Bitcoin is the most widely known and used cryptocurrency in the world. The current market

capitalization of just over $10 billion (USD) (Crypto-Currency Market Capitalizations, 2016).

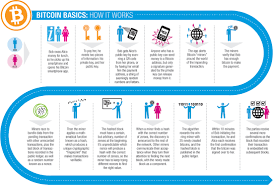

Bitcoin was originally developed by Satoshi Nakamoto as a strictly peer-to-peer electronic

payment system and a solution to the problem of double-spending (Nakamoto, 2008).

It is primarily designed to eliminate the need of financial institutions or ‘trusted third-party’ entities.Bitcoin does this by eliminating the possibility of fraud, increasing efficiencies, and providingobjective proof-of-work to guarantee validity and security in any transaction (Nakamoto, 2008).

The use of a public ledger as well as digital signatures allow for a secure and anonymous

transaction without the need for trust, as the public network of nodes validates transactions

through finding a consensus among a majority of nodes. Thus far, the primary use cases for

Bitcoin revolve around increasing efficiencies and eliminating unnecessary time and costs that arrive from using multiple trusted third parties to facilitate transactions (Tapscott, 2016).

Bitcoin is highly adoptable in markets that are lacking in traditional financial infrastructure but have access to mobile data, as well as markets with highly inflated currencies that require tools to allow for the mobilization and exchange of currencies (Magee, 2015). Bitcoin’s multiversion concurrency control is unique and allows for safe concurrent transactions without significant

delay (Greenspan, 2015).

Ethereum’s main point of differentiation is the ability to leverage the application of ‘smart

contracts’ within its code. While growing at a much more significant rate over the past year,

Ethereum has a total market capitalization of only approximately 10% of Bitcoin (CryptoCurrency Market Capitalizations, 2016). While the underlying currency, Ether, appreciates and depreciates in value, Ethereum’s value is largely driven by its increased utility and ability to eventually eliminate third parties’ involvement in determining contractual obligations.

The main benefit of Ethereum can be found in the belief that, as long as it can be coded properly, Ethereum’s smart contracts carry potentially unlimited utility (although, highly complex contracts could prove to be illogical at this point in time) (Greenspan, 2016). The Ethereum Network serves to facilitate the exchange of data, information, votes, etc. indicating that there is the possibility for use cases well beyond simply serving as a disruptor to the current financial institutions.

The Ether currency serves as the ‘gas’ that powers the transactions within the Ethereum Network. Ethereum leverages a Turing-Complete language which could, in theory, solve any computational problem (DeRose, 2016), allowing for an even greater possibility for

utility across many areas.

Cryptocurrencies, anonymous, no need for ‘trust’, blocks are ‘mined’ with increasing

difficulty, underlying use of blockchain technology

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.economist.com/sites/default/files/the_future_of_cryptocurrency.pdf

acha uchoko bhana duh