So it has been confirmed that Bitcoin futures will start trading on the 18th December. So what does it mean for Bitcoin and the crypto currency market in general?

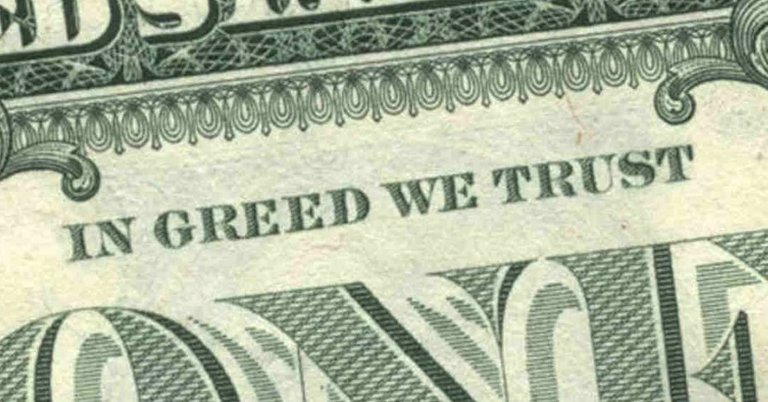

Firstly let me explain why I was so excited about the crypto world in the first place; It was created as a peer to peer market where free trade can take place with no control from outside forces to control or manipulate prices.

Here lies the problem with wall street selling paper contracts for Bitcoin futures. One of Bitcoins main strengths is that you cannot sell a Bitcoin you do not own, there is a limited supply and once the final Bitcoin is mined there will never be another one. Unlike our fiat monetary policy where the central banks of the world can turn on their printing presses and print currency out of thin air with no limits of quantity.

You only have to look at the metals market to understand the manipulation that can be done with selling futures contracts. I have witnessed the Comex on any given day dump Billions of ounces of paper gold on the market. This sometimes is more than the actual number of ounces pulled from the ground in a 5 year time span. This is done to control the price as following the simple laws of economics supply and demand.

So what is the biggest issue I see and why we should be concerned? If like me you are glued to Blockfolio and constantly seeing how our investments are doing. We always keep a close eye on the total market cap to see how much money is circulating around in the crypto world, this is what creates the prices of the coins. The only good thing I can see from this is it will bring greater awareness to Bitcoin and the Crypto world but sadly I feel it will take a lot of money rushing to the doors of wall street rather than the true Crypto space.

I would love to know your take on the new Bitcoin futures markets and how it will affect the crypto market.

So effectively the Whales could use these future contracts to manipulate the market to earn the most from the contract by dumping Bitcoin to flood the market? Pardon my ignorance, I've only recently researched future contracts.

But I agree, any increase in public awareness of Cryptos is good for the overall idea of decentralized currencies.

So if you are buying Bitcoin on the futures market, you are buying a piece of paper that says you own a Bitcoin at the price the Bitcoin trades at. Unlike Coinbase where when you buy Bitcoin you can send it to another wallet or exchange. With the Bitcoin on the futures market the 'actual' Bitcoin does not exist so cannot be moved about. The trouble starts when they print more futures that actually exists so in essence they can sell 10 billion Bitcoins which can dilute the price because there is too much supply.

How this will affect the price we pay from Coinbase is yet to been known but you just have to see how the metals are trading to understand how much power the markets have to suppress the price down.

Congratulations @lifefrommyeyes! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @lifefrommyeyes! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!