Bitcoin's constrained supply is going to get more restricted.

Notwithstanding an unexpected occasion, the 17 millionth bitcoin is probably going to be mined in the coming day, information from Blockchain.info appears, an improvement that would check yet another development for the world's first cryptographic money. That is on account of according to bitcoin's present principles, just 21 million bitcoin can ever be made.

Venturing back, the point of reference, the initial million-bitcoin marker to be crossed since mid-2016, is maybe important up 'til now another indication of the innovation's center software engineering accomplishment - computerized shortage made and empowered by shared programming.

To put it plainly, bitcoin's code, since cloned and adjusted by scores of other upstart digital forms of money, guarantees that exclusive a set number of new bitcoins are acquainted with its economy at interims. Excavators, or the individuals who work the equipment important to track bitcoin's exchange set, are compensated with this rare information each time they add new passages to the official record.

All things considered, there's a great deal of fluctuation all the while.

Of note is that it can't be decisively anticipated when the 17 millionth bitcoin will be mined or who will mine it, because of the numerous moment changes that are made in keeping a typical programming in a state of harmony. So, there's a relative consistency. Each bitcoin piece produces 12.5 new bitcoin, and as bitcoin squares happen generally like clockwork, around 1,800 new bitcoin are made every day.

Thusly, it's maybe best to see this occasion as a "mental boundary," Tetras Capital establishing accomplice Alex Sunnarborg told CoinDesk, one that is translated contrastingly by various groups.

Sunnarborg, for instance, tried to pressure that another method to decipher the outcome is that 80 percent of all the bitcoin that will be ever made have now been mined. At the end of the day, just around one-fifth of the possible supply stays for excavators and future purchasers.

Others see the turning point as one that is ready for valuation for the innovation and its accomplishments.

"I think it is wonderful," Tim Draper, the financial speculator who purchased a large number of bitcoin seized by the U.S. government at closeout in 2014, said of the coming turning point.

He told CoinDesk:

"I would wager the organizers wouldn't have envisioned how critical bitcoin would progress toward becoming in their most out of this world fantasies."

Path with words

Others looked to recommend the point of reference is one that ought to be considered as an open door for instruction about both the highlights of bitcoin, and those of digital forms of money comprehensively.

For instance, unless the greater part of the people who work the PCs running the bitcoin programming choose to roll out an improvement (a maybe impossible situation today), there's extremely no real way to ever present all the more new bitcoin. This accomplishment, a specialized reality, has assumed a key part in bitcoin's relationship with cash, financial aspects and other rare, normally happening resources.

Along these lines, the goldbugs and perusers of Austrian financial matters who heaped into bitcoin right off the bat rushed to understand the estimation of the element, maybe offering ascend to the expression "cryptographic money" itself.

Follow Meyer, one of this current gathering's most vocal individuals, summed up the reasoning in a current tweet, in which he contended governments may try to keep clients from holding bitcoin later on.

"Expanding cash supply is a way to appropriate through swelling which is a type of tax imposition without any political benefit or due procedure of law," he composed.

Indeed, even the new way new bitcoins appear, called "mining," is a gesture to the gold relationship.

As opposed to being issued by a national bank, bitcoin is made by a system through crafted by keeping up the blockchain. At the point when an excavator finds a legitimate hash for late exchanges, fathoming the bitcoin convention's bewilder, he or she is remunerated with a "coinbase exchange," bitcoin credited to her record.

A smidgen of digital money is made and deducted from the last supply.

The bitcoin supply bend

How members have been compensated has, obviously, changed after some time.

At the point when bitcoin's originator Satoshi Nakamoto mined the primary bitcoin hinder on Jan. 3, 2009, he made the initial 50 bitcoins. This reward remained the same for another 209,999 pieces, when the primary "halvening," or lessening in rewards, occurred.

It didn't come as an astonishment. Each 210,000 squares, as per a hard-coded plan, the system decreases the piece compensate by 50 percent. Following the latest halvening, in July 2016, the reward is 12.5 bitcoin.

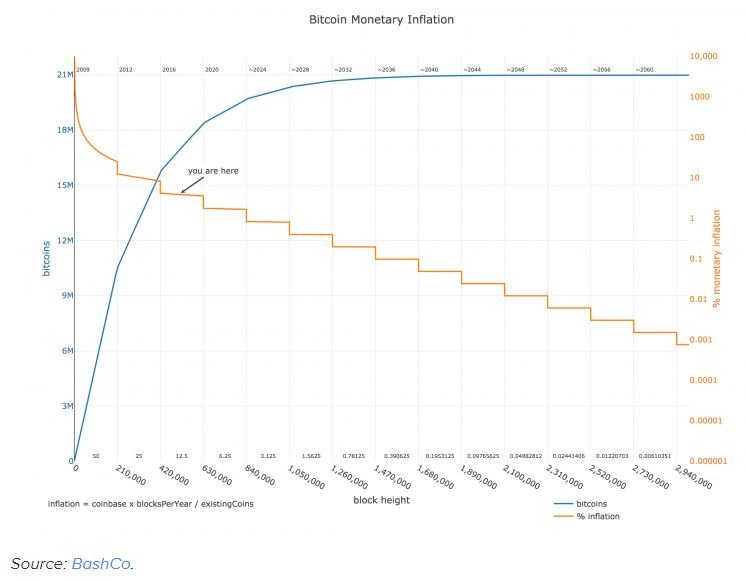

That implies that while there are just 4 million bitcoin left to mine, the system won't achieve its last supply in anything like the nine years it's taken to get this far. As the halvenings halven, the rate of money related swelling - supply development - moderates.

BashCo, a pseudonymous mediator on the r/bitcoin subreddit, has plotted the direction of bitcoin's aggregate supply (blue bend) against its rate of money related expansion (orange line).

Expecting the bitcoin convention continues as before (another square is mined at regular intervals by and large and the splitting calendar and supply top are unaltered), the last new bitcoin won't be mined until May 2140.

The following 120 years

In light of this, the graph clues at another normal idea while recognizing the turning point - that bitcoin is modified to keep running for quite a while.

Jameson Lopp, lead framework design at wallet supplier Casa, rushed to remind CoinDesk that bitcoins are distinguishable, and that all things considered, the littlest parts of each bitcoin can hold apparently vast esteem.

He stated:

"While 17 million BTC may seem like a ton, it's unfathomably rare - there won't be sufficient for each present tycoon to possess an entire bitcoin. Gratefully, each bitcoin is distinct into 100 million satoshis, accordingly there will dependably be bounty to go around!"

Be that as it may, there are different idiosyncrasies to the product too.

For one, bitcoin will never really achieve 21 million units, as excepting a convention change, the aggregate supply will miss the mark by no less than one satoshi. That is on account of on May 17, 2011, the excavator "midnightmagic" - for reasons that remain unlear - asserted a 49.99999999 piece compensate, as opposed to an even 50.

Further, to be clear, bitcoin does not quit running when 21 million bitcoin are delivered. By then, the thought is that excavators would be remunerated absolutely through the charges, which they effectively gather. (In spite of the fact that a few researchers have looked to extend whether such a market would work practically speaking).

With such a large number of inquiries left unanswered, on the off chance that anything, the occasion fills in up 'til now another indication of how far bitcoin has come, and exactly how far it needs to go.

In the expressions of long-term engineer Adam Back:

"Another million down four more to go."

A more detailed explanation of the bitcoin's supply and digital scarcity can be found https://en.bitcoin.it/wiki/Controlled_supply

What do you think will be the price in 2025? Thanks for this infos.

Thinking for the more to be in future.