Disclaimer: This article is meant to serve as a general guide and provides some insight from my personal experience of investing in cryptocurrencies. It does not constitute financial advice. You should always seek your own professional financial advisor and do your own research before investing or trading.

Before we start, we highly recommend Binance Exchange. Please register here. (https://www.binance.com/?ref=12695653)

We also recommend Coinbase to transfer money from Bank Account to Cryptocurrency. Please register here. (https://www.coinbase.com/join/569e63ed705bf25f2500020d)

So you’ve taken the red pill, and now you’re either looking to invest or have started investing into cryptocurrencies already. With the overall crypto market growing over $100 billion in value in just 2 weeks (as of this writing), space is heating up and it’s entering mainstream adoption.

But where do you start? There’s now over 1300 cryptocurrencies on coinmarketcap.com, and dozens of exchanges and many layers of technologies to understand. The crypto world can be quite overwhelming for newcomers, and it takes plenty of time and research to understand how to get started, and to avoid costly mistakes.

I’ll attempt to breakdown the basics and the major things every investor should know, including what crypto wallets are and how to use them, how to trade, where to trade, what to look for in good projects, and general advice that I’ve personally learned from investing in this space since the beginning of the year.

Want to start mining crypto?

Register for MinerGate here and get 15% signup bonus for a lifetime!

https://minergate.com/a/1c31f298338fa3da1da27925

Getting started

Here’s the topics I’ll cover in this article:

Wallets

Wallets are like bank accounts for your tokens. I’ll go over all the major types of wallets and how to use them.

Exchanges

How to send money to get started on popular exchanges.

Trading

How to start trading, and things you should understand about the crypto markets.

Managing your portfolio

Apps to help you get a better understanding of your gains & losses, and how to watch tokens and prices.

Security & safety

Tips on maximizing security for your holdings, best practices, and how to avoid phishing scams, etc.

Common mistakes

Costly mistakes you should avoid.

General tips & advice

Advice that I’ve found helpful from my own experiences, from trading, to research, etc.

Resources

Useful resources to learn more about the disruptive technology behind cryptocurrencies, keep up with crypto news, communities to engage in, and more.

Wallets

Wallets are like your crypto bank accounts, and different wallets store different tokens.

To trade any crypto currency, you first need a wallet for to store them, ie: Bitcoin needs to be kept in a Bitcoin wallet. Wallets are exactly like they sound, they’re like a crypto bank account.

How to get a wallet

The easiest way is to sign up to an exchange that allows you to buy, trade, or sell cryptocurrencies, they allow you to generate a wallet for every token that they trade, even if you don’t own any. Coinbase for example, gives you a wallet for Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

Crypto Wallets don’t actually hold anything, unlike a physical one.

An important thing to understand is that wallets are simply a secure “window” into the blockchain so you can view your records and transactions. Think of it like Gmail, where your wallet is your Gmail login and password, but you’re not actually storing the emails yourself, you’re simply accessing it. Your tokens and transactions are saved on a blockchain, which is distributed across a vast network. So it’s always there, no matter if you lose your wallet. You just won’t be able to access or do anything with the tokens without your wallet.

How to send and receive tokens between wallets

Every Wallet has its own unique address, so if you trade on 3 different exchanges, you will have a different Wallet and address for each exchange, for each token. Think of them as a different website address or URL.

Wallet addresses are currently a very long string of characters, called a hash.

An example of what a Bitcoin Wallet Address looks like on Coinbase.

