Anyone else considered that BTC futures offered by CME + CBOE and the likes could be affecting the market?

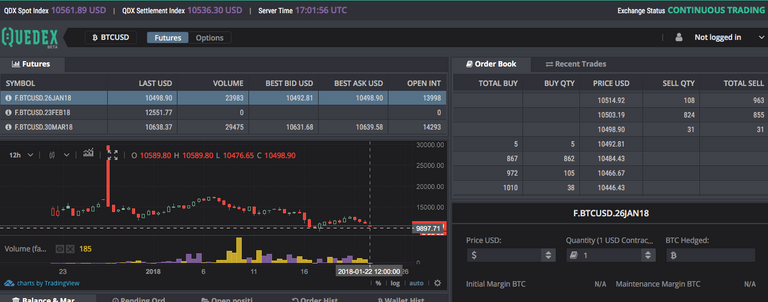

I am sure that we all agree that some people will do anything for $. I've been thinking about this since before Christmas, have done a bit of reading and have been back and forth about the 'conspiracy'. In my infinite stupidity, I never considered until tonight to actually see if I could access the charts - and I did. More about that in minute. (See image 2).

With only 3 days until the next futures contract offered by CME finishes - we could be back on the up, IF....IF the big players decide that is the way to go...

What are Bitcoin futures?

Without even owning any BTC, "bitcoin futures allows traders to speculate on what the Bitcoin price will be at a later date... Traders bet on this and profit accordingly." (Alam, N. 2018). Therefore it is in their interest and profit to be accurate about the price at the close of the contract, especially given that these 'proper' traders invest serious $, and also, are required on behalf of their brokerage to provide their clients with a good ROI.

How can they be so accurate?

The accuracy of the calls for the Banksters, can be achieved in a number of ways, first I am going to propose is insider trading - "Isn't that illegal?" Yes, in the everyday stock markets and exchanges it is. These futures contracts represent a cross over from a main stream, centralised banking exchange system (where insider trading is illegal) to the unregulated decentralised world of crypto. Therefore; it is plausible for them to operate in any way they choose, without legal reproach. Commanding something which most everyday users lack when beginning down the crypto path, these Banksters are able to access vast fiat amounts, amounts that give them the power to move the market to their will. In the crypto world - we call these whales.

How do we know that these individuals commanding vast resources are entering the market?

Public blockchain!!! I have seen a few wallets of various currencies appearing over the last 60-90 days.

For example;

NEO wallets;

AZx2onMci1CXa4STTMMhXDxsSyPZZxqyiZ

470,000 neo, new in the last 60 days.

That is; $62 million dollars for 470,000 neo.....

AJNNWpkh1kqi5UjtYXbSGMmcv81dMgAGim

244,000 neo, new in the last 60 days.

Think about these amounts of money for a moment, these have to be large Hedge fund investors, legit investments, that are probably part of a fund that also offers BTC Futures too... Beginning to get the potential move?

My working theory;

Accumulation period;

During 2017, there were occasional periods of FUD, (Fear, uncertainty and Doubt) these were usually triggers by threats of regulation, threats of outlawing crypto or the denouncement of BTC by some 'official economist' or 'Banking executive', Jamie Dimon, CEO of JP Morgan for example.

JD, (for short), was caught twice, very publicly hailing BTC to be a "fraud".

https://www.coindesk.com/jamie-dimon-bitcoin-fraud/

He then continued his assertions labelling those people buying BTC as stupid.

https://www.cnbc.com/…/jamie-dimon-says-people-who-buy-bitc…

All this time the markets were bleeding out, Suppoman was declaring sales and the Whales were swallowing up the cheap crypto like a plankton all you can eat buffet.

All the while he was dancing in front of the media, his bank was loading up positions in crypto.

https://www.zerohedge.com/…/if-jamie-dimon-hates-it-so-much…

Last year, 2017, awareness was raised another level and news about crypto currency crept into the mainstream. The occasional TV news article about the volatility and lack of security of BTC appeared, usually highlighting it's use for money laundering and illicit deals - not that fiat has ever been used for those aforementioned tasks, heck I would argue so far as to state that I have no doubt Mafioso's, cabals and drug lords prefer cash, as it is much more stable!! Anyway, I digress....

Q4 2017, new levels of people signed up, the banks secretly accumulated BTC. Crypto exchanges like Binance, Kraken, Kucoin etc struggled to meet the demand in regards to their infrastructure - requiring to freeze their uptake for short periods. The herd was coming.

Meanwhile, the Banks had their heads together and one; the "Chicago Board of Exchange (CBOE) became the first major derivative exchange to launch Bitcoin futures on December 10. Such was the euphoria among early investors that trading was halted twice due to CBOE speed breakers, which slow or pause trading when price movements are excessive." (Alam, N. 2018).

So it began...

Once the herd was allowed through the door, the price rocketed up again. The first future contract ended on the 17th of January. When it opened 10/12/17 BTC was at $15,771 per BTC and when it ended, 17/1/18 it was $10,000.

How convenient that some $90 billion left the market prior to the end of the CBOE futures contract. In my opinion, this is no happy accident that made many Wall Street and mainstream Hedgers clients wealthy.

17/1/2018 - DOWN - COMPLETE.

Notice $89 Billion left from the 16th-17th? After that everyone panic sells. After the futures contract closed - it went back up again. Who knows what will happen next...

Expiration dates of the next futures contracts; (Source: CME).

26/1/2018 - lets see how the price goes? UP?

23/2/2018 - DOWN?

30/3/2018 - UP?

With fresh meat entering all the time, it would be easy to pick off this $ over and over again. What's the worst that can happen? Everyone quits crypto and keeps their money in ISA's? Who wins - the banks.

Why did this all happen?

Not solely because the Banks fear the loss of $ from the centralised banking empires, but because they simply follow their capitalist yearnings to make more $, and saw within the naivety of the crypto world, the means to do it. And as another interesting aside - history ascribes that the Dutch tulip market bubble burst after the first 'futures' were offered in 1636. Will it be history repeating itself? Or will the herd get wise to the wolf?

Be careful out there. It'll be telling to see what happens after the contract ends on the 26th of January, I believe that it will start to go back up. Lets see.

I have been wondering about the futures market myself. I have been watching the regular crypto prices go up and down and the biggest pattern I have seen to dramatically raise or lower a price is mostly news driven. That makes sense for crypto that isn’t more than peer to peer but how would they know things about other types like EOS which is based more on a technology platform? Also EOS was one of the only cryptocurrencies up on Monday while pretty much everyday else dropped.

I think you are on the right track considering inside information or maybe those that create the hype one way or another are the ones who are trying to gain the most $...

Just my thoughts, thanks for an awesome post!