Q3 has been the busiest quarter yet for ICN Hodler in terms of development. There's a lot to talk about so I'll dive right in.

Q3 Summary

In the Q2 report at the beginning of July I said I felt the crypto market had reached a 'stable' level after what can only be described as a disastrous first half of 2018 (in terms of price for crypto hodlers). Price did indeed stabilize in Q3. Total crypto marketcap was around $250b at the start of Q3 and closed at around $223b, so down by around 10%. For comparison, in Q1 total crypto market cap started at almost $600b and ended at $254b. A 57% drop.

Price may seem irrelevant in the context of ICN Hodler but the purpose of ICN Hodler is ultimately to make sense of price / value and keep tabs on everything ICONOMI gets its tentacles in to. For that reason it's important to keep an eye on the overall crypto market and learn about how it impacts ICONOMI, DAAs, exchange activity etc...

New features / site updates

In the Q2 report, I said I hoped to introduce:

- ICONOMI Improvement Proposals (IIPs)

- Twitter & Google Trend Info

- Begin work on a site redesign

I'm happy to report all of the above was complete along with a bunch of other new features including:

- DAA price comparisons with BTC, ETH and other assets over time

- ICN exchange activity over time

ICONOMI Improvement Proposals

This was inspired by Ethereum's EIPs which act a formal way to propose improvements to the Ethereum protocol. Looking at the ICONOMI subreddit and discussion on RocketChat, it became clear to me that we needed a place to document ideas at length and keep them in a place where they could be accessed and referenced easily. There's an IIP repository on Github here: https://github.com/ICNHodler/IIPs and all IIPs are also available to read in an easier format on the ICN Hodler website: https://icnhodler.com/IIPs

To date there have been 4 IIPs and the ICONOMI CTO has responded positively to two:

https://github.com/ICNHodler/IIPs/issues/4#issuecomment-423530585

https://github.com/ICNHodler/IIPs/issues/2#issuecomment-423529471

A github project isn't the most user-friendly way of gathering submissions but it's a start. I intend to simplify the submission process so it can be done through the ICN Hodler website on a traditional form and then manually submitted to github by an admin.

Twitter & Google Trend Info

This was a massive undertaking but something I felt had to be done sooner or later. Whether it's a bot telling you when Tether has been printed or exchanges announcing new coins they're going to list, Twitter has become something we have no choice but to monitor whether we're traders, holders of tokens or just casually following the space.

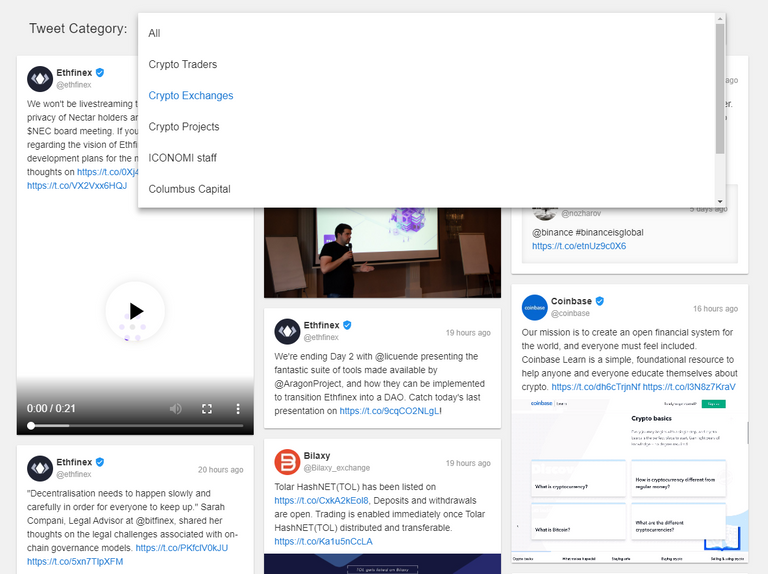

One of the main problems with Twitter from a crypto perspective is spam which confuses users and makes it difficult to distinguish between real / fake accounts. It doesn't help that getting verified on Twitter is not a straightforward process. This also makes search results unreliable, meaning it's not possible to display a feed of results and be guaranteed there'll be no spam in it.

In order to combat this and ensure a reliable stream of high quality tweets, I manually created several twitter lists such as Traders, Exchanges, DAAs etc... these lists contain hundreds of trusted accounts and will be updated manually over time. The end result can be seen here: https://icnhodler.com/tweets The latest 40 tweets or so from each category are combined and displayed by most recent first (retweets are deliberately not shown so that all tweets show authentic content).

