CryptoGram_0024: January 30, 2018

DON'T PANIC: Bitcoin and Ethereum - Ride Together Die Together! #CryptoGram

Getting into it...

First here are the main thoughts of this post:

- Bitcoin and Ethereum used to correlated inversely, they now appear to be correlated directly.

- The direct correlation of of BTC and ETH highlight a few key issues.

Point 1

Here are 4 graphs. The first 2 show BTC and ETH in the first quarter of 2017. The next 2 show BTC and ETH in the 1st quarter of 2018. (Continued below graphs)

Bitcoin - Q1 2017

Ethereum - Q1 2017

And now, YTD graph of the same coins:

Bitcoin - YTD 2018

Ethereum -YTD 2018

Point 1 Continued.

Looking at these graphs it is not exact, but during this time period last year, when BTC went up, ETH went down, and when ETH went up, BTC went down. During this time period, ETH acted as a good gauge for the majority of the alt coins. As ETH went, so when the alt coins.

When looking at the 1028 YTD graphs, both track very similar patterns. Basically, the inverse correlation that existed at this time in 2017 no longer seems to be present.

Point 2

I believe this highlights the existance of new reserve currency in ETH. "Duh," some people might say. The reason why this is a duh is because ethereum is leading the decentralized exchange marketplace in ERC 20 tokens. First via ether delta, which still runs well and now the pop ups of lots of 0x relays, then followed shortly by Kyber network and others. This has made trading solely based on Ether pairs very doable. This has an interesting effect.

When i look back at crypto history, i see the following phenomenon: (This is an inference, not something i have done the math on.)

When the reserve pair moves up or down to the USD, (used to be solely bitcoin, now btc and eth IMO,) the altcoins go with it categorically. This is because most trading is done in pairs to the reserve currency. Just because the value of the reserve currency goes up or down in dollars, doesn't mean that the on book trade orders are changed in dollar value. This is coupled with the fact that CMC is more or less designated in USD.

So the underlying effect of this is, when the reserve coin goes up 1$, all trades based on that reserve currency have also moved up 1$ and vice versa. In sell offs, this is then magnified by the retreat back into reserve currency before it is possible to go back to USD or USDT or something like that. basically, in a sell off case, all coins experience a drop, but the reserve coin experiences less of a drop because the panic sellers have to buy the reserve in order to exit their alt, and then move to fiat.

In summary, the change of ETH from an altcoin to a reserve currency is, IMO, responsible for the now direct correlation of BTC and ETH. Furthermore, this scenario, was brought on by the emergence of decentralized exchange starting with Etherdelta, and now be magnified by additional exchange protocols and marketplaces..

Let me know if you have any thoughts on this,

Thanks for reading,

-libertyhound

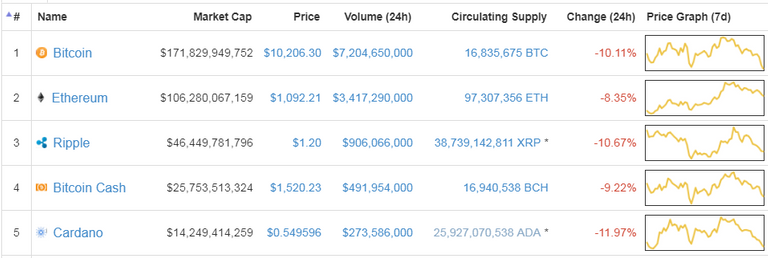

State of The Market:

For new readers:

Cryptogram is my personal journal of thoughts about cryptocurrencies and related topics.

Purpose of CryptoGram:

Currently in the crypto space it can be difficult to remember what you have discussed or been thinking from one week to the next. The rapid development of, and many changes in the space keep everyone on their toes. Now that I have been financially involved in the space for roughly a year, I realize that I would love to have my thoughts from 2017 written down somewhere. I believe having this information will help me stay focused, avoid repeating past mistakes, and hopefully help some other people, (anyone who decides to read this,) from making those same mistakes.

Briefly, I need a place to record my train of thought and that place will now be dubbed "CryptoGram"

My thoughts on the structure of this post are:

- About 500 words.

- Frequency of once a day to once a week.

- Each post will have a number and date.

- A snippet of top 5 cmc coins for price reference. (state of the market)

- I will always use these 5 tags, three of them will be:

- bitcoin cryptocurrency ethereum

- the other two will be topic specific

Nice charts. Some of this is because of the proliferation of trading pairs. Now there are almost as many Eth trading pairs as btc trading pairs. Especially with rise of zrx relays. If you sell an alt you have to buy either btc or Eth.

Good insight!

I also recognized this. But can you explain why the market always crashes at the beginning of the year? Because I would normally say that people start buying after they got their balances of the last year...

Congratulations @libertyhound! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!