With my 5 months experience in ICOs so far I have come across one pattern.

Not necessarily all ICOs will follow same path but most of them.

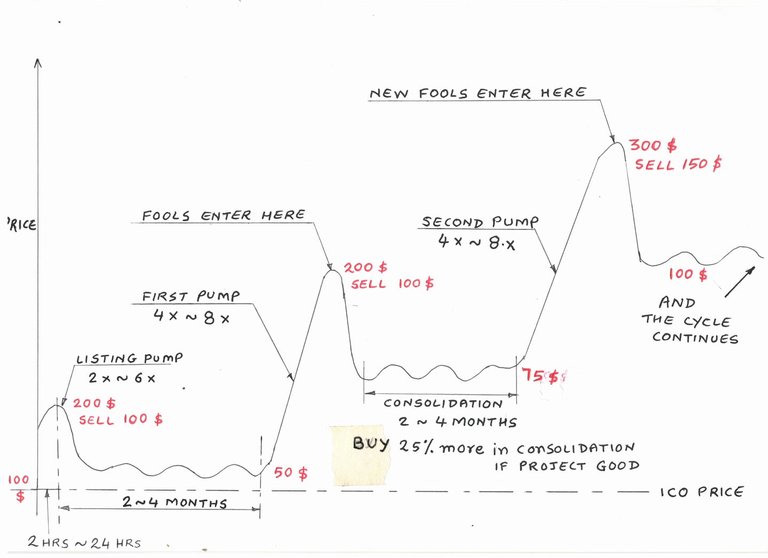

Capturing listing gain is important to multiply ICO money for further ICOs. With all fundamentals in place its hype and demand is more essential. Those missed in crowdsale, restricted nationalities and those unsatisfied creatures for a minuscule cap with multiple accounts are ready to buy as soon as it lists.

I have categorised 3 types in ICOs.

- Quick Flip.

ICOs with maximum hype rate with some red flags. E.g. Dadi, Arcblock. And some low cap momentarily hyped ones like CargoX. - Medium term (>6 months). ICOs with good fundamentals without any red flag. E.g. Fortuna, Electrify, Zeepin, Devery etc.

- Long-term (>1 year) ICOs with great fundamentals and the best of the month. E.g. Zilliqa, Elastos, WaBi, Republic Protocol etc.

In case of 1st category sell it within 24 hours at whatever price available and move on without looking back.

In case of 2nd category.

Sell half quantity as soon as it reaches 2X ICO price after listing mostly within 24 hours. You have removed seed capital. Use it for next ICO. Put sell order for remaining half quantity at 4X ~ 8X ICO price. This sell order will be activated in 2~4 months or maybe even 6 months depending on the project and market conditions. For good project, you will get first pumping in 4 months period. Within this period analyze the project closely and take a call what would be your action once first pumping is over. If not satisfied, then sell completely. If it is good then at this position you have already sold 75% of holding and left with 25% quantity. Buy 25% more of your ICO quantity when price come down to the floor. Around 50% from ATH and consolidating within small range for at least two months. Once you buy it, then again put sell order for that quantity(25%) at 8X ico price. Repeat the process after every pumping.

In 3rd category sell 1/4 on listing when price goes more than 4X and rebuy again when it comes down and stabilize. Buy within 2~4 weeks. Hold for 1 year and then take a call.

Exchange listing gain for good ICO is normally more than 4X in bull market and 2X in sideways market.

In case of bear market there are 50% chances of getting 2X price on listing. If couldn't get chance then you will miss listing gain and you have to wait 2~ 4 months for first pumping. In case of RPX and Request, I had to wait for 3 months to book profit in first pumping and now kept sell order for half quantity at 16x ICO price for next pumping whenever it happens. Request, Airswap and Ripio stayed below ICO price for 2 months.

In this period of initial 2 ~4 months when turn by turn pumping is coming in altcoins and your ico coin is unmoved, better to book loss. As I took loss in Blockmason and social.

In present scenario I have placed sell order for half quantity at 2X price in case of Zeepin. Same I will do for TheKey, Apex, Ink Protocol and Insights Network once available to trade. If within a month nothing happened then I will raise the sell order to 4X price and wait for first pumping because I missed listing gain due to bear market.

Arcblock and Dadi will sell within 24 hrs of listing at whatever price.

It is better to book listing gain on exchange. However if there is long waiting period for exchange listing then can be sold on ED.

I have demonstrated all these periods in following picture.

Coins mentioned in post:

Congratulations @learneternal! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!