15/05/2019/09:00CET

#BTC is holding its amazing gains, but for how long, and alts are gaining a risk bid. Lets take a look at the charts to learn some more about what is happening. And I will show you an extra peak into some worrying development in the banking sector.

BTCUSD Daily on Bitstamp

- We trade at about USD8020 at press time with very powerful volumes.

- Bitcoin is still way extended from its moving averages, the risk to reward for taking a long position here is quite bad. This will begin to weigh on the order books at some point shortly.

- A reversion to the mean (typically teh 21DEMA which is at 6360 today) is quite possible and many who analyse market data with TA would say is the likely short term prognosis. In fact historically, after such a stretch away from this indicator, the snap back often overshoots, meaning it could even go lower, say 6k or high 5k.

- Despite the sound of it, this is not a bearish prognosis. The market has to consolidate this new gain in order for it to have a more stable run to retest ATH @ 20k.

- I am just telling it like the history has shown over and over again in markets both great and small.

- But in stating this, if you follow my posts, I was predicting this when we crossed 6200 as well, and here we are at 8k. TA also gets it wrong sometimes. TA relies on statistically probably market moves based on historical precedent, but surrounding market fundamentals can sometimes totally overtake precedent.

- I will stick to my guns and call for a pull back to find support somewhere around the 6k level. I have staked my trading strategy on it.

Fundamentals - a list of possible drivers

- Trade war! This is the elephant in the room, so lets talk about it first. Trump is an idiot, but he is also president. His belligerent negotiation tactics have somewhat backfired with China. He underestimated their resolve and overestimated his own potency. The result is an escalation of the ongoing trade war.

How does this affect bitcoin? China has a few things it can do, but going head to head with retaliatory tariffs is not one of them. This is due to the huge trade disparity between the two. To retain market share, what seems to be one of the easier things for China to do is to allow, or push their currency into devaluation vs the USD. Not a pretty strategy, especially if you are a Chinese citizen, but somewhat effective. Every % devaluation is 1:1 compensating for % of tariff. The pain for the US consumer (paying higher prices because of tariffs is a tax in effect) is not dissipated, but the market share for Chinese industry is retained, despite the fact their raw material imports become more expensive.

Why does this affect bitcoin? If the Yuan is devalued, the wealthy are again under pressure to preserve their wealth and not watch it erode in a currency debasement. They will try to expatriate their money. Since China has closed many exit paths with their capital controls, one that is devilishly hard for them to stamp out is bitcoin.

There are many mining operations in China, so there is a ready supply of bitcoin to buy. This creates a bid for bitcoin as a safe harbor against devaluation.

Expatriating money does not mean you take it out of the country per say. Parking it in bitcoin is the same thing while still having access to it within China. It is a safe haven outside of the Yuan system. - The so called "Smart Money" wants in to cryptos before it runs away from them like it did in 2017. Having followed crypto and having ties to the traditional banking systems here in Switzerland gave me some front row seats to the sentiment amongst moneyed people back in 2016-2017. They felt a deep chagrin at their money managers, and the bankers themselves felt dumb having not foreseen this explosion of interest in bitcoin and the crypto market.

They do not want to miss the next boat which they are pretty sure will set sail in the near future. We have already heard loud whispers from the OTC desks about the growing spread between bids and asks as the asks dry up and bids become ever more desperate. Their leakage out into the open - onto exchanges, was a logical next step.

The smart money sees the writing on the wall now as crazy monetary policies are doing more long term damage to the financial system than good.

Cryptos are starting to look like the basis of the next financial system and they want in before it is too late. - Still on the subject of so called "Smart Money", they, more than anyone are starting to wake up to the fact that the current financial architecture is not just getting a few scratches but some structural cracks are appearing. They have seen it before (2007, 2000, 1983,...) and they know how fast it can go once the leash is off. They, in particular the older crowd or those of us who have a fetish for economic history, know that the last 2 recessions have had a truly global feel to them and the next one which is most likely so close you can smell it, will be a progression of this trend. There will be few and fewer 'other' places to park your money to avoid the disaster. Another way to say it is the safe havens within the traditional financial architecture are getting fewer and fewer.

Is the choice of safe havens being whittled down to things like precious metals and cryptos? This topic is one that I decided to look into recently.

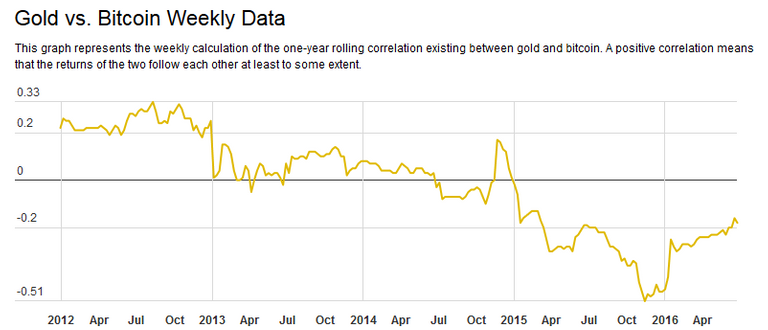

This chart I found on coindesk seems to indicated no.

Just to balance this out is a story covered by Cointelegraph from the WSJ. It argues that there is short term high correlation between gold and bitcoin albeit for short periods of time suggesting a growing correlated sentiment amongst institutional investors toward these 2 assets. Make of this what you will. But the latest move higher in #bitcoin seems to have had a sympathetic move gold, albeit for a short time. Correlation is not causation though. It will be interesting to see this relationship play out if we see the traditional safe haven of US T bills loose confidence. (ie yeilds begin to spike) - In general the sentiment of the market has stopped looking back at the euphoria of 2017 and subsequent depression of 2019 and is taking on a positive bullish hue as 2019 unfolds. This is against the backdrop of the traditional financial system, having been pumped so full of stimulants begin to show a frighteningly accelerating dependency condition. Think an heroin addict who needs ever greater hits to get the same high. At one point the hit will be fatal and there will be no high to enjoy.

Within the bitcoin world, the bears predicted bitcoin to go as low as 1k before a new bull trend can start. They are sounding quite stupid at the moment. If they are still on the side lines with their capital, how many of them are rethinking their strategy and maybe wading into the market once again?

For that matter many die hards capitulated when 6k support was breached back in mid Nov 2018. Many of us are sitting on our pile of cash waiting for a more certain entry point. And the emotional ones of us are buying now! - Whether or not we hear about it in your news feeds or not, the story if failing currencies around the world is continuing, Venezuela, Turkey, Argentina, Ukraine,... What next, the Euro?

In our hyper connected financialised world, sovereign currencies are more and more at the mercy of the whales in the space, namely the USD, EURO, Yen, Yuan. The jostling of capital sloshing quite freely around the world amongst all the currencies, but in particular between the larger ones, create ripples the look like tsunamis to smaller currencies, or even the mid range ones! As a example of what I mean, again I will touch onto the cross boarder mortgage market and what happens when things go wrong covered in this piece in the Telegraph. Suffice to say, the more volatile the capital movements become, the higher the risk for collateral damage in the global financial system. So many people have a lack of understanding of how connected the financial world really is and how contagious problems can become. I do not claim to understand this connectivity any more than anyone else, but I have crossed to Rubicon in my comprehension of the general risk of this phenomenon. I think that my experience is spreading further and wider with each passing day. Everyday people are getting more nervous and loosing faith that the central authorities have everything under control. This is an erosion of faith in the system. THE NUMBER ONE MOST DANGEROUS PHENOMENON FOR A FIAT BASED FINANCIAL ARCHITECTURE

Loss of faith is a frighteningly rapid thing once it gets going, and devilishly hard to reverse.

