If you didn’t catch my introductory post explaining why I’m creating and tracking different Cryptocurrency Indices, check out my first post in Month 1. https://steemit.com/cryptocurrency/@maskedrider/cryptocurrency-index-investing-experiment

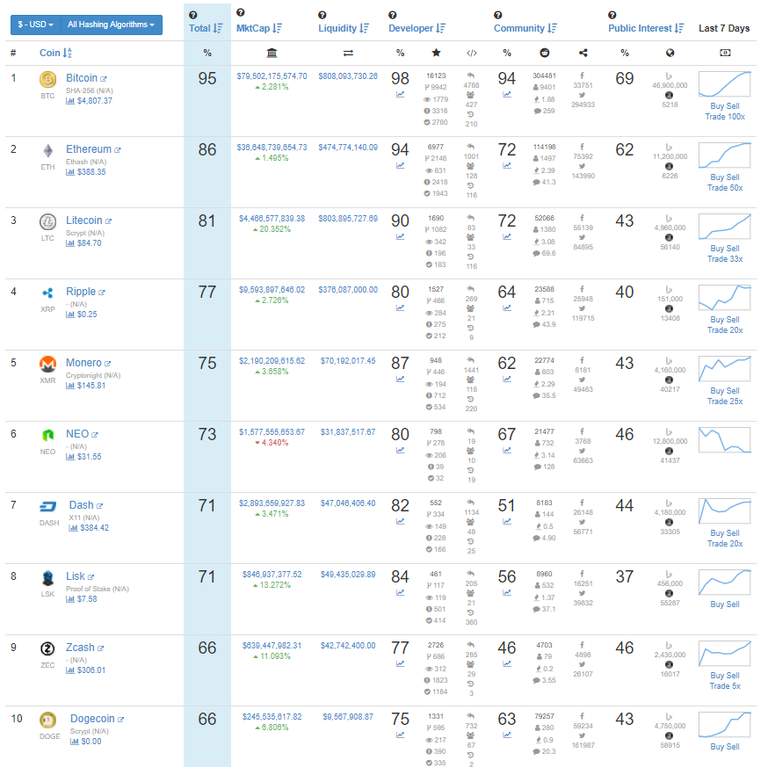

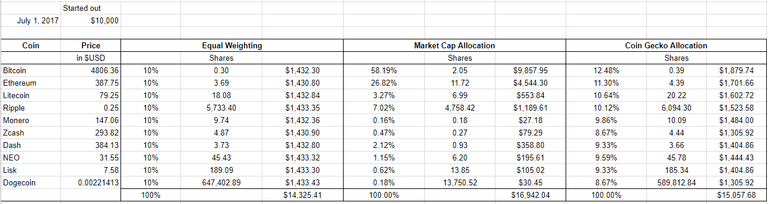

A quick recap, I’m using the top 10 coins in coingecko.com and starting out July 1, 2017 with $10,000 paper money into 3 different index strategies and track which performs the best.

Equal Weighting - This is the most straightforward way to allocate the 10 positions. Each receives an equal weight, $1,000 spread out over the 10 coins.

Market Cap - This allocation takes the total market cap of the top 10 coins, divides the individual market cap of each coin by the total and ranks the allocation accordingly.

Coin Gecko - This takes the Coin Gecko ranking and divides by the total rating of the 10 coins and allocations the portfolio.

August 2017 Recap

What a fun wild ride August 2017 was in Crytoland! Bitcoin was up over $2,000 alone, ETH jumped from $223.52 to $387.75. Litecoin, Ripple, Monero, ZCash, and DASH all had massive gains in August.

EOS and Saicoin dropped out of Coin Gecko’s Top 10 and was replaced by NEO and Lisk. EOS and Saicoin were liquidated out of the indices and all 3 indices were rebalanced.

Equal Weighting - finished August up to $14,325.41

Market Cap Allocation - finished August up to $16,942.04

Coin Gecko Allocation - finished August up to $15,057.68

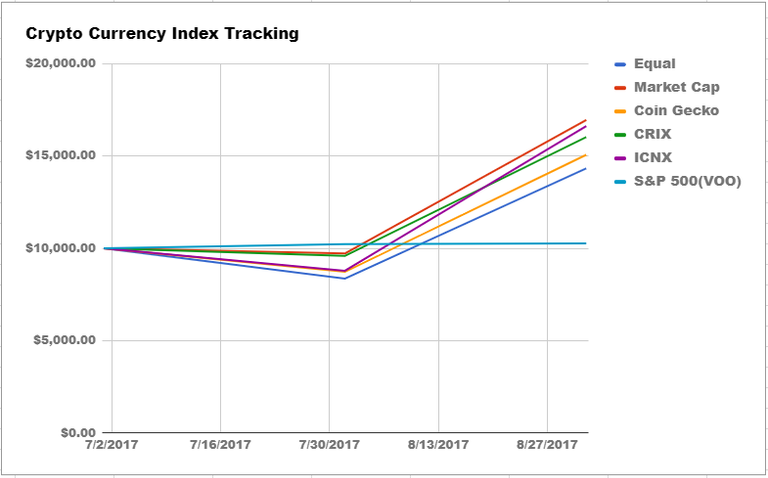

The above graph tracks investments in the Equal Weighted Index, Market Weighted Index, Coin Gecko Weighted Index, CRIX index, ICNX and VOO(Vanguard S&P 500 ETF).

In August 2017, you would have had the greatest return by investing a Market Cap Weighted Crypto Index or simply investing in ICONOMI’s ICNX index. August was a month that Crypto left the S&P 500 in the dust. If you’re one of the growing number that believes the fundamental valuation of the stock market is getting high, Crypto has got to be looking really attractive right now.

As always, would enjoy any comments, questions or suggestions on how to improve this experiment and I look forward to further tracking these. Until next month.