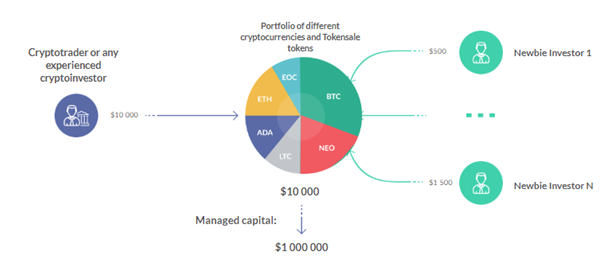

Safinus is a platform that will make a very profitable investment in cryptoassets available to new audiences of newcomers while enabling professional market participants to significantly increase the number of assets and managed earnings. The platform will combine a unique portfolio, which allows experienced investors and cryptofunds to create a portfolio of cryptocurrency tokens and ICO on an internal Safinus exchange, which new investors can join in just a few clicks. This platform will provide portfolio ratings and provide transparent reports on each portfolio. The Safinus Platform consists of the following major components:

- A portfolio-making mechanism, which allows experienced investors (or funds) to make their cryptocurrency and ICO portfolios on the platform, and every investor (even the most experienced) to join the portfolio with funds in just a few clicks.

- Universal portfolio ratings, automatically generated through stored and verified Blockchain information related to portfolio revenues.

- The mechanism of individual cryptoasset management, which allows professional traders to serve large investors individually.

- Voting System to add cryptocurrency and ICO, which allows only communities and merchants who verify authentic cryptocurrency and ICO to be added to the platform. It protects platform users from fraud.

- Mechanisms for simultaneous trading across multiple exchanges through a single interface, which ensures the liquidity of assets in the portfolio.

- Instruments for automation of cryptocurrency trading strategies and portfolio management.

Portfolio creation mechanism

- Making portfolio. Experienced investors create portfolios of cryptocurrency and token by registering Safinus's diplatform, filling out the registration form, then purchasing SAF tokens to create a portfolio that will illustrate the strategies that will be used to manage the portfolio assets.

- After creating a portfolio, Investors make deposits of personal funds into the portfolio. The greater the initial number, the higher the investor's confidence in the portfolio, due to the fact that the portfolio manager is risking his own personal funds.

- Investors must establish criteria for joining a portfolio. criteria include Arrange fixed commissions to join and leave the portfolio, set a commission from the investor's earnings and set a minimum period so that investors can join the portfolio.

- The investor chooses the portfolio. Investors will study the portfolio ratings created on platforms with portfolio values calculated on a daily basis. The portfolio selected should be based on transparent, verifiable revenue Blockchain and the volume of funds managed. Then, Safinus automatically evaluates the platform portfolio in USD based on exchange rates from popular exchanges (Poloniex, HitBTC, Bittrex). If the portfolio holds an ICO token that has not been added to the exchange, its value will be based on the purchase price and will not change until the token becomes available for trading on the exchange.

- After joining, investors can join any portfolio on the platform and add their capital to them. Investors can join several portfolios they like at the same time.

- Income of portfolio managers. Portfolio makers earnings, from portfolio management, are based on the commissions they make for each individually created portfolio. There are two types of fixed commissions for investors who join and leave the portfolio (generally ranging from 0% to 5%) and the percentage of the investor's earnings from the portfolio (typically ranging from 10% to 30%). Earnings are fixated either when the portfolio goes out, or once a year (depending on what happens first).

- Income of investors. Investors get discounts from portfolio valuations based on their investments. Portfolio Example brings cryptocurrency worth $ 9,000, An investor decides to join a portfolio, investing $ 1,000. Now, the total portfolio amount is $ 10,000, therefore, the investor now has 10% of the portfolio, Half a year has passed, the portfolio value has doubled and is now $ 20,000 and the last Investor may decide to leave the portfolio, improve his earnings. This can be achieved with just a few clicks. Due to the fact that he is entitled to 10% of the portfolio value, he will continue to receive $ 2,000 (before commissions and fees).

Conclusion

Safinus will provide significant returns to investors, when SAF's balance for portfolio manufacturing is enormous. the greater the initial deposit, the greater the profit that will be in the investor. It's a good thing for kryptomarket developments and investors will not run the risk of losses because their portfolios are based on transparency, Blockchain verified revenue and volume of managed funds.

[Website] = https://www.safinus.com/

[Telegram] = https://t.me/safinus

[Twitter] = https://twitter.com/SafinusICO

[Facebook] = https://www.facebook.com/SafinusPlatform

[Medium] = https://medium.com/@safinus.com

[Whitepaper] = https://www.safinus.com/whitepaper/

Repost in Linkedin = https://www.linkedin.com/feed/update/urn:li:activity:6407985360088981504

Twitter =

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.safinus.com/whitepaper/