02/08/2019/10:00CET

The US Fed has cut! For the first time in the life of #bitcoin, we go into an easing cycle in the US.

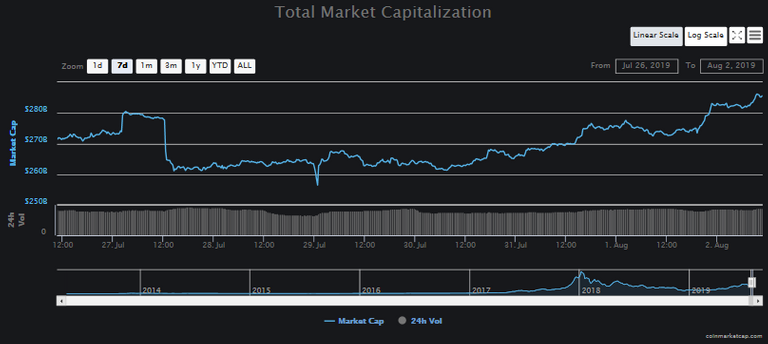

7 day Overall Marketcap

- We are 285.5bill USD market cap at press time while having topped out over the last 7 days just a few hours ago at 286.2 bill USD. The low of the last 7 days was around the 255 bill mark.

- The entire crypto complex has had a nudge since the fed fubar 2 days ago

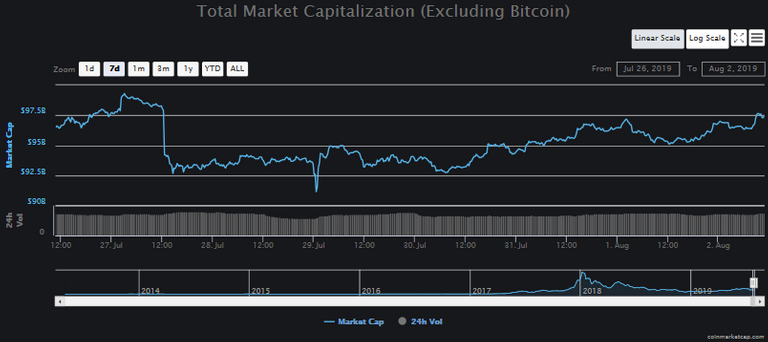

7 day Overall Marketcap (ex. Bitcoin)

- When looking at individual alts in the top 100, I do not see any great outliers either in the positive or negative territory

- Of the winners in the top 100 over the last 24h, bitcoin is No. 11

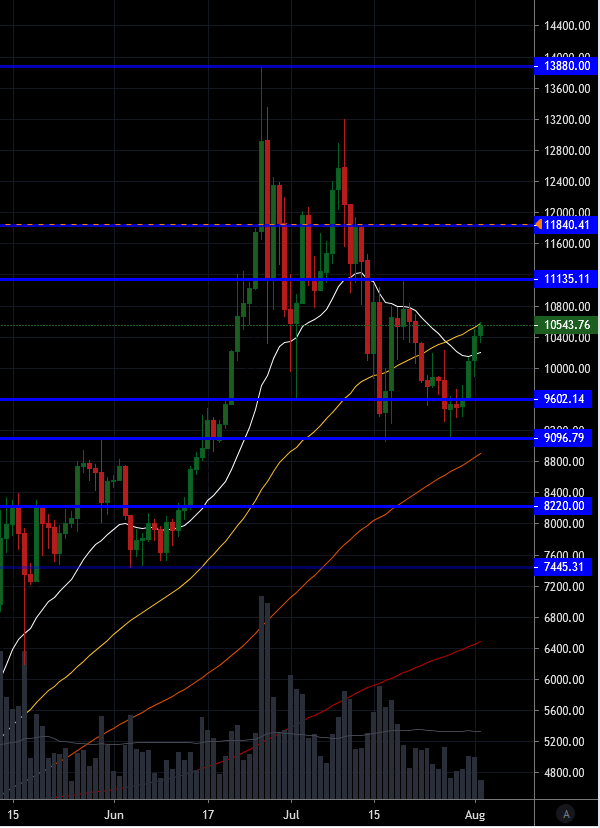

BTCUSD Daily on Bitstamp

- 10543 USD after having visited lows just north of 9100usd.At press time #BTC trades again in the 5 digit range standing at

