It has been about a week since I’ve started looking seriously at cryptocurrency, and I do believe that my understanding of cryptocurrency has progressed significantly. Yet there still remained some doubt about where, and how much, to invest. Instead of spending a week reading, I’ll summarize my key insights, as well as my first venture into cryptocurrency investment. Hope it helps!

Do Not Believe Everything You Read

The internet, life-changing as it is, is also a double-edged sword: information can be disseminated freely by both scholars and conmen.

“Trust me, Wilbur. People are very gullible. They'll believe anything they see in print.”

– E.B. White, Charlotte’s Web

While it was written in a children’s book, it is a sobering reminder for grown-ups as well.

There are numerous scams going on in the crypto-sphere, preying on those who are inadequately informed about what they are getting into. Be cautious of any writing that promises daily gains or fast money.

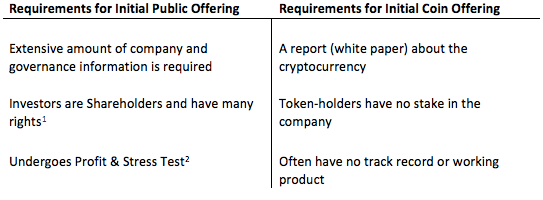

Conmen aside, there are the regular people who have no malicious intent when promoting an Initial Coin Offering (ICO), but have no real knowledge of the mechanics behind it. Blindly following the opinions of everyone online is not a good idea.

Cryptocurrency is an asset to invest in, and should be treated as such; due diligence should be carried out.

Be Aware Of The Danger, Recognize the Opportunity

“The Chinese use two brush strokes to write the word 'crisis.' One brush stroke stands for danger; the other for opportunity. In a crisis, be aware of the danger--but recognize the opportunity.” - John F. Kennedy

This saying perfectly describes the cryptocurrency market today. The potentially astounding returns come with a commensurate amount of risk. It is highly unlikely that an investor has never had a loss; the crypto-sphere is no different.

Yet investment is still of utmost importance: it helps to combat inflation, it is an efficient way to save up for the future, and it enables one to increase wealth. And cryptocurrencies are becoming increasingly important as part of one’s investment portfolio.

Legitimacy is Key

Cryptocurrency is not legal tender (falls outside the traditional government-backed currency system), and therefore is not protected by the civil and criminal laws regarding tangible cash. This has sparked worries about the law being unable to provide redress for victims of theft or fraud.

Yet cryptocurrencies are fast gaining traction. Rather than issuing a ban, Singapore has taken steps to address this issue to prevent being left behind. The Monetary Authority of Singapore (MAS) issued the following statement:

“MAS prefers to apply existing regulations to new fintech models. So if a digital token has the characteristics of securities, it will be regulated as such.” – The Straits Times, 2017

As a Singaporean, I fully appreciate the stringent policies MAS has come up with that has enabled Singapore to become home to over a thousand financial institutions. Over the past decade, MAS has consistently kept inflation rates low and enabled rapid recovery from economic downturns.

“A smart man makes a mistake, learns from it, and never makes that mistake again. But a wise man finds a smart man and learns from him how to avoid the mistake altogether” – Roy H. Williams

My understanding of cryptocurrency and ICOs is limited, and there is no shame in admitting that my government likely has a better grasp of the full implications of cryptocurrency in this day and age.

Any ICO backed by the MAS is definitely worth taking an interest in.

References:

- Securities Investors Association (Singapore): https://sias.org.sg/index.php?option=com_content&view=article&id=268&Itemid=102&lang=en

- Colin Ng & Partners: http://www.cnplaw.com/en/files/articles/2005/au/au_june2005_feature_1.pdf

you got me at MAS