The day everyone has been waiting for, the U.S. government regulators to give some true insight on their views of this ever growing technology. With that said, the news was bigger than any Superbowl ad could've done to get the market to do a 180 degree turn around. And although we may not be out of the clear in the short-term, this news is good for anyone looking to invest into cryptoassets (I will be using the term cryptoassets more as that is a better representation of many tokens) for the long-term, as they're are here to stay and have got recognition from governments around the world now.

The most bullish news by far, came from the Honorable J. Christopher Giancarlo, Chairman of the CFTC (Commodities Futures Trading Commission) stating:

"If There Was No Bitcoin, There Would Be No Distributed Ledger Technology."

The SEC Chairman, the Honorable Jay Clayton said very positives remarks regarding Bitcoin and it's underlying technology, blockchain, but also had some words to say about those trying to avoid securities laws. (Author note: this quote is long, I ended up listening to the hearing and typing this out [unfortunately it wasn't in the testimony transcript], as I thought it would be good that people read the opening statement from the SEC Chairman regarding their view on this new asset class.) Here was his opening statements regarding the tech:

"A promising new technology referred to as distributed ledger technology or blockchain. Proponents of this technology assert that it will bring great efficiencies to our national and global economies including our capital markets. I hope that it does. The commission looks forward to working with market participants who seek to bring efficiencies, including more effective oversight to our markets. The second and third categories are cryptocurrency and ICOs, which are subsets of the products seeking to take advantage of the commercial opportunities presented by blockchain.

The second and third categories are cryptocurrencies and ICOs. Which are subsets of the products seeking to take advantage of the commercial opportunities presented by blockchain technology. One is promoted to be a replacement for dollars, the other is like a stock offering. Cryptocurrencies, some of the more widely known cryptocurrencies were introduced as substitutes for traditional currencies, such as, the U.S. Dollar or the Euro. Those who promote these so called virtual currencies have asserted they will make it easier and cheaper to buy and sell goods, particularly across borders. They asserted that transaction fees and costs will be eliminated or reduced. To date many of these assertions have proved elusive in many areas.

ICOS, from what I've seen, initial coin offerings are securities offerings. They are interests in companies much like stocks and bonds under a new label. Promoters use the term coin based on the fact that the security being offered is represented by a digital entry or coin on an electronic ledger as compared with a stock certificate and a related entry in a company's records. You can call it a coin, but if it functions as a security, it is a security. Also importantly, an ICO may have nothing to do with distributed ledger technology beyond the coin itself.

Buying an ICO does not mean you are investing in blockchain related ventures. There are many problems with the way cryptocurrency and ICO markets are operating, but two are worth paticular attention. First the market for these products have substantially less oversight than our traditional securities markets. To be blunt, if you are trading cryptocurrencies on a platform that looks like a stock exchange, do not take any comfort from that look. Our stock exchanges have extensive rule sets and they are required to conduct surveillance. Also broker-dealers who facilitate securities trading have capital and conduct requirements. These requirements without a doubt are necessary to protect those markets and our investors.

Second, many ICOs are being conducted illegally. Their promoters and other participants are not following our securities laws. Some say this is because the law is not clear, I do not buy that for a moment. The analysis is simple, are you offering a security, if so you have a choice. Follow our private placement rules or conduct a public offering registered with the SEC."

Chairman Clayton is spot on with ICOs. I wrote an article back in September covering how out of hand ICOs were getting, especially with promoters like Jamie Foxx, Paris Hilton, Floyd Mayweather, among others doing these celebrity promotions. Many ICOs fail to pass the the Howey Test, which was derived from 1946 a Supreme court case (SEC v. Howey). Under the Howey Test, a transaction is an investment contract if:

- It is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

The term "money" can also expand to include investments of assets other than money.

One thing to note, Chairman Clayton mentionted that both the SEC and the CFTC do not have direct jurisdiction over the popular markets that trade true cryptocurrencies. He said this is due to the fact that cryptoassets are a new asset class. Hinting to the possibility of a new government entity being created to regulate this space.