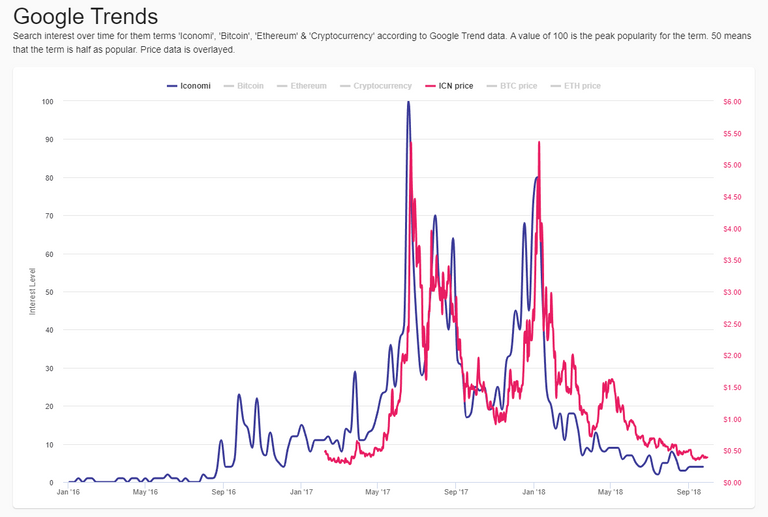

Google Trends data isn't so complex but that doesn't mean it's not valuable. People have often said that there's a correlation between Google Trends data and price. Now, you can see for yourself whether that's the case. I've displayed weekly, global search trend data for the terms 'Iconomi', 'Bitcoin', 'Ethereum', 'Cryptocurrency' and overlayed price data on top: https://icnhodler.com/trends

Begin work on a site redesign

In Q4, the homepage will be redesigned so that emphasis will be on the most important / most accessed info. DAAs will get their own 'profile' pages which will in themselves be mini homepages for specific DAAs containing visual & table based performance of assets the DAA holds, AUM history, price history and more. The overall look and feel of the site probably won't change much but everything will become more connected and less fragmented. Work on this has already begun.

DAA price comparisons over time

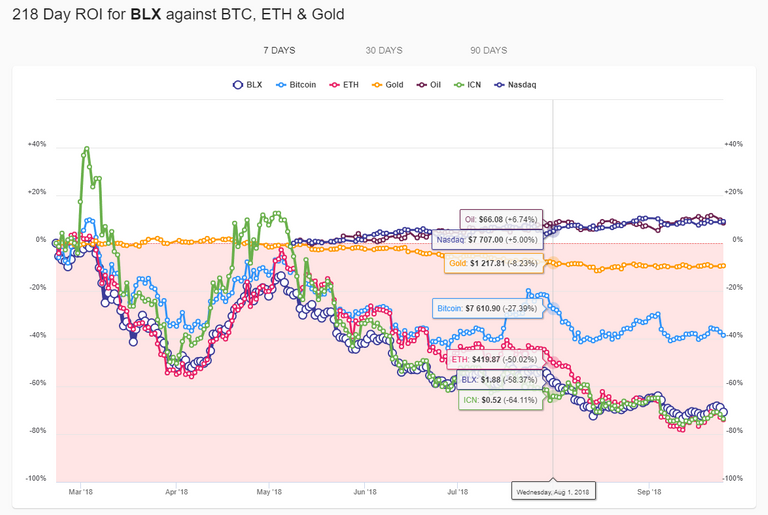

One of the most requested features I've seen from the ICONOMI community has been the ability to compare DAA performance to the performance of ETH and BTC over the same time period. ICONOMI have often mentioned how BLX or certain DAAs have outperformed Bitcoin in the past but it was never clear whether they had cherry picked stats from a certain time period to make performance look good or whether DAAs consistently outperformed Bitcoin over a range of time periods.

In Q3 it became possible, for the first time, to check out performance for yourself on ICN Hodler. DAA price data is logged for all DAAs along with BTC, ETH and even Gold, Oil & Nasdaq price data. You can check ROI between two dates for any DAA by using the following url format: https://icnhodler.com/daas/BLX/charts?from=20-feb-2018&to=25-sep-2018 Where you can swap 'BLX' for any other DAA name and replace the 'from' and 'to' dates to dates of your choice.

ICN exchange activity over time

Towards the end of Q3, Google made the Ethereum dataset available in BigQuery: https://cloud.google.com/blog/products/data-analytics/ethereum-bigquery-public-dataset-smart-contract-analytics. What this means is that it becomes relatively fast and easy (in comparison to what had to be done before) to search through all Ethereum transactions over time. As an experiment, I put together a static page on ICN Hodler here: https://icnhodler.com/exchange-activity which visualises total daily deposits and withdrawals of ICN over time to Kraken, Binance and the ICONOMI platform.