Cryptos, lead by Bitcoin have shown a resilient way to park capital outside of the current financial architecture. And parked in a way that is virtually undetectable (if you understand how it works), and highly mobile. This message is permeating the human psyche more and more. This may represent an easily underestimated buying pressure which may become unleashed if financial pain increases much further for the average man in places like Italy, Greece, Turkey, Venezuela, Zimbabwe, Argentina, Australia, Russia, China, UK, Ukraine, ... and the list seems to just get longer with each passing month.

n.b. FX tracking is usually referenced to the USD being the reserve currency. But the USD has its own movements which may make everything ease better or worse depending on your perspective. This is what I mean by "The jostling of capital sloshing quite freely around the world amongst all the currencies, but in particular between the larger ones, create ripples the look like tsunamis to smaller currencies"

Take a look at the DXY index that tries to objectively track the USD...

My feeling is the macro outlook for this index is for the USD to strengthen. My thesis is simple, it is the least dirty shirt in the laundry basket.

I did not intend for this update to get going this badly in a rant. My apologies.

There were at least another 3 points I wanted to make but I will save them for another post when my fingers recover.

The overall feeling I want to convey though is the gathering storm clouds. They are getting hard to keep track of and there are some that seem to defy normal explanation, but they all usher inclement conditions approaching.

We all strive to financially navigate ourselves through a confusing world to at the least maintain our lifestyles. More and more of us are finding this harder and harder to do. The ranks of those that are waking up to the inherent unfairness of the current global financial architecture is growing. This automatically spurs us to seek shelter from said architecture, and the realization that we are somewhat trapped within it rapidly appears. Bitcoins reputation as a scam and medium of exchange for criminals is giving way to a new realization that it is a serious option as a safe haven outside said architecture. The cracks in the dam hemming us into this current and obsolete architecture have sprung leaks that are only widening. What will happen once a nice big chunk breaks out of the dam face spewing a torrent of capital? That will be exciting to watch from the other side.

Bonus material

If you have hung with me till now, bravo and thank you.

I promised a look at a bank that if it fails, will be a tremor that will ripple across the entire financial landscape and could usher in a shift from which there is no going back.

I am talking of the bank everyone loves to hate, Deutsche Bank.

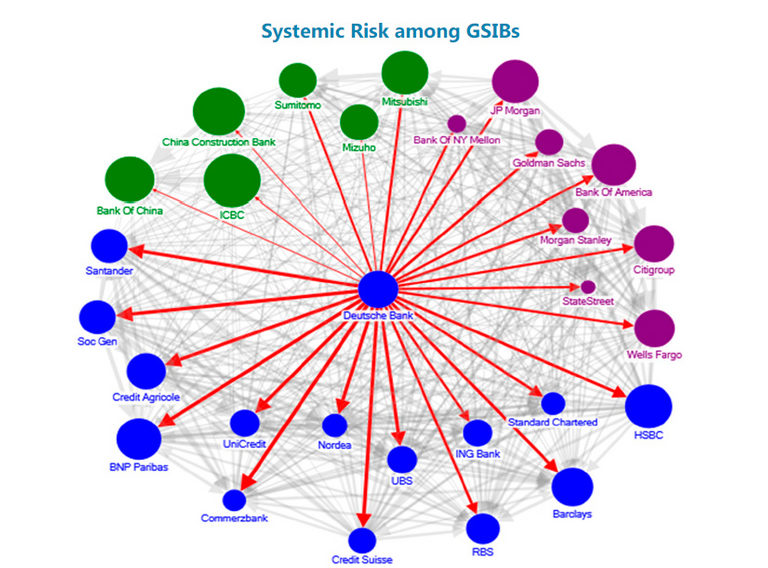

Deutsche Bank is a true monster in the Banking world

As far as the inter-connectivity of the global banking world, Deutsche Bank stands head and shoulders above the rest.

And Deutsche Bank is unhealthy at the moment. This is a common thread amongst the European banks it seems.

