For me FUD is sort of a double-edged sword, it’s annoying especially if it’s not true and it eats up a lot of your time and resources, but on the other hand it really pushes me to do a deep dive on my own accord to see what’s behind the curtain of any given particular project — which is valuable especially if I’m invested in it. If you’ve followed some of my other articles, you’ll know that I’ve been talking about a lot of FUD-related issues a lot, and this installment is no different. In this we’re going to be analyzing some of the big FUD that’s been surrounding $USDC. So let’s first take a look at the tweet that started it all:

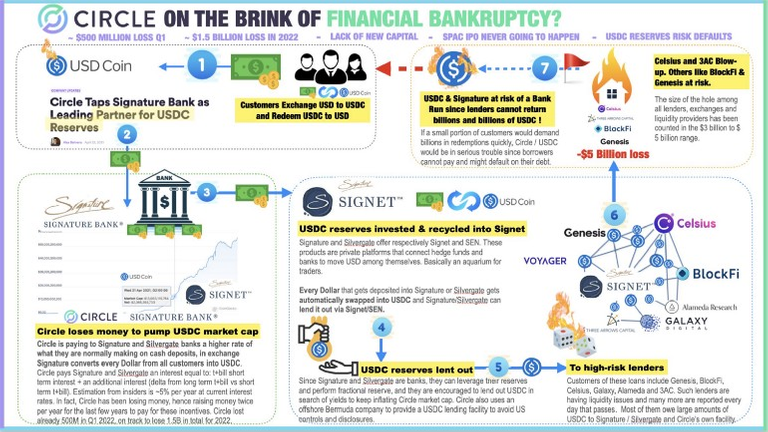

I’m not really sure who “Geralt Davidson,” is, but for the purposes of this article, it really doesn’t matter. What I’m more concerned about is the infographic that he’s put together, so we can dissect a bit further into how much of a concern this should actually be to $USDC holders (including myself). So let’s first take a look at the infographic itself:

At a glance this might seem a bit complicated as there’s several steps involved, but the good news is that whenever you’re trying to get your company to go public— especially through a SPAC (Special purpose acquisition company) as in the case of Circle— you have to go through the SEC. To quote the SEC’s website, this means that the prospective company needs to have:

“the SPAC’s IPO prospectus as well as its periodic and current reports filed with the SEC pursuant to its ongoing reporting obligations.”

In other words, all of the information pertaining to the company’s business plan, how it generates revenue, what it’s assets entail — are all made public for everyone to see, in fact you can see Circle’s SEC filings here. Therefore, it can take some time, but it’s quite easy to fact check some of this information and see if some of these FUD-related dots can actually be connected. For the purposes of this article, I’m taking information from their SEC filings as well as statements from the latest July 8th, 2022 interview with Circle’s CFO, Jeremy Fox-Geen with Forkast.

So without further ado, let’s break down some of the issues that are raised in the graphic:

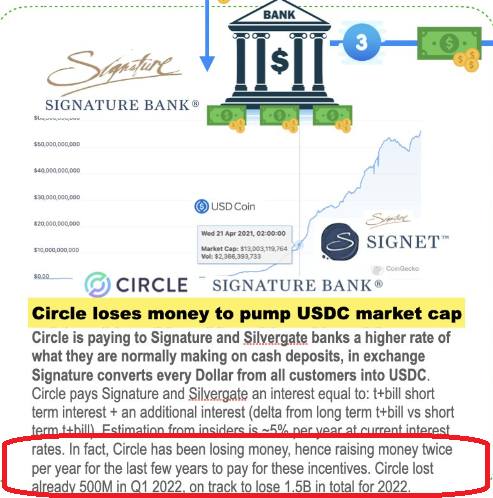

Accusation 1: Circle has been losing money, hence raising money twice per year for the last few years to pay for these incentives. Circle lost already 500M in Q1 2022, on track to lose 1.5B in total for 2022.”