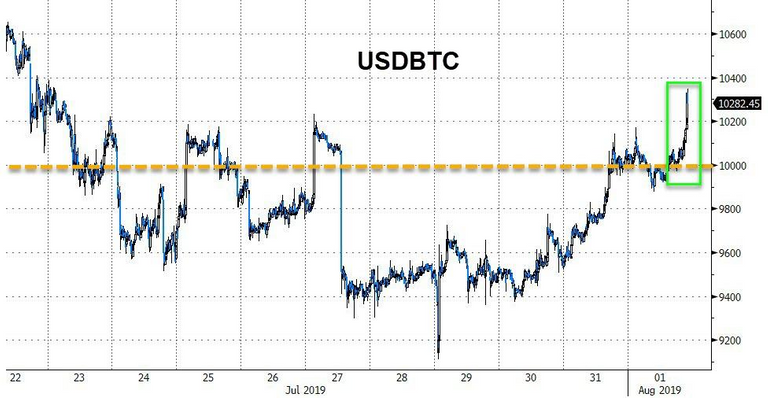

- As you can see, something broke the uncertain trend of the last week or so, on the 31/7

- The elephant in the room was the FOMC press conference where Jay Powell announced that the Federal Reserve Bank of the US will cut the fed funds rate by 0.25% to a range of 2.00 - 2.25%

*Timing seems quite interesting. Seems that the most recent break of 10k is timed with the actual FOMC statement release. But when looking at the hourly chart of BTC, there is not noticable spike just at that time. Seems that price was already on its march upward and just got a kick from the Fed.

BTCUSD Hourly on Bitstamp

marked with the timing of the FOMC statement and 10k

marked with the timing of the FOMC statement and 10kThe FED and the Financial World

We have entered a new paradigm. Some may call it the end game of the current financial architecture.

- I have been waiting for such a clear signal since I discovered bitcoin. A signal of its contrarian roots, of its true non correlation. This is the FIRST time we see the reaction of Bitcoin to the start of an easing cycle from the Global reserve currencies central bank. If you follow the philosophy of Satoshi Nakamoto, he/she/they were strongly influenced by the perceived flaws in our current financial architecture. Is it now coming to light what these flaws actually are?

- The crash of 2008-9 (which actually started in 2007, but had its roots all the way back in 1971) was the event that marked the "straw that breaks the camels back" in terms of the unsettling realization that there is no way out of the global debt bomb. It was not evident back then and for all we knew, it may have been possible to yet again douse the fire of the economic crash with debt.

- Those in Bitcoin for fundamental reasons are probably completely on the same page as me, but there are many for whom the origin story and driving philosophy behind the genesis crypto currency, Bitcoin, are not known, or irrelevant. For those in this later camp, it would serve your profit motives strongly to learn this fundamental cornerstone of the technology. In many ways, it's reaction over the last 3 days is powerful proof of this.

- A rate cut from the Fed has been well telegraphed as to be "priced into the market"

- The Fed Chair, Jerome Powell, faced the convictions of his words. If the Fed was truly data drive and apolitical, then they should have either held rates or raised them.

- With all first tier data points looking very positive (stock market, inflation measures, and unemployment, GDP), a rate cut seems completely nonsensical

- But as one looks at the second and subsequent tier data points, those who's manipulation is harder to manage, point toward catastrophe. Not only in the US but everywhere! (Baltic dry index, worker participation rate, bond yields, trade wars, quantitative easing, etc....)

- Mr Powell, has sent a strong signal to the market that their bull rally is protected despite whatever longer term damage the rate cut may cause.

- The ECB, and the Bank of Japan have both been signalling to their respective markets and the world that an easing signal from the US FED will be met with more easing in their monetary systems.

- Australia has panicked in the past few months and cut rates 2 times in response to the growing domestic signs of economic slowing.

Central Banking painted into a corner

- The DOW futures certainly made its feelings known about the FED's call

- Obviously a 0.25% cut was not enough, and they wanted more certainty that the trend with rates was reversing.

- Here we can see the selloff through the eyes of the uber bullish fang stocks. These few stocks hold massive sway over the S&P and the DOW. This indicates an EFT selloff rather than a targeted correction.

- As you would expect, the VIX spiked with the selling action.

