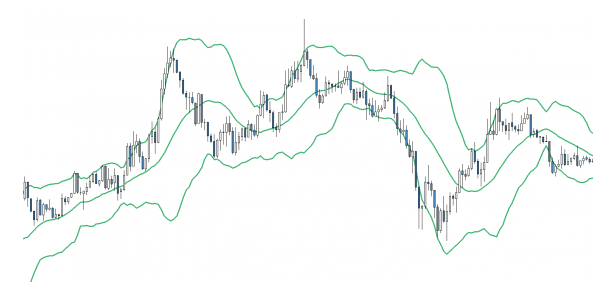

Bollinger Bands are a tool used as an indicator by many traders for technical analysis of financial markets such as Forex, the creator was called John Bollinger, hence the name, basically are 3 lines: 1 lower and 1 higher together to a moving average that is right in the middle.

The more volatile the market is, the greater the amplitude of the bands, so if we see little volatility they will be closer together, a concept that has to be very clear to use this technique of technical analysis of cryptocurrencies is that if the price passes the upper line would enter overbought, likewise if it exceeds the lower line it would be oversold, when a movement starts in one band has the tendency to end over the other, when we see that maximum and minimum left the bands can mean a change of uptrend or bearish.

Every person that is dedicated to trade with cryptocurrencies knows how volatile this market is, today you are up and tomorrow you are down, that is why the Bollinger Bands can help you identify good points to buy and sell at the right time, it can seem quite logical:

- Buy when the price is stopping over the Lower Band.

- Sell when the price is stopping on the Upper Band.

But beware, this does not mean you have to sell or buy anything else touch the Bollinger Bands since you could stop earning profit, for that we have to identify key supports or previous ups / downs to find the boss and anticipate it.

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly & Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness