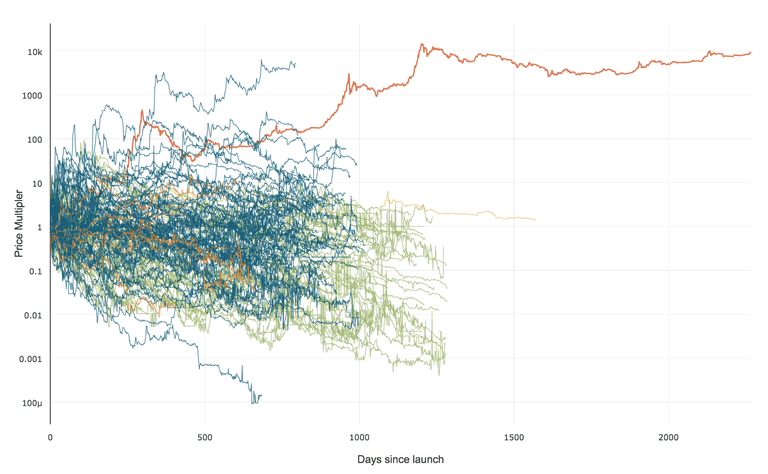

There’s been a graph of altcoin performance doing the rounds recently, and there’s a single outlier: GAME. Is it variance, or some quirk of statistics, or is there more substance to it?

Take a look at this blog post (http://woobull.com/data-visualisation-118-coins-plotted-over-time-this-is-why-hodl-alt-coin-indexes-dont-work/), if you haven’t already. It’s an analysis of a chart of 118 alts that have achieved at least $250,000 market cap, giving an overview of their performance since their exchange launches against bitcoin’s own performance.

There's one quote in the article that will interest gamecredits’ holders. "All my friends are asking if that wiggle above bitcoin is Ethereum. Sorry no, it’s GAME, I don’t know what that is, but it’s likely a statistical aberration – someone’s gotta get lucky. I mean when I look sideways, it’s like a rocket engine, some of the exhaust flames go to the edges, it’s just thermodynamics."

Naturally, those with an inside track on gamecredits’ plans will dismiss the writer’s analysis that this is just random variation – akin to saying that if you throw 118 darts at a board blindfolded, one will probably hit the bullseye. For example, there’s the fact that practically no altcoins have had promising real-world use-cases just yet, so of course when one comes along it will likely outperform those that do not. But there are more and better insights on offer here if you ask the right questions.

Market cap

You can see the shortcomings of the ‘day #1 multiplier’ metric for success by comparing the red bitcoin line with GAME. Bitcoin reaches the same multiple of starting price over a year later than GAME. But gamecredits’ market cap is still a tiny 0.1% of bitcoin’s – around $10 million, against bitcoin’s vast $14 billion. The message here is that, all things being equal, if two athletes start from two different places and run for the same period of time, they will end up in different places. The finishing points of each doesn’t necessarily tell you a lot about their relative performance.

In a subsequent article we’ll unpack these ideas further and look at what GAME’s apparent outperformance might really mean.(Please check back in tomorrow if you're interested in that next article) For now, we’ll just say that the author’s conclusion is worth paying attention to. "It seems that alt-coins are best left for trading due to their volatility, but very risky as holds. This may change in the years ahead, but for now, out of 700+ coins in my database I would say less than 5 have a shot of doing something interesting. It reminds me of early stage startup investing actually."

If you're interested in GameCredits please feel free to join the official GameCredits slack and ask the team anything: http://gamecredits.com/slack.html

Combining cryptocurrency and gaming is a no-brainer at this time in history.

Love what you guys are doing!

And happy to read this analysis =)

Glad you enjoyed! If you have any other questions, just let us know. Thank you for the feedback.