Spreads in Trading

With cryptocurrencies

One of my first jobs in finance was at a trading desk as a glorified assistant, besides a myriad of odd jobs I sometimes had to prepare charts for the chief trader, on one such occasion he asked me to chart a couple of price series and told me that the spread had flipped, obviously some sort of trading signal. I nodded enthusiastically but really had little idea what precisely that meant.

So today I’d like to talk about spreads as they relate to trading and cryptocurrencies.

Even though cryptocurrencies are a new asset class, they share a lot in common with both equities and forex, so things are somehow interchangeable across assets.

What’s a spread ?

In general a spread is the difference in between 2 data points, which data points and what this difference means depends on the context, let’s start with a trading spread or bid-ask spread…

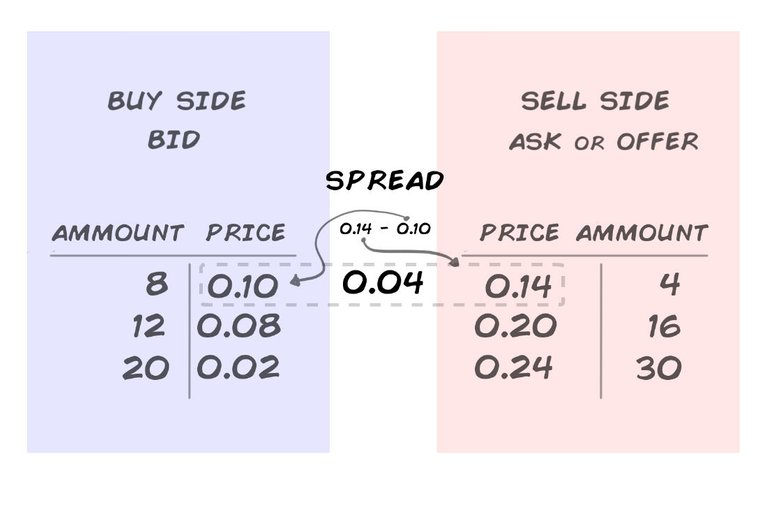

Your average trading exchange has both Bid (buy Side) and Ask (Sell side ) quotes, the difference in between these 2 makes the spread:

Couple of things to notice, this type of spread will never be zero because if it were, then a bid would match an offer and a trade would execute, likewise they can’t be negative because orders would match until the spread is positive again…

A spread size is relative to the underlying assets market price, a spread of 0.04 is tiny for something that usually trades in the 100’s, yet huge for another asset that sells and is bought for 0.0100’s.

What does it mean ?

In a bid-ask spread, a small spread is a sign of liquidity ( folks are buying and selling the coin or asset). A big spread is a sign that there is an imbalance in the assets market like lack of liquidity ( few people trading ) or some other event ( good, bad news, manipulation ).

Consider our previous spread of 0.04 as the baseline, here are some other values for spreads and causes:

A different type of spread

When measuring pairs of currencies(or cryptocurrencies) like ETH-BTC, a spread can also refer to the difference in between exchange pairs.

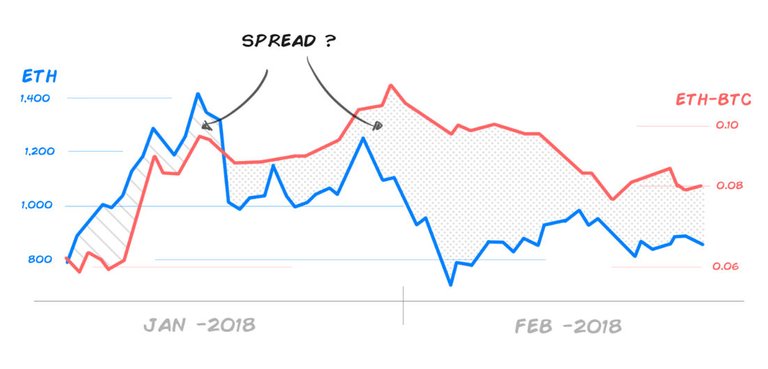

Unfortunately it is very easy to misread or misconstrue these spreads, take for instance this chart:

You could easily be mislead ( and forgiven ) to think that the price of ETH is relatively lower to that of BTC and that the spread in between them has flipped ( none of these things is actually happening ). The problem in case you haven’t guessed it, is that both series have different scales ( 0.00’s vs $100’s) and bases ( BTC vs USD), this is chart junk of the highest quality.