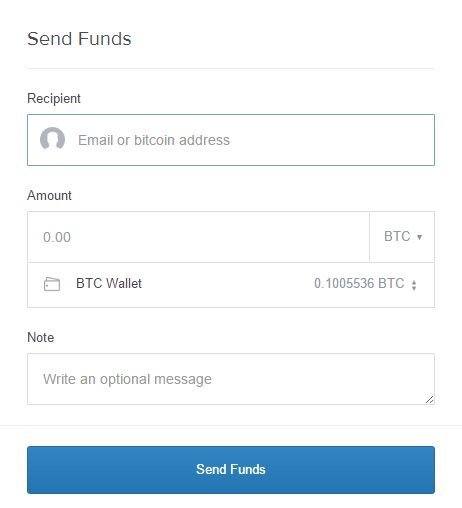

To send tokens between wallets, you will need to first copy the receiving address, and then enter the address into the Recipient field when sending. Here’s an example of what the sending screen looks like on Coinbase:

Sending Bitcoin from Coinbase.

Wallets are currency specific

Meaning, they only allow sending and receiving of their own token. This is very important to understand. In the crypto world, you cannot send different coins to different wallets (there are exceptions), otherwise you will lose your funds forever.

ERC-20 based tokens (the exception)

To dive a little deeper, there are certain tokens based on the ERC-20 protocol (generated from the Ethereum blockchain), that can be stored in the same ERC-20 compatible wallet. So for example, if you have two ERC-20 tokens, “Apple Coin” and “Orange Coin”, you can send them both to an ERC-20 wallet, such as MyEtherWallet.com.

Make sure you always double check that the link you are visiting is correct, there are lots of sites out there with a confusingly similar spelling attempting to trick users into logging in, thinking it’s the real site, therefore “phishing” or stealing your login info! Try not to search Google and click into a site, always enter it directly or visit from a bookmark!

Always make sure you are on a secure connection, and double check it’s a legit web address.

Different types of wallets

Online wallets are often regarded as the least safe, although most convenient for trading. If you have your tokens on an exchange, you can trade with them immediately. However, there are a few main types of wallets:

Desktop wallets

Mobile wallets

These are app-based wallets that you can download and install on your phone, although more common for Android based phones. Examples include the Blockchain mobile wallet for Android.

Online Wallets

All exchanges offer online wallets, to allow you to send and receive tokens. For example, Coinbase or MyEtherWallet.com. It is highly recommended to store tokens offline to reduce risks of hacks, phishing attempts, and also the collapse of exchanges. While most exchanges have security protocols in place, there have been disasters like the infamous Mt Gox hack in 2014where $460 million worth of Bitcoin was stolen.

Paper Wallets

Paper wallets are basically a print out of your wallet’s public and private keys, along with a QR code you can scan. A private key is basically a sequence of letters and numbers (much like a long password), that you, and ONLY you should know, in order to unlock your wallet and access your tokens. Coindesk has a guide on how to create a paper wallet.

Hardware wallets

These are the most secure way to store your tokens. Hardware wallets are completely offline (often referred to as cold storage). Hardware wallets do not support every token out there, so you will need to find out if the tokens you want to store are supported by the hardware wallet. Popular options are the Ledger Nano S and the Trezor Hardware Wallet.

These are wallets usually created by the token developers. For example, to find an official supported wallet for Bitcoin, you can download one from https://bitcoin.org/en/choose-your-wallet

To learn more about wallets, Coindesk has a great article on wallet options.The Ledger Nano S hardware wallet. From https://www.ledgerwallet.com

Exchanges

Unlike traditional stock markets, crypto exchanges never sleep, it’s global and it trades 24/7.

To start trading cryptocurrencies, there’s a few key things to understand:

Only a few exchanges allow you to buy Bitcoin with Fiat currency (your domestic currency, such as the US dollar).

Bitcoin is currently the most common trading pair, meaning in order to invest in other tokens or projects, you’ll most likely only be able to trade/buy it against Bitcoin. Thus, you will need to hold Bitcoin to make most trades. Ethereum is also starting to be more widely accepted as a trading pair, so there are tokens you can trade against Ethereum as well.

Most exchanges are not regulated, invest at your own risk.

Unlike the traditional stock exchanges, crypto exchanges have no opening and closing hours, they are always open, 24/7, 365 days, globally.

With those in mind, here’s a few of the most popular exchanges.