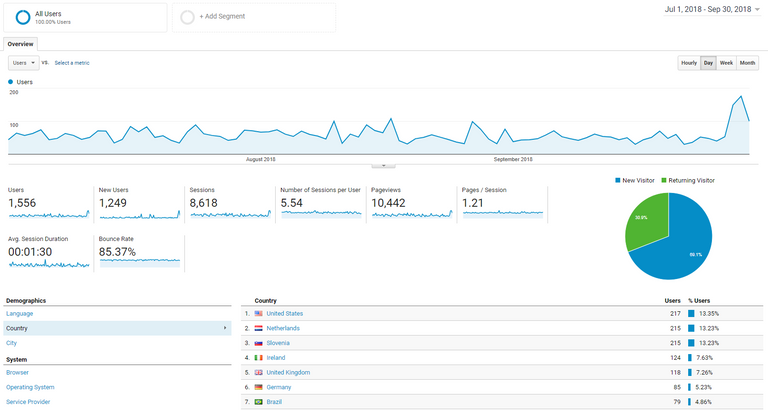

Q3 Traffic

Traffic was up slightly from Q2. At the minute it's still not something I pay much attention to other than to get an idea of user behaviour / what sections of the site people use. That will probably change once the site redesign is complete and more emphasis is placed on search engine optimisation.

1,556 users (+7.24%)

10,816 sessions (-20.32%)

30.92% returning visitors (-11.69%)

85.55% bounce rate (-0.21%)

Plans for Q4

Website Redesign

The homepage in particular will see a lot of change as more emphasis is put on making sure the most accessed and most useful content is on show. The homepage as it stands hasn't really been changed from day 1. Since then a lot of new features have been added and ICONOMI have also changed the way they communicate. The subreddit is no longer a major communication tool used by ICONOMI, therefore the ICN Hodler homepage will be redesigned to reflect that.

DAA Profile Pages

Finding, discovering, analysing and comparing DAAs will become increasingly important as more DAAs are added. This is a UX challenge ICONOMI themselves face and in Q4 I'll be taking baby steps towards improving it on ICN Hodler. DAAs will get their own profile pages which will contain AUM history, price history, price comparisons and a treemap view of individual asset performance among other things.

Coin Profile Pages

Something I've seen many people mention and ask about before is the ability to search for DAAs by coin. For example they want to see a list of all DAAs that have 'Bitcoin' in it, sorted by DAAs who place the most weight on it. In Q4, I'll be introducing a feature that will allow you to do this but it will contain a lot more info and allow for multiple sorting and filtering options. For example wouldn't it be nice to search for DAAs with an AUM over $1m, that contain WAN, GNT & BNB and that have an ROI of greater than 0% over the past 6 months? "No results found" may be a common response but that's ok. In time, as more DAAs are added and as more assets are added, searching, filtering and sorting will all become much more important.

Thoughts on eICN

A few days ago ICONOMI announced big changes to company structure and the ICN token. The ICN token will effectively be superseded by eICN which will represent a legal shareholding and equity stake in ICONOMI. Naturally this has generated quite a lot of discussion within the community and I'll do my best to keep all communication from ICONOMI in relation to eICN up to date on this page: https://icnhodler.com/wiki/eICN-token.

There are still quite a lot of unknowns around eICN and most hodlers now face the tricky decision of whether to cut losses and take ETH while they can, or take a leap of faith and swap ICN for eICN, possibly complicating tax matters for themselves and not knowing if / when eICN will become trade-able and where it may be listed. Those unfortunate enough to be unable to verify for Tier 2 on the ICONOMI platform face an even bigger dilemma in that they don't know when or even if they'll be able to swap ICN for eICN.

However, the issue of ownership was always a thorny one and ICONOMI have now put it to rest. Whilst ICONOMI originally said ICN represented ownership, they hadn't explicitly re-confirmed it since the whitepaper despite repeated questions / concerns raised by the community. ICN gained utility features earlier in the year but was always seen as a security token, something that became a cause for concern within the community over the possibility of de-listing from exchanges. With eICN, there should be no more doubt about ownership and no doubt as to the token's legal status. Pro-actively addressing the issue is something that should be commended and it shows yet again that ICONOMI are leading the way in trying to self-regulate and eliminate legal unknowns which are never a good thing when trying to attract investors, satisfy token holders and ultimately establish trust to manage other people's money.