Kyle Samani, a managing partner at cryptocurrency hedge fund Multicoin Capital, believes the majority of the top cryptocurrencies could be considered securities

Samani points out “sufficiently decentralized” isn’t a quantifiable measurement and could lead to ambiguity. Hinman’s words point exactly to that, as he states analysis are not set in stone and could change at any moment. In his example, if someone were to place bitcoins in a fund and sell interests, this particular product would be considered a security.

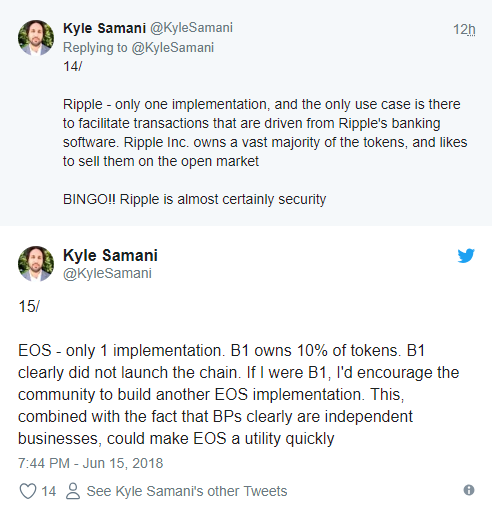

Samani believes that, given the SEC’s guidelines, the number of implementations by independent teams is one valid metric which can be used to determine if an asset is truly decentralized. Following his logic, apart from bitcoin and ethereum, litecoin, bitcoin cash, and ethereum classic may be the only digital assets in the clear.

He said that, as it stands now, XRP, Tron, stellar, Cardano’s ADA token, and IOTA are almost certainly securities, while EOS may be a security but could quickly become a utility if the community pursues certain measures in the near future.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ccn.com/half-of-top-10-cryptocurrencies-may-be-securities-crypto-hedge-fund-executive/