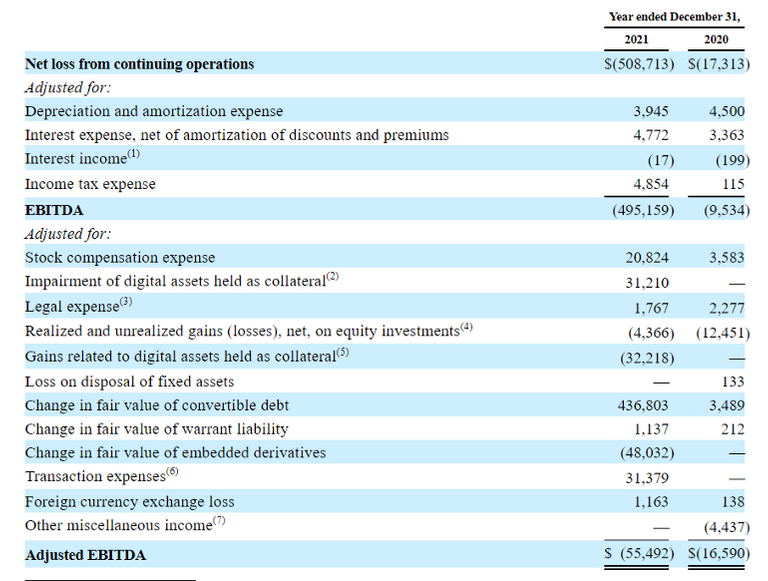

Findings: In the years past, Circle has lost money, but not nearly to the tune of what’s being said. The figures that he quoted for Q1 2022 — those stats aren’t publicly available, but if you look at their latest SEC filing, they had losses of roughly $500 million over the course of 2021, and $17 million in 2020:

Is this concerning? Maybe, and Geralt is right in the fact that they have been raising money — last April they raised $400 million and in May 2021 they raised $440 million. But as far as 2022’s numbers go, a $500 million loss over just one quarter is significantly more than a $500 million loss over the course of an entire year, and Geralt’s numbers are extremely incongruent if you take a look at Circle’s P&L Summary for 2022–23, for you’ll see what the estimated adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) are for 2022, which look very comparable to 2021’s. But in a nutshell, even if his $500 million Q1 loss is accurate, I still think it’s a bit of a stretch to say that Circle is going to lose $1.5 billion over the course of this year, especially considering how volatile the market has been.

Verdict: Circle right now is definitely operating at a loss and has been for the past couple of years. This however doesn’t seem to matter, because of what we’ll see in Point 2.

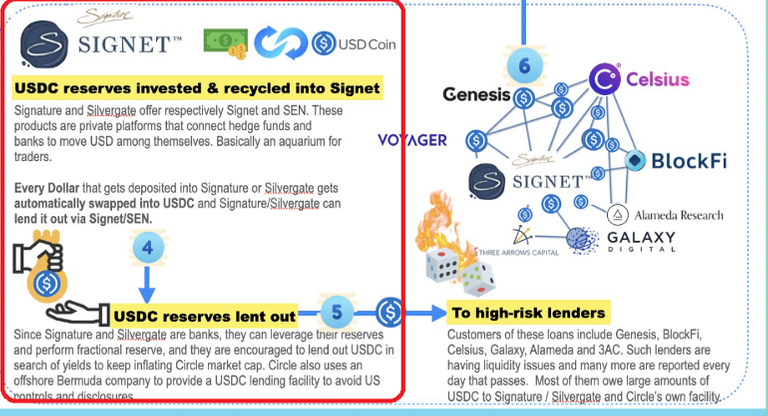

Accusation 2: Circle is giving control of the USDC reserves to partner banks and they’re lending them out to bad actors

Findings: During his interview, Fox-Green explained that this was categorically false, and that the USDC reserves were not being lent out to anybody. As I’ll get into later, it appears loans to the likes of Voyager got lent out, but apparently this has nothing to do the actual reserves that customers would need in order to redeem their USDC for fiat. He goes on to explain:

“That segregation ensure[s] that the USDC reserve is complete and separate from anything else that Circle does,” Fox-Geen told Forkast. “A holder of USDC can always be confident that they can redeem it at any time, one for one for a U.S. dollar.”

If Geralt Davidson did his homework, he could see this mirrored in Circle’s June 2021 audited consolidated financial statements (Page 10 to be exact), which of course was filed with the SEC as well:

“Cash segregated for the benefit of customers and USDC holders was $4,024.7 million as of December 31, 2020 and $522.1 million as of December 31, 2019. This represents cash and cash equivalents maintained in segregated Company bank accounts that are held for the exclusive benefit of customers. These funds represent cash deposits held by customers in their fiat wallets and unsettled deposits and withdrawals. The Company segregates the use of the assets underlying the customer funds to meet regulatory requirements and classifies the assets as current based on their purpose and availability to fulfill its direct obligation under custodial funds due to customers. The Company has cash balances that exceed the FDIC deposit insurance limit of $250 thousand per institution.”

This basically indicates that there will be enough cash on hand to cover the spread of people trying to cash out — thus if there were to be a bank run, the filling states that there is enough fiat to cover all deposits and withdrawals.

In case if you’re wondering what does happen to the USDC reserves, this information is all on Circle’s website but essentially Fox-Green states:

We hold approximately 80% of USDC reserves in U.S. Treasury bills with durations of 3 months or less…We hold approximately 20% of USDC reserves as cash

Verdict: The USDC reserves are mostly held in treasuries (as Gestalt himself alludes to figure 3), a with a smaller portion in cash. The idea that USDC reserves are given to degen-companies appears to be complete FUD. The only major scenario where this probably doesn’t play out well for retail is if the U.S. Treasury bills fail…and if that happens…we have a lot more to worry about than just USDC.

Conclusion

There’s probably a lot more to uncover here, but I don’t think the other issue(s) have to do with the backing or the redemption-capabilities of USDC, and personally that’s what I wanted to shed the most light on. If we zoom out a little bit, it seems to make common sense that Circle wouldn’t be doing a degen-play with USDC’s reserves — in fact, I’ve read that one of the ultimate goals for Circle is their desire to have the Federal Reserve to directly back USDC, which would make its value even more tied and fundamentally insured. Therefore the transparency required by the SEC, in addition to their overall hopes of getting this one day approved by the Federal Reserve makes it seem that it would be quite foolish (and even catastrophic) if Circle was trying to do something so risky and secretively.

In fact throughout my research, I was extremely impressed with Circle’s degree of transparency, but of course, I’m not a financial advisor (or a corporate auditor for that matter) so there’s a significant chance that there were significant things that I missed. If you believe that I did, please feel free to drop me a message in the comments because I would certainly like to hear about it.

Thanks for reading, and if you have any opinions/facts to the contrary, I would be very interested in hearing about them in the comments below. Also please be sure to follow me on twitter if you want to receive all my latest updates: https://twitter.com/CryptosWith

Disclaimer: None of this is financial advise and is suited for entertainment and educational purposes only. Please as always, do your own research and find what investment(s) might be best for you.

Resources

https://www.sec.gov/oiea/investor-alerts-and-bulletins/what-you-need-know-about-spacs-investor-bulletin

https://www.sec.gov/Archives/edgar/data/1876042/000110465922056979/tm2124445-8_s4a.htm

https://forkast.news/circle-customers-could-redeem-all-usdc-in-one-day/

https://www.coindesk.com/business/2022/04/12/usdc-issuer-circle-raises-400m/

https://www.coindesk.com/business/2021/05/28/usdc-builder-circle-raises-440m/

https://www.circle.com/hubfs/investors/Circle%202022-2023%20Financial%20Projections.pdf

https://www.sec.gov/Archives/edgar/data/0001824301/000121390021036070/ea143875ex99-6_concordacq.htm

https://www.circle.com/blog/usdc-trust-transparency-minimizing-risk

https://www.circle.com/blog/circle-submits-response-to-federal-reserves-cbdc-discussion-paper