Popular Exchanges

Coinbase

Based in the United States, Coinbase is one of the largest Bitcoin exchanges in the world. Coinbase currently only allows you to buy four cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. You can buy them directly with your credit card with a $250 weekly limit. This limit can be increased if you complete some identity verification requirements. They charge a 4% processing fee.

Bittrex

Also a US based exchange, Bittrex is one of the more popular ones for crypto, as it trades a handful of the 1300+ alternative cryptocurrencies out there(or commonly referred to as alt coins). You cannot deposit Fiat currency directly into Bittrex, so you’ll first need to buy Bitcoin or Ethereum, and transfer them into Bittrex before you can start trading.

Binance

Based in Hong Kong, Binance was only launched in early 2017, however they quickly pivoted their platform to open up to the western part of the world and they’ve catapulted to become one of the largest exchanges by volume. I personally recommend Binance because of their superior user interface, ease of use, lower fees (with the use of their Binance token to facilitate trades), and the selection of tokens/alt coins they trade. Binance is highly prefered.

Bitfinex

Also based in Hong Kong, Bitfinex is one of the largest exchanges and handles the most Bitcoin volume for an exchange that targets North American traders. It offers a range of alt coins as well, although not as long of a list as Bittrex or Binance.

Trading Cryptocurrencies

Now that you understand how wallets work and you’ve discovered the exchanges you can trade on, it’s time to learn how the trading mechanics work in the crypto world, as well as general tips and common mistakes to avoid.

Trading pairs — Understanding how to trade in BTC values

Most trading interfaces are similar across all exchanges, there’s a few main concepts to understand, which are quite similar to traditional stock exchanges. The only key difference, is that most tokens are traded against Bitcoin, or in some cases, Ethereum.

Bitcoin and most tokens are divisible. With Bitcoin itself divisible up to 10 million units. You do not have to buy or sell a whole Bitcoin.

It’ll take a bit getting used to, but it’s a good habit to conduct your trades referencing not just your native Fiat currency, but also the value against Bitcoin or Ethereum. For example, as of today, $1 USD is worth 0.00006246 BTC (or Bitcoin). All exchanges that trade a token with Bitcoin as a trading pair, will take buy and sell orders against a Bitcoin value. Here’s a full chartbreaking down the units.

One Bitcoin is divisible up to ten million units, and 1 Satoshi is the unit name for 10 millionth of 1 BTC.

Making Trades

There’s three ways to make a trade:

An example of the trading interface on Binance.

Limit Trade

Limit trading allows you set a price you want to buy or sell a token at, and specify how many tokens you want. This is a good way to automatically fill a buy or sell order at a future time when the price of the token hits your price target.

Market Trade

Some exchanges like Binance will allow you to buy at the market rate. On Bittrex, this is called an “Ask”, which is the asking price on the market. This is the quickest way to buy in the market if you want to purchase or sell a token immediately.

Stop Limit

A stop limit basically allows you to automatically trigger an order at a set price, or better. For example, if you set a “stop limit” at $5, then you’ll automatically start buying up to a set limit when the price is $5 or less. Vice versa when you set a stop limit sell order.

Bittrex’s trading interface. Clicking “Bid” allows you to fill in the last market sell or buy price.

Tip: To quickly check you entered the right Bitcoin value in terms of dollar amount, you can paste in the amount on http://preev.com/ to convert it to dollars.

To learn more about trading, here’s a well-written, detailed guide by @humanpuck on how to buy crypto on Coinbase:

A Beginners Guide to Buying Crypto Currency — Steemit

Introduction I’ve had several people reach out to me about getting started with crypto’s so I put this handy little…

steemit.com

Managing your portfolio

Now that we’ve covered trading, let’s move on to how to manage your portfolio. In the current crypto ecosystem, you might find yourself spread out quite thin across various exchanges and dozens of wallets. Remembering which tokens you’ve invested into, how much you bought, what price you bought in at, across a multitude of addresses and locations can quite frankly be a major chore.