Indexing

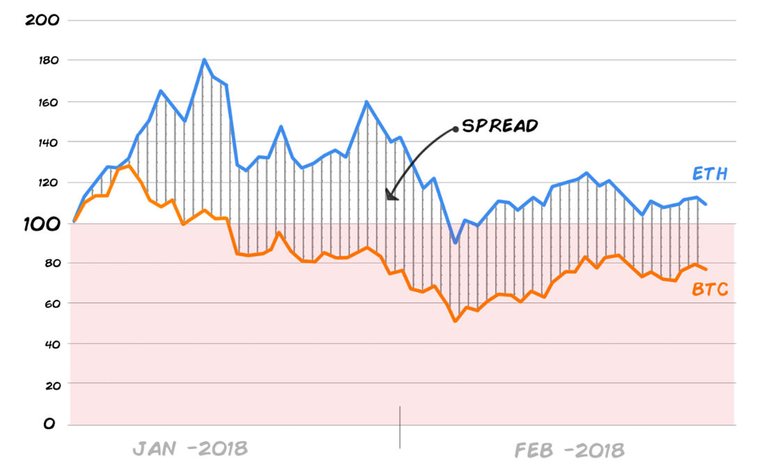

In order to accurately measure the spread ( as related to performance ), we need to index 2 or more price series…

Indexing simply divides each value in the series by the first occurrence, ( it always starts with 100 ) and in general is used to normalize or compare 2 different instruments over the same period of time, let’s revisit our previous data as an indexed chart for ETH and BTC :

This chart is immediately more helpful and informative, just from looking at it I can tell you that BTC has underperformed ETH and that If I had bought $100 worth of BTC on January 1st I would have roughly $80 now vs $110 if I had bought ETH.

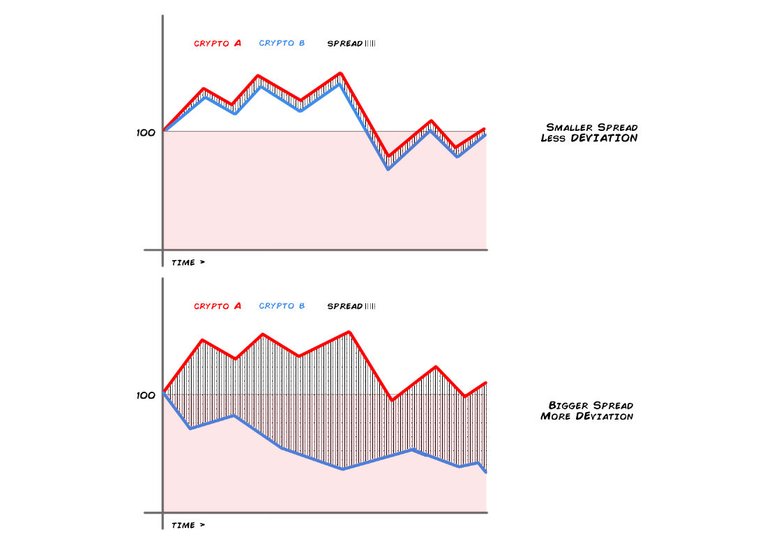

In this context, the spread is the area in between the indexed series and can be read as how both assets move with the market, a low spread means they move together and a positive or negative ( they can be negative in this context )means they have a different or opposite performance, consider 2 cryptocurrencies and their performance:

The flipping spread & the trading signal.

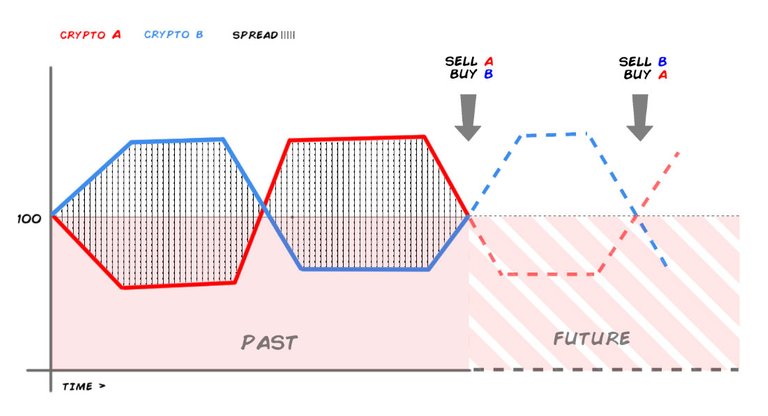

So now we have all the information needed to figure out this flipping spread business and more importantly how it relates to trading, here is a final chart with 2 indexed cryptocurrencies :

The story and trade goes like this:

You observe that in the past the spread in between the performance of 2 indexed currencies has fluctuated and expecting that the spread flips again as they narrow ( the trading signal ) you buy one and sell the other as they are about to flip, you might even repeat the reverse trade as they flip once more at a later date…

In reality there is no guarantee that they will perform this way and spreads are rarely this clear cut, this is where fundamental analysis and experience ( historical information ) can help you decide.

Conclusion

It is helpful to know about spreads while trading or doing research on an asset , adapting these finance terms to cryptocurrencies can help you understand both bid-ask dynamics as well as identify longer term investment opportunities and strategies if measured correctly… you can now also throw and understand some trading jargon 😎

Happy trading !

Keno.

And up vote follow me if you are feeling it.

thanks for the breakdown i once was introduced to spreads through apex investing via nadex. where they have low-risk capped spreads and binary options , so this post was a refresher. i was looking to trade spreads in crypto and this just boosted me