025/06/2019/09:00CET

#Bitcoin is hitting a key level or resistance shortly. How will it react and how will this rally play out. Lets take a look at the charts and see what we can learn.

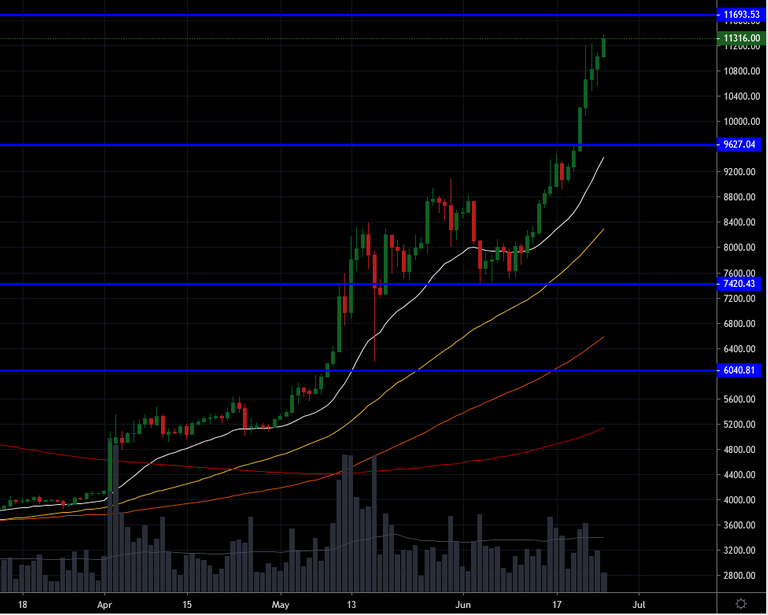

BTCUSD Daily on Bitstamp

and...

BTCUSD Weekly on Bitstamp

- Trading just above the 11300usd handle. This is pretty much the all time high for this year.

- This monster rally in BTC has exceeded everyones expectations. The question on everyones lips is: How much more power does this rally have?

- We are stretched way beyond all the moving averages. This is a contrarian signal. Nothing stays like this for long.

- A simple retracement to the daily 21EMA would have a 16% drop from here to the 9500 levels!

- The weekly is showing a positive moving average indicator which is the final crossing of the complex to assemble into the bull pattern, i.e. all moving averages are stacked from shortest at the top to the longest at the bottom. We had this final setup in the daily back in early April, about a week after the monster green candle on the 2nd April. What many would call the bull pen being smashed open.

- Since April this year (just 3 months) we have had 175% return on Bitcoin!

- Volumes are looking like they are reflecting a more serious bid on Bitcoin rather than just thin volatility being behind the rally. Something we lamented for months back in 2018. Lack of volumes.

The bull case vs the bear case. First the bull...

- So many people are calling this: "the crypto bull is back", but before we get all wet about this, lets look at facts.

- As many a successful long term trader has proclaimed, when the crowd is pointing in one direction, always take a look over your shoulder. i.e. being a contrarian often pays

- We have had a surge in volume and positive interest in crypto and bitcoin in particular. As I said in a previous post:

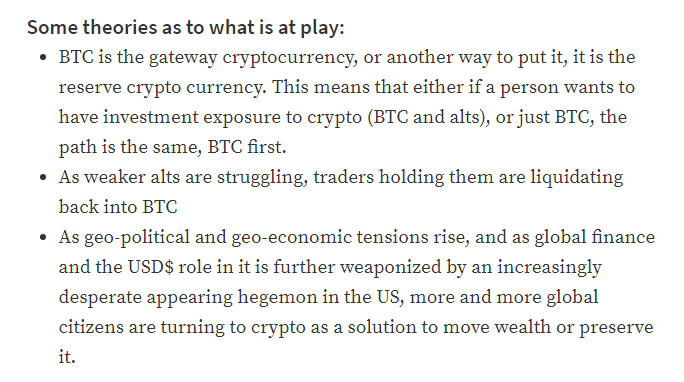

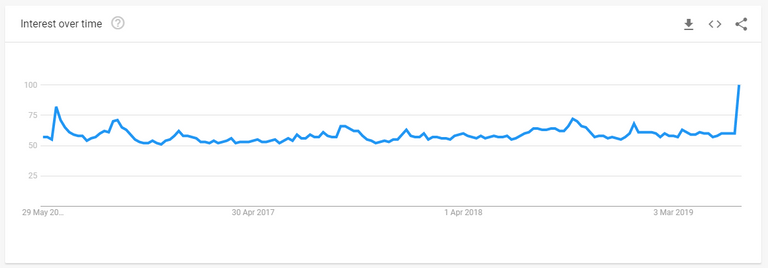

- An interesting resouce is google trends to analyse sentiment in a statistical manner. This is the search volumes over time for the term "bitcoin"

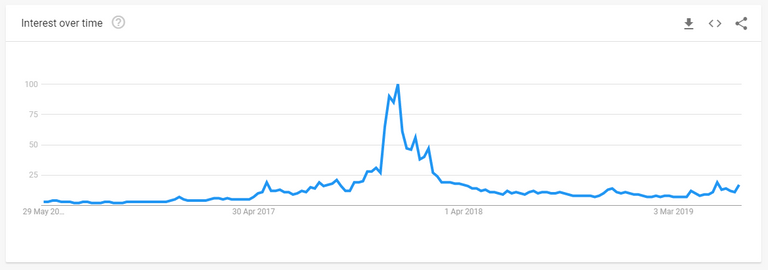

And here it is for the term "cryptocurrency"

- We are still very far away from the FOMO hysteria of 2017!

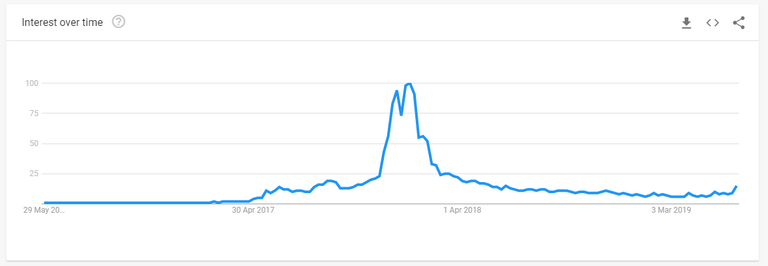

Just out of interest I pulled up the same search time range but for the term "libra"

- If we are at the foothills of mt. crypto again, this time we will be in for a ride that will hit prices for bitcoin in the +100k levels. In an overshoot of the tops, we could seriously see John McAfee save his dick, i.e we go to 1 mill!! Though if there is any stock in resistance at round numbers, then we would see it here!

- I thought about the OTC markets and the inevitable (at least according to me) overflow as prices rise, i.e. sellers reduce ask volumes and bidders get desperate, that this phenomenon would spill institutional demand into the open and onto exchanges where their bids will overwhelm the asks and spike the price. I would add this theory to the ones I listed in my previous post.

And now for the bear, or contrarian analysis

- We have not had anything that could be called a retracement and consolidation yet since the start of April. True there was some sideways actions after the start of April, but retesting some support is what I am getting at.

- The white moving average on the weekly chart is the 21 week exponential moving average. This is an indicator to watch. Historically it has signaled all major support in bitcoin bull runs. I invite you to go and check out how stable and predictable this indicator is. To be blunt, we need to retest this indicator as support to have a healthy and longer bull run. Today this indicator is at 7080usd.

*We are about to touch a key level of support and resistance. This is at 11700 handle. We paused here on several occasions during the early bear market of 2018. I am unsure of how much stock to put into this but the charts do show this level has some historic significance. - Elliot wave theory is in a grey zone at the moment as to this breakout. I follow this theory even though I am no expert practitioner. It has been proven time and again to be a reliable indicator to market trend reversals.

- At the moment equal compelling cases can be made to show that we are in wave 1 of the bull, or we are in wave C of the bear. I could make a hash of relaying the details of this analysis to you or I could point you to a great vid by Alessio Rastani on youtube here

- In it he lays out the potential that we have not yet hit the bottom of the bear market. I know this may be hard to swallow, but be a contrarian in your analysis, that way there are no surprises.

- In short, my contrarian thinking leads me to believe that this rally cannot keep going like this for long. When it breaks there will be a capitulation back to some support level. Which one is not clear, but there are some good candidates.

- I am placing my bets on the 21WEMA as I mentioned above. It is converging with the 7400 range shortly, and the 100WSMA is also loitering there. Odds favour this level as major support.

- Bouncing off this support is essential to invalidate the Elliot wave theory of a wave C of the bear playing out.

This was a long update so thanks for your patience and I hope you got some value out of my analysis.

As always guys, leave comments, have fun and trade safe.

Disclaimer: This post is not financial advice. Before investing any funds do your own research and make your own decisions. Cryptocurrencies are highly speculative.

And finally: Do not invest money you are not comfortable losing.

Help me to make more content like this.

Upvote me, comment and resteem.

Thanks