"Gold is the bitcoin without electricity. "Charlie Morris, chief investment officer of the British group Newscape Capital.

Is not this formulation too simplistic to be fair? What characteristics make it possible to put the bitcoin on the same plane as gold?

A concept dear to Ronald Stoferle is that of stock / flow ratio, a notion that I describe in my book. The high stock / flux ratio distinguishes the yellow metal from all other raw materials.

In 2012, when it was about 61 for gold (ie the world gold stock was about 61 years of production), it was only about 0.06 For copper that is produced and consumed at a tight flux (ie, the world copper stock was equivalent to about 3.5 weeks of production). Money has a stock / flow ratio of around 1.7.

Given the size of its stock compared to its flows, gold is much less sensitive to changes in supply and demand than other commodities.

Today, the stock / gold ratio is 64 while the bitcoin ratio is 25. Therefore, "not only is the bitcoin rare but the existing stock is relatively constant over time, which Confidence in this currency, "write Stoferle and Valek.

The stock / flow ratio of the bitcoin is nonetheless intrinsically bound to increase in time due to the halving. Every four years, the number of mined bitcoins is halved. For example, by 2020, the world stock of bitcoins will be no longer 25, but 56 years of production and then about 119 years of production by 2024.

The inverse of the stock / flow ratio is the inflation rate. Today, due to mining, annual inflation on the bitcoin is 1/25, or 4%. This rate will be reduced to only 0.84% in 2024. I can not say what the annual inflation rate of the euro or the dollar will be on that date, but I am sufficiently convinced that it will not decide the comma…

Thus, gold and the bitcoin have in common a "regular and low inflation rate". They owe this characteristic to the fact that "decisions about the production and control of money supply are not left in the hands of fallible humans. Bitcoin transfers the responsibility of humans to computers, while gold depends on nature. This is what makes American entrepreneur and investor Chris Dixon say that "there were three monetary eras: the commodity-based one, the one based on politics and today the one based on Mathematics "

THE DIFFERENCES BETWEEN BITCOIN AND GOLD

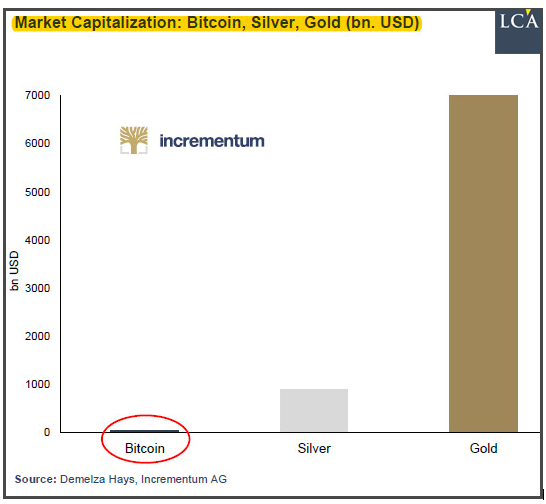

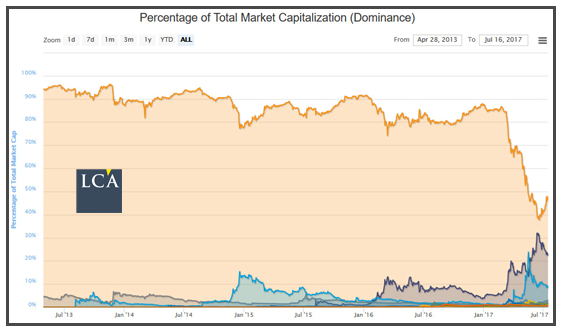

The gold and the bitcoin are however very different - in terms of market capitalization, first of all. Although the value of the bitcoin has increased tremendously since its inception, its capitalization still represents only 0.5% of gold's capitalization; The capitalization of the bitcoin itself represents a little less than 50% of that of the market for cryptodevises.

The advantages of the bitcoin on gold are quite obvious:

Speed of transaction execution and increasing number of possibilities of use (where I doubt we will be close to seeing a Youtuber take up a challenge in the mode "I lived 30 days by settling all my gold expenses"), ;

Low transfer costs (while physical gold transfer costs considerable);

Low storage costs.

I will mention three of the four disadvantages of the bitcoin on gold noted in the report:

Risk that the bitcoin should be exceeded in value by other cryptodesvises (there is still very little recoil, but the last correction was for the bitcoin the opportunity to regain ground on its competitors);

Risk of a change in state regulation (even if some states begin to consider that it would be better to regulate the bitcoin to better control it, rather than to prohibit it);

Dependence on the Internet, electricity and physical computer hardware (see Charlie Morris's quote).

FOR YOU: 10 TIMES LESS BITCOIN THAN GOLD

What percentage of bitcoin is reasonable to integrate into a portfolio? Here is the advice of Stoferle and Valek: "A growing number of academic research papers indicate that a portfolio should be diversified up to 2% to 4% in bitcoins, when gold can be allocated Up to 20% ".

Either, but how to invest on this sector when one is one is still novice? - you may be wondering. The best way to manage your wealth is to train yourself.

You should also know that Stoferle and Valek announce that their Incrementum fund will invest in cryptomonies.

Good Luck!This post was resteemed by @resteembot!

in the introduction post.nullLearn more about the @resteembot project

This is one of the best Bitcoin posts I have seen for a while... Resteem'd

thank you

Te Gustaria Ser Parte De Este Projecto?Este Post ha recibido un Upvote desde la cuenta del King: @dineroconopcion, El cual es un Grupo de Soporte mantenido por 5 personas mas que quieren ayudarte a llegar hacer un Top Autor En Steemit sin tener que invertir en Steem Power.

Would You Like To Be Part of this Project?This Post has been Upvote from the King's Account: @dineroconopcion, It's a Support Group by 5 other people that want to help you be a Top Steemit Author without having to invest into Steem Power.

How do you like that flag @kaib? Lol. I told you dont mess with me bro..I know people.