Some people wrongly assert that cryptocurrencies are a kind of fiat. But they're not. Not yet, anyway. Maybe in 20 or 30 years that might happen, somewhere.

Fiat means "by decree." The US Dollar has value by decree. Cryptocurrencies have no value by decree. Their value is only derived through market forces.

So how does the US Government decree value? What is the exact mechanism?

Congress can't simply resolve its value by a vote. That wouldn't work. They have to manipulate.

The method of manipulation is primarily the fact that US taxes can only be paid with the US Dollar. There are other mechanisms to ensure the US Dollar has value by decree. But that's the main one: taxes.

There is another reason that most people don't encounter day-to-day, which is the fact that the US Courts only settle lawsuits in US Dollars. In the olden days, it was legally possible to use gold, silver, even chickens to settle a court case. Today, if you are going to settle in chickens, there still has to be a dollar value placed on them by law, which indirectly props up the fiat status of US Dollars.

Fact is, anything can be fiat, even gold and silver, at least to some degree. In ancient times, kings would try to price-fix gold, which had disastrous effects. But the process of trying to set the price of gold meant that gold's price was set by decree, therefore fiat.

In fact today, gold and silver are fiat, in certain situations. The Euro is backed by gold, up to 25% of its face value. This is a meaningless backing. Who would accept 25% of face value? But by doing this, the gold component of the Euro itself has a fiat component. Weird, right?

Certainly any fiat currency gets some of its value by market demand. But it's bootstrapped by decree.

Scrip, Not Fiat

My point is that just printing money out of thin air, does not a fiat make. If we must assign a historical category to cryptocurrencies, I think scrip fits best.

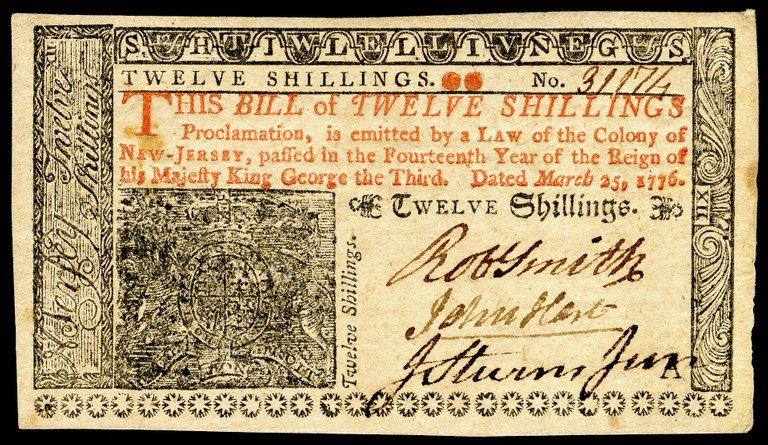

The term scrip is short for subscription receipt. They were often private-issue, but not always. They were often serialized to discourage counterfeit, but not always.

They were not typically accepted for paying taxes beyond local municipalities. In fact, when Benjamin Franklin told the King about his beloved Colonial Scrip, it was eventually made illegal by the British Government.

And scrip has dilution. Every time a new scrip certificate is issued, it dilutes the value of the other certificates.

When Colonial Scrip was a successful currency (while it was still legal), the criteria to print new certificates turned on the homestead of land. If you were a homesteader, (and white, and male), you were allowed a certain amount of new Colonial Scrip.

Your neighbors would accept dilution because you were bringing value to the land. The goal was to print enough certificates to provide liquidity to new land owners, so they could trade, balancing this against printing too much.

Voluntary

The most important component in privately issued currencies is that they are voluntary. Voluntary currencies mean that if you want to opt out of using them, there's no penalty (other than perhaps a loss of business). You can boycott a voluntary currency. You can ignore them. You can even refuse payment and demand something else and no one will get on your case for that specifically.

Good luck boycotting the US Dollar. Even if you live outside of the US, the government who claims jurisdiction where you live still has to acknowledge the US Dollar, or else.

Accountable

STEEM has accountability. Just look at the #witness-category. Witnesses (sort-of like representatives) provide governance and must beg for votes. Votes can be revoked at any time. If a witness turns bad, they can be kicked out in literally 3 seconds.

Conclusion

Dilution can harm a currency if it is not managed with care. All of the successful alternative currencies in history had their problems, mostly due to centralization, not dilution.

Since centralization is mostly a non-issue with cryptocurrencies, governance is the key to success. Some currencies rely on (mostly) immutable structure which has the benefit of stability. Other currencies have superior consensus models that provide another form of stability.

The great thing is, competition between currencies will improve them all.

Thanks for the post.

Earned my follow.

really good post. seriously!

Up! Mostly over my head but fascinating nonetheless

That is faulty logic.

Assume taxation is theft. Even then, not all theft is taxation. Not being a tax doesn't mean that something isn't some other kind of theft.

Here's the same logic with different nouns: Cryptocurrency is money. The US dollar is not a cryptocurrency, therefore it is not money.

Well, I'm glad someone is holding my feet to the fire.

There's a town outside of Blacksburg that has their own scrip. Floyd! That was it. They used Floydian scrip. I think @stan had a Floydian scrip.

I agree what you wrote , it was very nice

Great post. I had never heard of scrip before.

Is that true? I thought its value was determined by the market.

If it is true, what is its value decreed to be?

So you just stopped reading right there, eh?