U.S. Sentator Mike Crapo (R-Idaho), the Chairman of the United States Sentate Committee on Banking, Housing, and Urban affairs delivered the following remarks regarding CFTC and SEC at a full committee hearing on Tuesday titled "Virtual Currencies: the Oversight Role of the SEC (Securities & Exchange Commission) and CFTC:

“For its part, the SEC has put forth many statements and guideposts to help the markets and investors. Namely, the SEC has: issued investor bulletins on initial coin offerings; issued an investigative report on what characteristics make an ICO a security offering; issued several statements by Chairman Clayton on the issue; brought enforcement actions against fraudsters; and issued joint statements with the CFTC about enforcement of virtual currency related products."

“The CFTC has also been helping inform the markets by: launching a dedicated website on virtual currencies to educate investors; bringing enforcement actions against individuals involved in cryptocurrency related scams; issuing several statements by Chairman Giancarlo and other Commissioners on the issue; and scheduling hearings on the topics."

Senator Crapo also noted that most of the news surrounding cryptoassets had been negative lately, referring to the most recent Coincheck hack, which was the largest ever, valued at $530 million at the time. Also, other exchanges like Nicehash which was hacked in early December for a value of $64 million at the time. Then you have the scams like Bitconnect and Davorcoin. Bitconnect is now dead and Davorcoin recently received a cease & desist order from Texas State Security Board.

He stated this at the hearing:

“Much of the recent news about virtual currencies has been negative; between the enforcement actions brought by your agencies, the hack of the international Coincheck exchange, and the concerns raised by various regulators and market participants, there is no shortage of examples that increase investor concerns.

He followed up with a more positive note, clearly seeing the potential in the technology involved here.

“It is also important to note that the technology, innovation and ideas underlying these markets present significant positive potential."

All of this is pretty expected and as I've stated before, regulation is necessary in some cases to help deal with the fraud and scammers that are still quite rampant in the cryptocurrency space.

U.S. Senator Mark Warner (D-Virginia), spoke about a "coordinated effort between the Securities & Exchange Commission and the Commodities & Futures Trading Commission."

J. Christopher Giancarlo is the hero cryptoassets need

Chairman Giancarlo's opening statements were nothing short of phnomenal, discussing how his college aged kids and millenials are into this stuff. On top of that he says taking a "do no harm" approach is the best way to go at this, similar to the internet. Here is his opening statement (Author Note: I typed this one out too during listening as this opening section was not included on the testimony transcript):

"With your permission, I'd like to begin briefly with a slightly different perspective and that is as a dad. I'm the father of three college-age children, a senior, a junior, and a freshman. During their high school years we tried to interest them in financial markets. My Wife and I set up small brokerage accounts with a few hundred dollars that they could use to buy stocks. Yet other than my youngest son who owns shares in a video game company, we haven't been able to pique their interest in the stock market. I guess their not much different than most kids their age.

Well something changed in the last year, suddenly they were all talking about Bitcoin. They were asking me what I though and should they it. One of their older cousins who owns Bitcoin was telling them about it and I got all excited. And I imagine that maybe members of this committee may have had some similar experiences in your own families as of late. It strikes me that we owe it to this new generation to respect their enthusiasm about virtual currencies with a thoughtful and balanced response, not a dismissive one. And yet we must crackdown hard on those who try to abuse their enthusiasm with fraud and manipulation. I mean we must thoroughly educate ourselves in the public about this new innovation and we must make good policy choices and put in place sound regulatory frameworks to reduce risks for consumers."

Chairman Giancarlo's statement was nothing short of amazing and his views managed to help the market rebound from it's lowest point seen in nearly three months. He even managed to say "Hodl" in front of a bunch of senators when he was referring to his niece's experience with Bitcoin. It's hard not to like Giancarlo if you're a crypto enthusiast.

