If you haven't heard about Tether, it's something you should definitely be aware of.

Tether

A quick summary to help bring you up to speed. Tether is a cryptocurrency that's intended to be tied to the United States Dollar; in other words, 1 Tether is intended to equal $1.

Here's a scenario to help explain the fragile market Tether has created. I have a plate full of ham sandwiches. I've priced them at $1 each. George comes in and offers me 2 IOUs for a ham sandwich. I do the quick math in my head, 2 is greater than 1; "Hmm, okay, you've got a deal!" Diane walks in and I let her know the last price was 2 so you can either give me 2 IOUs or $2; she only has $2 on her (she shrugs her shoulders, "What's an IOU?") and hands over the cash.

George's IOUs are artificially inflating the ham sandwich market. If I go back and try to sell those IOUs to convert them to dollars, they may in reality only be worth $0.50 each which means the original sandwich was purchased for $1. So Diane paid double for her ham sandwich! Worst case scenario is that those IOUs are actually worthless.

Replace the ham sandwiches with Bitcoin and IOUs with Tether, extrapolate that over millions of transactions and we have a recipe for disaster. That ~$10,000 Bitcoin may actually only be worth $100. Tether has been used to dramatically inflate the market value of Bitcoin and other coins over the past few months.

If we look at just the past two months, here's the amount of new Tether that has been created, distributed, and used to drive up the value of Bitcoin and other coins.

| Month | New Tether |

|---|---|

| January | $850 million so far |

| December | $650 million |

You can keep an eye on Tether printing via the Twitter account 'TetherPrinter'.

Here's the timeline of events that make the situation all the more worrying.

- Aug 2016 - Bitfinix exchange is hacked and around 120,000 Bitcoins are stolen. (>)

- Nov 2016 - Bitfinix begins crediting all of its customers impacted with 1 BFX token for each $1 lost. (>)

- Apr 2017 - Bitfinix reimburses all of its customers for the losses by swapping each BFX token with 1 Tether; the BFX token is retired. (>)

- Apr 2017 - Bitfinix exchange is cut off from US banks. (>)

- Aug 2017 - Bitfinix admits to being majority owner of Tether (>)

In my ham sandwich analogy, I wasn't aware of the function of an IOU. Unfortunately, Bitfinix is directly involved and closely partnered with Tether. It's a huge conflict of interest. In such an environment, I could have hired George to intentionally use 2 IOUs to purchase my ham sandwich and raise the overall market price from 1 to 2. Diane is the victim of our ham sandwich price manipulations.

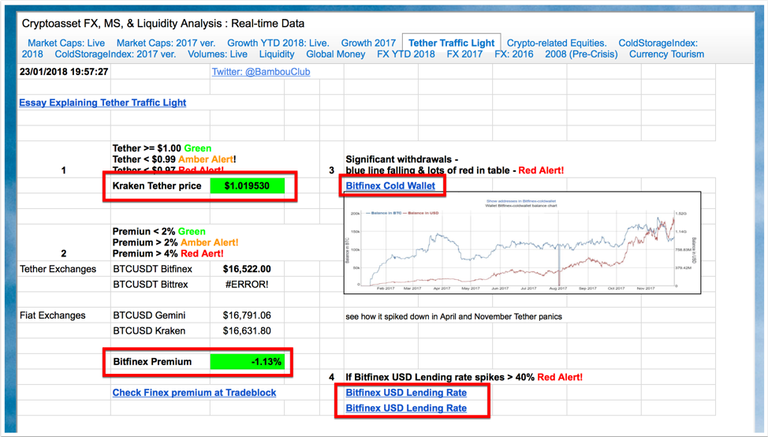

Weather

So how can you proactively monitor and protect yourself from a potential Tether crash? Blocklink.info has created a handy Tether monitor. The idea is that if the four indicators are green, there's nothing to worry about (except to remain informed and aware); however, once you start seeing the indicators change yellow or red, it's time to exit the market and protect your assets.

I'm not trying to scare anyone but I do think it's important for you to be informed since your hard earned money is at stake.

Please let me know if you have any questions.

Thanks for reading!

It’s nice to see this finally getting more widespread attention. Hopefully we can get some answers so the market can begin to look forward rather than being held back by Tether’s ball and chain.

“U.S. Regulators Subpoena Crypto Exchange Bitfinex, Tether”

https://www.bloomberg.com/news/articles/2018-01-30/crypto-exchange-bitfinex-tether-said-to-get-subpoenaed-by-cftc