ICO Token: VME

ICO Token price:1 ETH = 3000 VMEs (0.00033333 ETH)

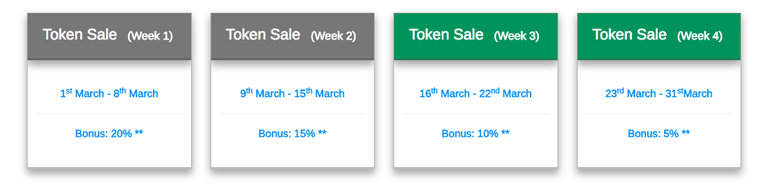

ICO Date: Crowd sale ends on March 31, 2018

Soft cap: $3mn

Hard cap: $30mn

Pre sale discount: 45% (Raised 13.5MN as on March 22, 2018)

Tokens for sale in ICO: 300,000,000

Total supply: 1,000,000,000

Minimum contribution: 0.2 ETH Any contributions above 10 ETH will get extra 5% VME tokens.

PROJECT OVERVIEW:

VeriME is an intermediary digital Validation-as-a-Service (VaaS) that allows Service Providers who are its Partners to validate and/or authenticate a potential Customer who has already been verified and approved by VeriME. The verification process can be self-done by the Customer anytime, anywhere in 3 minutes right on the Customer’s mobile device via smart application which uses sophisticated technologies such as Artificial Intelligence, Computer Vision and Cloud Computing.

VeriME helps in strengthening the transparency & accuracy of transactions and improving user experience, while saving time and cost for Customer KYC and Authentication processes. VeriME operates on a Blockchain-based decentralized model. A customer’s Profile that has been validated & certified is stored right on his/her mobile device, ensuring privacy and eliminating the risk of data leakage

VeriME would initially offer two solutions to its partners:

D-KYC : Using this product, VeriME’s partners would be able to validate potential customers and complete onboarding process with them seamlessly within seconds. Typical partners in this case would be Peer-to-Peer Lending Companies, Resellers/Distributors of Insurance and Financial Products, e-Wallet Providers, Banks, Insurance companies, Government Institutions, Credit Card Issuers, Pre-paid/Private-Label/Loyalty Card Issuers, TelCos, Travel & Ticketing Companies, Payment Service Providers, Independent Sales Organizations, Merchant Service Providers, and last but not the least, Companies raising funds through ICOs!

D-SECURE: Using this product, VeriME’s partners would be able to seamlessly authenticate customers during the purchase of goods and services. Typical Partners in this case would be Banks, Payment Service Providers, Online Merchants, Marketplaces, Independent Sales Organizations, Merchant Service Providers, Merchants involved in high risk businesses such as Airlines, Luxury Goods, Gaming, Gambling, and all D-KYC Partners who accept payments from their customers for sale of Goods and Services. Apart from authenticating a sales transaction, D-SECURE would also provide dispute/chargeback protection to its Partners.

TOKEN UTILITY:

.As VeriME becomes a popular VaaS platform in the Blockchain and traditional space, many Partners will have to purchase VME Tokens in the open market through the Exchanges to use VeriME services. As demand increases, the value of VME Token in ETH and USD will grow sharply, bringing great benefits to the members in the VeriME ecosystem owning VME Tokens, especially those investors who purchase through ICO campaign at a very nominal initial price.

TEAM and ADVISORS

Team is strong and demonstrated their ability to deliver through a working offchain product

Advisors are highly experienced in fields of FinTech and eCommerce.

and have created good support in community

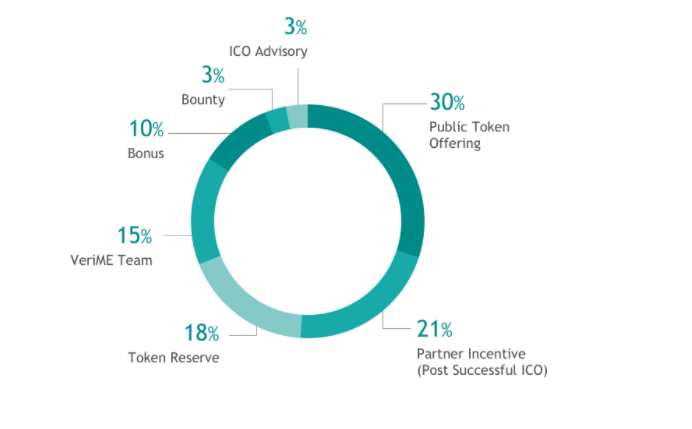

TOKENOMICS AND USE OF FUNDS:

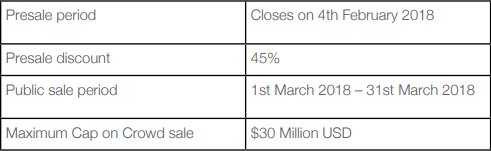

The VME Tokens will be allocated as follows:

300 million: Public offering through an ICO campaign to raise funds for developing the VeriME ecosystem.

30 million: To be used for ICO Advisory Services.

30 million: To be used for ICO Bounty programs.

100 million: To be used for ICO Bonus Campaigns.

150 million: Will be reserved for VeriME Team. These Tokens will be frozen for 18 months post successful ICO.

210 million: Will be used for Partner and Customer Incentives. These Tokens will be part of VeriME Token Reserve and will be released to VeriME Partners and Customers.

Remaining 180 million: Will retained for future use as part of VeriME Reserve Management

ROADMAP:

Roadmap isn’t well detailed and is not providing clarity of project.

GITHUB: Weak

MARKETING:

Telegram 45k

FB 112k

Twitter 10k

Marketing is good and has created a strong community over time with post on all media channels (huffpost, yahoo etc)

PARTNERSHIPS: Strong partnership support

Short term goal is to expand our operations in 3–4 high density APAC countries and have 100+ partners within 9 months of the ICO. By 2020, we aim to establish our presence in 20+ countries, have over 3,000+ key partners performing D-KYC and D-SECURE transactions for 1 Billion+ Customers.

CONCLUSION:

High risk of competition from established tech companies and Little progress on blockchain integration. But with promising number of quality partnerships with enterprises and government. Verime has Immediate use utility for blockchain product.

We would rate VeriMe 5.5/10

We, at Ledgerfund run one of the biggest Crypto Hedge Funds in the world and give returns in bitcoins. To know more about how you can invest your bitcoins in this fund, refer to our website: https://ledgerfund.io

The Original Analysis was published here : https://medium.com/ledgerfund/verime-ico-analysis-9eb3e7ac162a

Follow me and i will upvote you.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.verime.mobi/static/dl/whitepaper.pdf