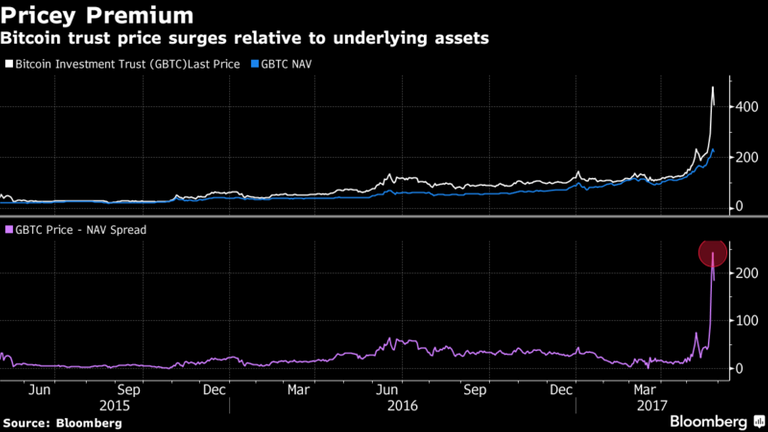

Currently Grayscale operates three crypto funds: Bitcoin, Ethereum Classic, and ZCash. Grayscale's original investment trust was Bitcoin (ticker: GBTC), which currently trades over-the-counter (OTC). For those unaware, Grayscale gives investors exposure to cryptocurrency via a security in the trust. The fund's demand has been so great that it tends to trade far above it's net asset value (NAV).

Grayscale's managing director, Michael Sonneshein stated this on Tuesday:

“By the end of the first quarter of this year, we’ll have a total of eight investment products.”

Sonneshein withheld info on the four new cryptocurrencies being added, leading us to figure out what the fifth fund/investment vehicle will be. Possibly leveraged or inverse fund for those seeking to hedge.

He also stated that they will be OTC too, with no plans to list on exchanges. Last year, Grayscale attempted to list the GBTC on the NYSE Arca, which was scrapped part way through. For those who don't know, the NYSE Arca, was formerly known as Archipelago Exchange (ArcaEx) prior to doing a reverse merger with NYSE Euronext.

GBTC's Stellar Year

For anyone following GBTC, it was a terrific year for the trust. It went from a low of about $106/share last January, to a high of $3,464 on December 18th, 2017. That is roughly a 3,400% return, which is phenomenal (GBTC actually outperformed Bitcoin itself in 2017).

The downside is not many people are able to get exposed to Grayscale's investment as they are only available to accredited investors. For those unaware, an accredited investors in the U.S. are defined as someone with a annual sallary greater than $250,000 or net worth more than $1 million. Hopefully in the future they open the trust to more retail investors as to give them safer exposure than it would be to holding Bitcoin, Ethereum Classic, or ZCash, which requires one to be tech savvy. Especially since ZCash and Ethereum Classic aren't on an exchange like Coinbase where it is "click" to buy and "click" to sell. As dumbed down as it gets and they take advantage of people by charging very high fees. (Author Note: I hate Coinbase and their fees. Do yourself a favor and use Gdax, your Coinbase account will transfer right over. It is Coinbase's trader platform that allows you to buy and sell cryptocurrency right away versus Coinbase where you wait days for your crypto or cash to show up. You can easily wire/transfer money in and out. You're welcome.)

Possible new cryptocurrencies added

Since they are adding four, here is my list of the possible coins (I have bias, so take this with a grain of salt.) I chose these coins as they are large cap coins, have solid fundamentals/team(s)/use case, and have been around a while. I highly doubt will see something like Tron, IOTA, Verge, etc. that gets pumped and dumped (Verge), plagiarized white paper (Tron), fake partnerships (IOTA-Microsoft partnership debacle) , or no product/lack of working product (Tron, Verge [Wraith] & IOTA).

List is in order of most likely to be added:

- Ripple

- Litecoin

- Ethereum

- Stellar

- Monero

- NEO

Here is my quick not so in depth reasoning behind these coins being listed.