One of the approaches would be to setup an excel spreadsheet, but to keep in sync with live data proves to be a challenge. Luckily, there are a few apps out there that can help you log your trades to show you your gains/losses.

Apps that help you manage your portfolio

If only Bitcoin was still $997…

Blockfolio

Blockfolio was one of the first apps that were released specifically for managing your crypto investments. It’s one of the more popular options as it’s been out for a while, and it’s available for both iOS and Android.

To get started, there’s a bit of setup, as you’ll need to enter all of your transactions manually. Once setup, it’ll show you your portfolio balances and gains/losses, and you can switch between viewing the values in BTC or in your default fiat currency. It generally does a good job showing you an overview of your portfolio and the pricing of coins that you’re holding. However it’s a little tricky to see how much you’ve made per coin, as you’ll need to tap into the coin and then the holdings tab to see your profits, which is a bit of a UX annoyance.

You also have the ability to set price alerts, and it also pulls in the latest news from crypto related news sites such as cointelegraph.com, etc.

Pros:

Blockfolio tracks over 2000 altcoins, making it one of the most comprehensive portfolio apps out there

Price alerts

A basic news feed

Supports multiple fiat currencies

Available on iOS and Android

Cons:

Entering transactions can get quite tedious, as it only allows you to manually enter transactions

Graphs are not interactive

There have been some server issues with the app loading quite slowly, especially in the past two weeks with the increased mainstream attention that the crypto market received, Blockfolio was completely down.

At times the data (prices of tokens) can seem to be inaccurate from actual exchange rates

The design is quite barebones and the UX can be a little confusing at times

Delta presents your data in a better UI.

Delta

Delta is a newer app that’s also manages your crypto investments and shows you your gains and losses. Like Blockfolio, you’ll also need to manually enter your transactions for it to calculate your profits.

Delta’s UX is IMHO better designed than Blockfolio and is generally more user friendly. I also like the fact that it shows you the profits per token upfront, without needing to tap into a few screens. It’s a small nitpick, however I think it’s one that makes a big difference in terms of usability.

Pros:

Also tracks over 2000 altcoins, so most of the tokens you trade should be available

Price alerts

Supports multiple fiat currencies

The UX is much better than Blockfolio

Available on both iOS and Android

Cons:

Entering transactions are also manual like Blockfolio, so if you trade quite a bit it can be difficult to track down your exact trades to get an accurate view of your holdings

Graphs are not interactive

No news section like Blockfolio

Matrix Portfolio (In development)

Matrix is a project that I’ve started after trying a bunch of the portfolio apps out there, and found most of them were lacking in features and the UX lacked polish. So I set out to build my own to make tracking investments easier.

One of the key things I found challenging was to automatically pull in your holdings from exchanges you trade on, which surprisingly not many apps offer. This is something that will be built into Matrix.

Development is underway, and we’re looking to launch a beta version in the coming month. Here’s a preview of the latest designs:

Features & key differences of Matrix:A preview of our latest design prototypes. Signup for beta access at http://matrixportfolio.com

A carefully crafted design and simple user experience, UX is a high priority (Designs completed)

Comprehensive support for most coins (In development)

Secure syncing with exchanges to automatically pull in your trades and balances, to calculate your profits and losses, without manual entry (In development)

Manual transaction entry is also available if prefer (Completed)

Beautiful, mobile friendly, interactive graphs (In development)

Multi-portfolio support (Completed)

Multi-currency support (In development)

News feed (Planned)

Plus many other exciting features that are planned but we can’t announce yet!

Early beta signup for Matrix

If you think Matrix might be useful for you, I’ve setup a signup page for early beta access to try the app once it’s ready: http://matrixportfolio.com

Security & Safety

I’m sure many of you may have heard of the many horror stories of lost private keys, stolen Bitcoins, hacked exchanges, etc. When there’s so much money at stake, it’s important to take every security measure possible, even if it may add some additional inconvenience. The peace of mind that your investment and hard earned money is kept safe and secure is invaluable.

