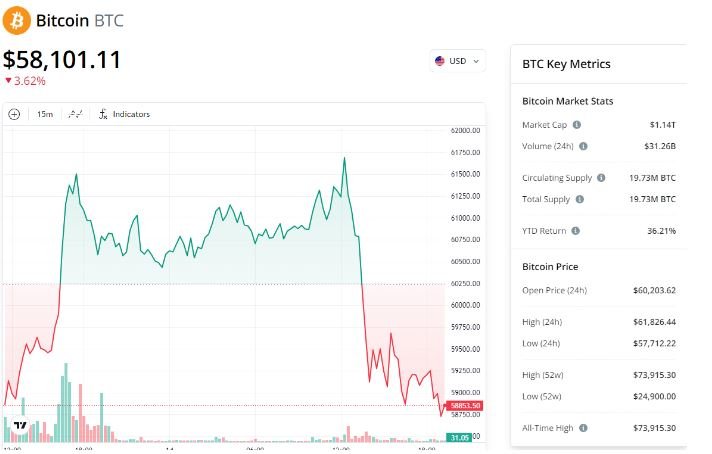

Reading updates on Bitcoin's price action, I came across an article by Zoltan Vardai, where he indicated that the Bitcoin price fell to $58,101 and inferred that BTC could experience significant downside volatility unless it manages to recover above $60,000 before options expiration on August 16.

In Vardai's words, “The upcoming cryptocurrency options expiration threatens to add a lot of Bitcoin selling pressure, which could push the price below another key support level.”

On the other hand and according to data from Farside Investors, “Inflows into U.S. spot bitcoin exchange-traded funds (ETFs) were positive for two consecutive days, but turned negative again on August 14; net outflows exceeded USD 81 million”

However, according to Bitfinex analysts, “Favorable CPI data is expected to catalyze further inflows. Investors are likely positioning themselves to benefit from the expected rate cut and the possibility of a broader market rally.”

According to pseudonymous trader Crypto Pump Analytics, “The bitcoin price is now expected to reach the next demand zone of USD 56,000. When the bitcoin price approaches the USD 56,000 zone, we will try to invest in longs”

SOURCES CONSULTED

Cointelegraph. Bitcoin sell pressure may break $56K support as options expiry looms. Link

OBSERVATION:

Cointelegraph The cover image does not belong to the author: @lupafilotaxia, the image was taken from: