26/06/2019/11:00CET

#Bitcoin has broken above 12k! Is there no stopping it? Things can never go up like this forever, so lets take a look at some likely scenarios of price action in the coming weeks.

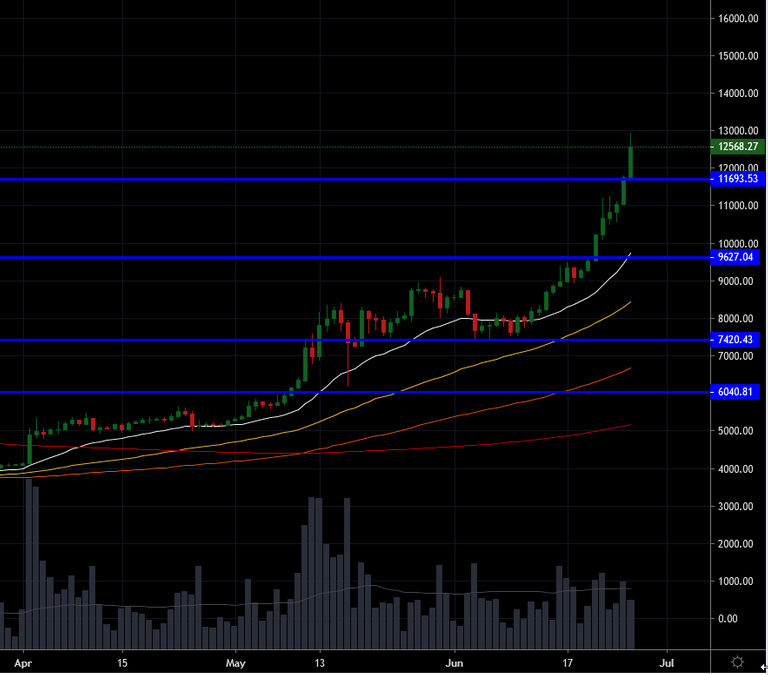

BTCUSD Daily on Bitstamp

- We are trading this morning at 12568USD after blowing through 12k with no resistance.

- I had expectd (hoped even) that Bitcoin would cool off at the resistance around 11700, but this did not happen.

- Now there is no real resistance till we hit the 20k ATH. Will we power through to it? This is starting to look like a real possibility.

- If we do, there will be a lot of profit taking at 20k. Will it be enough to see the cool off we need? Will it cool off to a healthy 40% retracement?

- One thing I am quite certain of though, buying in at these levels is a dangerous game. We have had a real parabolic run of monumental proportion.

Theories abound about the reasons, the one I like is a combination of:

- institutional players getting cold feet about the rally (bubble) in stocks and bonds they are in, with the less than inspiring reversal in interest rate sentiment (cutting rates*) all around the world.

- these same institutional players who were early to get into the OTC markets for bitcoin in the shadows are seeing the asks dry up, and are now forced to venturing into the open markets with their bids.

These 2 are putting a strong bid under the Bitcoin price at the moment.

The power of that bid may mean retracements in price are cut short, and dip buyers are left more desperate for the next dip.

So when will the dip happen?

Odds are shaping up for one of these 2 scenarios:

- If BTC closes a daily candle north of 12k, it now has no overhead resistance left, and keeps going like this to 20k. At that point I think there will be a retracement of some kind.

If we hit 20k with the velocity we have been having over the past week, the 21WEMA (weekly exponential moving average) will be at the 11500-12000 levels. This will be the level to watch for a bounce. Breaking this level could indicate a more bearish scenario as explained in my previous post based on Elliot wave theory. - This monster rally peters out at around this level, then begins a retracement down to the 21WEMA which will be at the low to mid 7k levels.

Rallying past 20k and beyond is not impossible, but becoming quite improbable.

I am firm believer that any bull market has to have retracements. They are a healthy test of the strength of sentiment. Price action must have cool offs. Prices have to drop somewhat every now and again to test if there are bids below. A show of resilience. Without them it becomes price becomes fragile and falls potentially become more violent. Analysis of support and resistances, Fibonacci, Elliot wave, etc... are all studies in timing and intensity of these movements. Their existence is beyond argument. You do not have to believe me. Just look at any chart of any market. It is part of the greed and fear balance of open markets.

*Cutting interest rates is what is done when economies are in trouble. It's meant to spur borrowing which increases money supply, which gives the economy a sugar pump to get over some hard times.

We have never before seen it done in such an extended period and with such intensity. In some cases negative interest rates are still in play (Switzerland, Denmark). Also never before have we had it in such a coordinated way around the world, and never before have we had such an interconnected financial world.

Have lower interest rates lost their desired ooomph?

If more money in the system is the goal, and the mechanism is driven by lower interest rates as the incentive, then it still requires someone to borrow for the stimulation to happen. With debt levels at all time highs globally, will lower rates have the desired results, i.e. will people and companies really borrow more simply because interest rates are cheaper?

And this begs the big question: if lower rates cannot produce the stimulative effect desired, then what else can central banks do?

I remember you saying Bitcoin was a buy 3 months ago, people should have listened to you.

Thanks, but I probably was not so blunt and sure of myself as you make it sound.