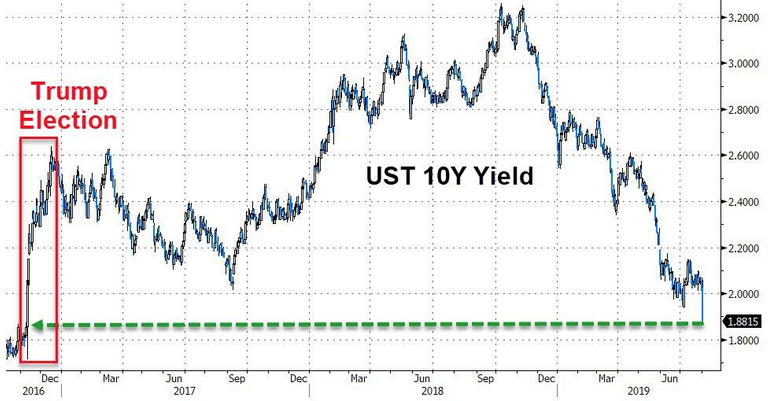

- And Bonds also reacted

- Here we see a full round trip into panic

- And the yield curve - UGLY.

- It is well accepted that certain reversals in the bond yield curve act as great barometers for the economy. And this is now signalling strongly that recession is on the way.

And now for the contrarian indicators

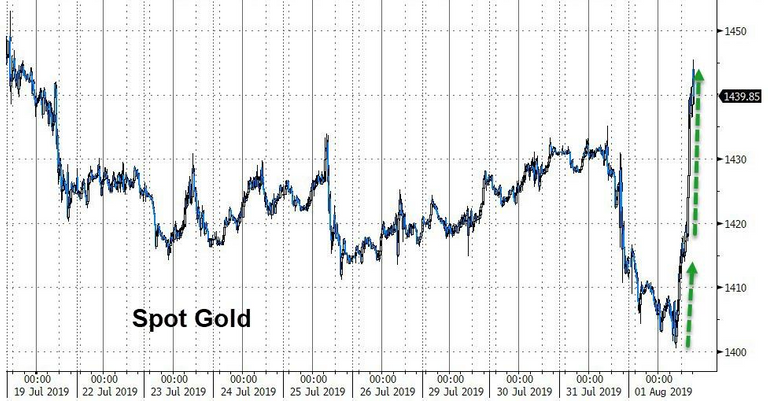

- Gold reacted as it should with such clearly negative signals coming out of the market.

- Seems the public is starting to hedge against both an economic and a market downturn.

And Bitcoin comes out of the closet to match Gold

Just to Recap

- US fed finally admits the economy is fucked.

- All other central banks by extension are likewise exposed.

- They are in a corner. Either:

1./ They raise interest rates and try to prick some of these enormous bubbles before they get any larger, and in the process give the wonky system a chance to right itself on its own, or

2./They try to throw some debt onto the problem again. Extend and pretend, kick the can further, ... (enter your favorite euphemism) - Its obvious they can only do one thing, and now it is also obvious it will not work any more!

- We have entered the post central banking world. They still exist but all they can do is fuck things up more.

- Algo bots, pension fund managers, hedge funds, corporate leaders, and the rest of us, are now left to realign themselves to this new reality. Some will be able to live in denial better than others.

- We will have some rather frightening economic upheavals in the near future. Tremors that will be difficult to ignore and and ever harder to explain away with pfaff and bullshit.

- The main stream media (MSM) will be faced with either siding with the people or to finally become openly government sponsored propagandists.

Trump was not satisfied by the reaction from the markets and decided to sabotage the economy just a little more by announcing some more tariffs against China, for no better public reason that he was having a bad day when he should be having a good day. But snickering behind his hand, he things, "well if the economy is doing too well for a 0.5% rate cut, and/or some talk about continued easing, I'll kick it in the guts with more tariffs. They seem to be working a treat to influence the FED. All they need is more..."

As always guys, leave comments, have fun and trade safe.

Disclaimer: This post is not financial advice. Before investing any funds do your own research and make your own decisions. Cryptocurrencies are highly speculative.

And finally: Do not invest money you are not comfortable losing.

Help me to make more content like this.

Upvote me, comment and resteem.

Thanks

Congratulations @mastercore! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!