Another statement I thought was very positive look on the disruption this new asset class, cryptoassets is creating. Giancarlo mentions:

"Emerging financial technologies broadly are taking us into a new chapter of economic history. They are impacting trading, markets and the entire financial landscape with far ranging implications for capital formation and risk transfer. They include machine learning and artificial intelligence, algorithm-based trading, data analytics, “smart” contracts valuing themselves and calculating payments in real-time, and distributed ledger technologies, which over time may come to challenge traditional market infrastructure.They are transforming the world around us, and it is no surprise that these technologies are having an equally transformative impact on US capital and derivatives markets."

Just like the internet disrupted many businesses and processes, so will blockchain and the assets that run on top of it. A classic example of internet disruption was the Blockbuster-Netflix case. Reed Hastings (now CEO & co-founder of Netflix) founded Netflix in 1997 after getting a late fee returning a rental movie too late to Blockbuster. In 2000, he approached the then CEO of Blockbuster, John Antioco, and asked for $50 million. They negotiated for a while and John decided the DVD mailing business was a small, niche business. We all know how that ended. Netflix is now the first thing that comes to mind when you think of streaming.

It's not the strongest who survive, but the one who is most adaptive to change.

Market Reversal?

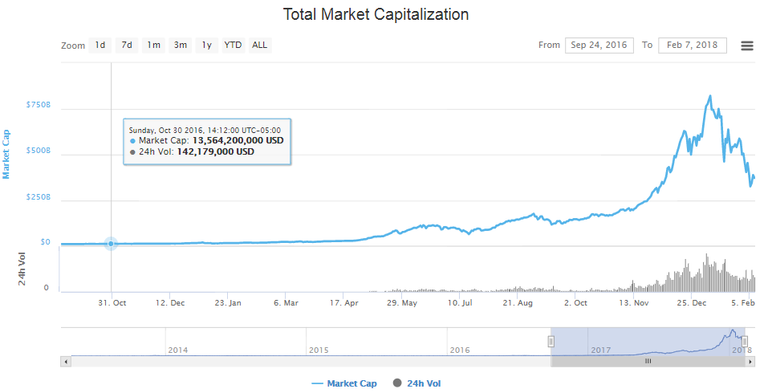

After the news seeped its way out to the public, the markets seemed to turn around (I say seemed because we still aren't in the clear yet). Crypto Twitter did a compete 180 overnight, as many yesterday were hunkering down with very few positive things to say until this testimony came out which coincided with the rebound. After about a month of bleeding from the all time high of $832 billion cryptocurrency market cap to $276 billion per Coin Market Cap data. A thing to note was this last dip was more rounded out then the previous bounces, where they formed more a sharp "V" shape (red arrow denotes "V" shape dip), versus a semi-circle in this last dip.

It's all about perspective.

I say this because one year ago this was a $17 billion market cap and few could've imagined the massive wall of a chart in front of them. Even if we go back to October, when the cryptocurrency market cap was around $175 billion, we're over 100% up from that point. Do you know how crazy people would go if the NASDAQ Composite was up 100% in under five months. People would lose their minds. This is just the beginning and I foresee this being over a $10 trillion dollar market in coming years.

Overall, this news is bullish for anyone who is long-term on cryptoassets and the space itself. A year ago, cryptoassets were largely ignored for the most part, except for the few who saw the real value these teams were creating. My prediction for total cryptocurrency market cap at the end of 2018 is $6 trillion. A very lofty number, but this space grows fast. As more vendors and governments accept cryptoassets, we will see them grow very fast.

Considering the equity market is heavily overvalued and due for correction, I wouldn't be surprised to see a flight to safety. A flight to safety is when money flows from stocks to bonds, but instead of to bonds which may be effected heavily like the 2008 crash to cryptocurrency itself. Systematic risk may be avoided here possibly due to the fact that cryptocurrency ignores macroeconomic events and Bitcoin for instance can be seen as a digital gold (store of value).

What are your guys predictions for the end of 2018 cryptocurrency market cap! Comment below.

If you liked this content, please upvote, comment, share, and resteem it!

Follow me @investoranalysis

Follow me on Twitter @Brett_Kotas to stay up to date with the crypto scene.

Follow me on Instagram @crypto_coitas to keep up to date on crypto.

Thanks!

Check out my website and my Contributor site, Influencive.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.