Here’s a few things every investor should do to keep their investments secure:

Enable two-factor authentication (2FA)

This is the first thing anyone investing should immediately enable after you register on an exchange, or any location where you store your tokens. All exchanges have this option, so enable it! 2FA ensures that even if your login and password is compromised, hackers cannot get into your account unless they also enter a time-sensitive 6 digit code, that only you can access on your phone.

To setup two-factor authentication:

Download either Google Authenticator or Authy

Navigate to where you can enable 2FA for your account on the exchange/website

You should see a QR code, simple scan it with the app

That’s it!

After that, everytime you login to your account, it will additionally ask you for a 6 digit, time-sensitive code as an extra security, before access to your account is granted.

A common misconception is that you must use Google Authenticator to enable 2FA. This is not true. I personally recommend Authy for managing your 2FA, as it can sync with multiple devices, incase you change or lose your phone/device, you can always recover your 2FA codes.

Use long, secure passwords (And a password manager, they’re free!)

It might be a bit of a hassle to dig it up every time you want to login to trade or check your balances, but that process is much more seamless if you take advantage of secure, password managers that helps you generate and remember every login/password for all exchanges you trade on.

I recommend either 1Password (free for 1 device), or LastPass (free for multiple devices).

Tip: It’s also useful to save your 2FA backup code in the password manager, as well as your wallet addresses, so you can easily copy and paste them when transferring tokens!

Don’t reuse passwords and logins

This goes without saying. If one of your account gets compromised, it’s not hard to imagine the hacker can easily find your other accounts on various exchanges. Before you know it, your hard earned investments will have completely disappeared.

Common mistakes to avoid

Sending tokens to the wrong wallet address

This is super important to remember! Once you send your coins to an incorrect address, it is unrecoverable. Always ensure you are double checking the send/receive address.

Sending the wrong amount of Bitcoin

General tips & advice

“It’s a safer and more profitable strategy to put time in the market, instead of trying to time the market.”

Invest what you can afford to lose

Cryptocurrencies are a brand new asset class, as well as a brand new market. It’s an ultra-high risk investment, and you should invest with the mindset that the money you put in could very well be worthless one day. So don’t invest more than what you can afford to lose.

FOMOing in to buy a coin on the rise

Quite often, when a coin is surging in price or making a bull run, it’s tempting to want to buy in and catch the wave. I strongly recommend avoiding rushing in to buy a trade, as most likely, by the time you buy in, the price will start to correct and you’ll be stuck holding tokens at a loss.

Don’t try to time the market

When it comes to trading cryptocurrencies, not only is the market much more volatile than traditional markets (where 20%-50% swings in a day is commonplace), but it’s also much more unpredictable. You can’t always sell the top and buy the bottom. It’s a safer and more profitable strategy to put time in the market, instead of trying to time the market.

HODL

The more you trade cryptocurrencies, the more you’ll notice people say “Just hodl.”. Originally a typo on a Bitcoin forum, it’s now become a meme and a general trading strategy that means to hold long term. It’s sensible advice, and one that I personally follow and found effective. Simply hold onto your investments throughout the highs and the lows, and avoid day trading. As the markets grow over time, so will your investments, don’t get greedy and try to make multiples of your investments too quickly.

Buy the dips

Over time, you’ll start to notice patterns in the crypto market, and there are usually periods of bull runs (strong rise in pricing), followed by a correction. These corrections (or dips), are the perfect time to add to your position and inject more money into your portfolio.

Diversify your portfolio

There are a few categories of projects that have natural synergy and near-term applications with blockchain technology, and others that are more long-term potentials or moonshots. Beyond reducing risk, it’s also important to diversify your portfolio to ensure you cast a wider net to bet on different categories to ensure you don’t miss out on any opportunities. I personally suggest looking at the following categories: Currencies (BTC, VTC, etc), Platforms (ETH, NEO, QTUM), Supply-chain (WTC, VEN, WaBi, MOD, etc), Privacy focused (XMR, ZCash, XVG, HUSH, etc), Blockchain Agnostic (ARK, LINK).