- Ripple(XRP) - Ripple has signed on over 100 financial institutions by fall 2017, including the notable Amex partnership. Per Ripple's website, XRP can handle 1,500 transactions per second (TPS), and scalable up to 50,000 TPS. On top of that, XRP is currently being used in their xRapid product for remittances. Most notably with Cuallix recently, where their CFO, Nicolas Pallacios, said this on xRapid and it's efficiency's:

"We ran the costs on our end and see that this is 1000 percent more efficient than what we’re doing now. The xRapid pilots all went perfectly."

Litecoin (LTC) - Bitcoin's little brother has had a lot less drama surrounding it in 2017 and has achieved many milestones. These include Lightning Network (LN), SegWit (Segregated Witness), and atomic swaps. Along with that, the founder, Charlie Lee, is a very straight forward man and keeps the Litecoin community stable. In my opinion, Litecoin is a better store of value and use case than Bitcoin in it's current state.

Ethereum (ETH) - Ethereum absolutely dominated the space in 2017. Launching a majority of the ICOs from their platform, it currently runs a lot of the market on top of it via it's ERC-20 token. Scaling has been Ethereum's Achilles' heel, having been able to only handle 10-20 transactions per second. We saw most recently the scaling issues come into play when digital kitties managed to clog the Ethereum network, causing severe back logs. With the launch of Casper, Ethereum's switch to Proof-of-Stake, we will see scaling improve vastly.

Stellar Lumens (XLM) - Stellar is a fork of Ripple and is headed by none other than Jeb McCaleb, the brain child behind Mt. Gox and Ripple (he is the founder of both, and he left Mt. Gox before the hack), but subsequently left Ripple after a dispute with Chris Larsen. Stellar is currently focused on Peer-to-Peer (P2P) settlement. They had a huge partnership announcement in October with IBM, which sent the currency from around a penny all the way past $0.80 in the matter of three months. Per Stellar's website, it can currently handle 1,000 TPS.

Monero (XMR) - Monero is one of the best privacy coins out there. It uses Ring CT (Confidential Transaction) to hide the transactions via concealing the amount, origin, and destination of the transaction while allowing for verifiable, trustless coin generation. Privacy coins demand is still far below where it will go over the next few years as users, companies, and others seek to hide their assets and transactions.

NEO (NEO)- NEO, also known as the Chinese Ethereum is a smart contract platform set out to compete with Ethereum. The advantage NEO has is it uses Java, Python, C#, Kotlin, and more other languages making it easier for devolpers to jump right in and write smart contracts versus Ethereum which uses it's own language, Solidity. NEO also has some ICOs coming up on it's platform, that will give the token a boost in Q1 2018. NEO uses a consensus you probably haven't heard of before, Delegated Byzantine Fault Tolearnce (DBFT). Consensus is achieved in DBFT by "gamified" form of block verification by professional node operators. These professional nodes are appointed by ordinary nodes through a delegated voting process.

2018 will be the year of crypto

More and more bullish news keeps coming out each day surrounding cryptocurrency and blockchain technology. Robinhood, the stock trading app, just announced it was moving into cryptocurrency and will be offering zero-fee cryptocurrency trading and tracking. Coinbase will finally have some much needed competition. We are seeing more public companies working with the technology now. IBM has their "Blockchain" commercial where they discuss utilizing blockchain tech, Watson (AI), and the cloud. The masses will be coming into crypto, are you ready?

If you liked this content, please upvote, comment, share, and resteem it!

Follow me @investoranalysis

Thanks!

Check out my website and my Contributor site, Influencive.

Disclaimer:

This author currently owns some XRP (Ripple).

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of the author on whether to to buy, sell or hold shares of a particular cryptocurrency, cryptographic asset, stock or other investment vehicle. Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets. Past performance is no guarantee of future price appreciation.

Ripple seems like the very likely choice, it is really inline for what it's original intent was to be.

I'm biased towards Ripple, but even then it's a no-brainer. When they announce the coins, I imagine will see the underlying assets (XRP, ETH, NEO, LTC, etc.) themselves get a nice jump in the market. 2018 will be a wild ride, that's for sure.