Always do your own research

Since the crypto-market is currently unregulated, there are a lot of scam projects or simply money-grabs out there. It’s the wild wild west, and you should always, do your own due diligence before investing your hard earned money. There are lots of factors that you should consider when judging if a token/project is a good investment, here’s a few of them:

Team — Is the team experienced, do they have a reputable background? Are they real, verified identities?

Technology — Are they building real tech that contributes to a need or solves a problem? What’s different about their approach? Are they in active development? Do they have their own blockchain? Is it a clone of another token?

Token — While some projects may have a good concept, it doesn’t necessarily mean it will be a good investment. It’s important to understand whether the token you are purchasing will have properties that will make it increase in value over time. You’re investing in hopes that the price will go up, so the token should have incentives for it to do so, with real utility.

Timeline — Does the project have a roadmap? Do they have real, clearly defined goals? Do they already have a working product? What kind of goals have they set and when will they be launched? Understanding the timeline is important to know whether it’s the right time to invest. If there’s no foreseeable milestones until a year later, it would be wiser to invest elsewhere in the short term.

What is cryptocurrency mining?

Ever wondered how bitcoins are actually made?

Over the past several years, cryptocurrencies like Bitcoin have been quietly growing in popularity, with an ever-larger number of people buying and selling them. Now that Bitcoin has hit the mainstream and become a worldwide phenomenon, more people than ever are looking to get into the cryptocurrency game.

With Bitcoin being divisible up to ten millionth of a unit, it’s hard to keep track of how much money you’re actually sending. Use a website like http://preev.com/ to double check the value of the BTC you are sending/receiving.

However, the production of cryptocurrencies isn’t anything like that of regular money. There’s no central authority that issues new notes; instead, bitcoins (or litecoins, or any of the other so-called ‘alt-coins’) are generated through a process known as ‘mining’. So what is cryptocurrency mining, and how does it work?

Cryptocurrency mining and the blockchain

Before getting to grips with the process of cryptocurrency mining, we need to explain what blockchain is and how that works. Blockchain is a technology that supports almost every cryptocurrency. It is a public ledger (decentralised register) of every transaction that has been carried out in that cryptocurrency.https://www.nicehash.com?refby=738266

In conclusion

Blockchain technology and cryptocurrencies, as of today, are still in its infancy, and there’s a bit of a learning curve to fully understand the space. I personally find it quite fascinating, and it’s awe-inspiring to witness this explosion of wealth, innovation, and technology. It’s reminiscent of the early days of the internet, and there’s no better time than now to invest in projects you believe in, for potentially life-changing returns on investment.

So buckle up, place your bets, learn about all the various projects, and watch as the industry reaches mainstream adoption in the years to come. Good luck!

Thanks for reading!

What should I cover next? Leave a comment below!

Found this post helpful? Clap for visibility!

DONATE:

Please see our full donation list here:

BTC: 1K3kLTxAY9jU51UwPBbBBGwHmCzAAuebxw

LTC: MDRwsWCm2kyhjE8ZAkg6NemYBFg6ZWRAFU

ETH: 0x7615363C3a6eFEb1F84925A005bad89f1C7b98e5

Or signup with my referral links:

https://medium.com/@BinanceExchange/full-donation-list-please-read-3adfc9ae0b23

For more Cryptocurrency Exchanges ranked, please check: https://hexabase.net/

Get $10 to invest with Coinbase when you signup with my referral link:

https://www.coinbase.com/join/569e63ed705bf25f2500020d

Or Binance:

https://www.binance.com/?ref=10027623

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/a-beginners-guide-to-getting-started-with-cryptocurrencies-76027bebb1b1

Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.✅ @kevinc000, I gave you an upvote on your first post!