So unhealthy is Deutsche Bank, that the German government tried to coax Commerz Bank, Germany's second largest bank and also limping along geriatricly into a marriage of convenience. But the shareholders would not support the move seeing no advantage for themselves in this merger. The merger talks were terminated at the end of April and covered by Bloomberg here

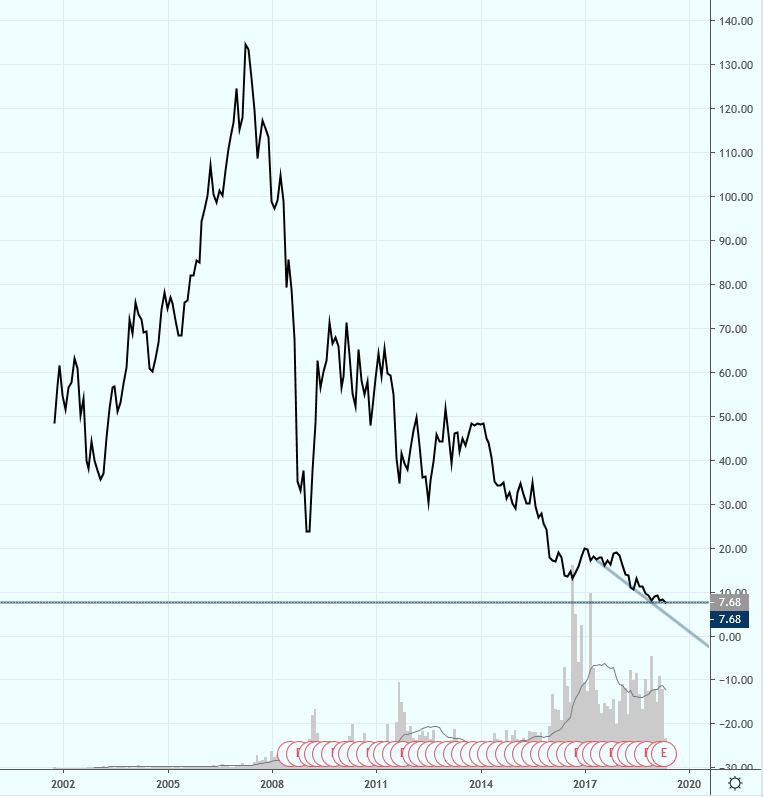

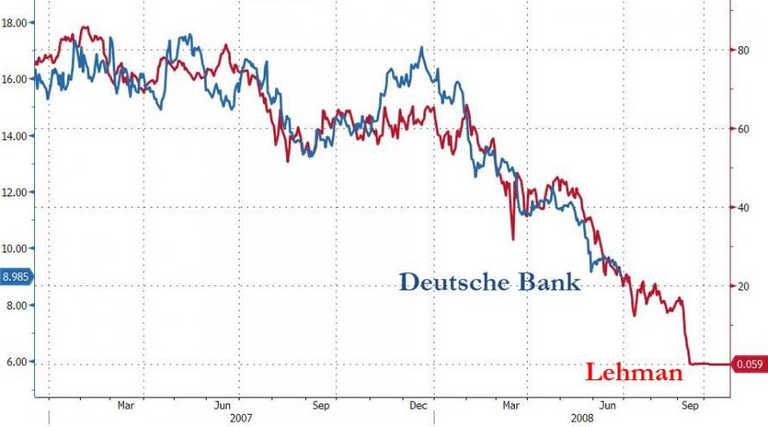

This is todays shareprice of Deutsche Bank...

I think it does not take a genius in TA to see trouble ahead for DB.

On the daily we can easily see the double bottom test.

Remind you of anything?

The German government could not bail out this behemoth, even it if wanted to. In addition to this an attempt would smack of the most glaring of hypocrisies from the Greeks, Italians, Spanish and Portuguese since it was the Germans that castigated them, and prevented them from assisting their local banks with ECB money.

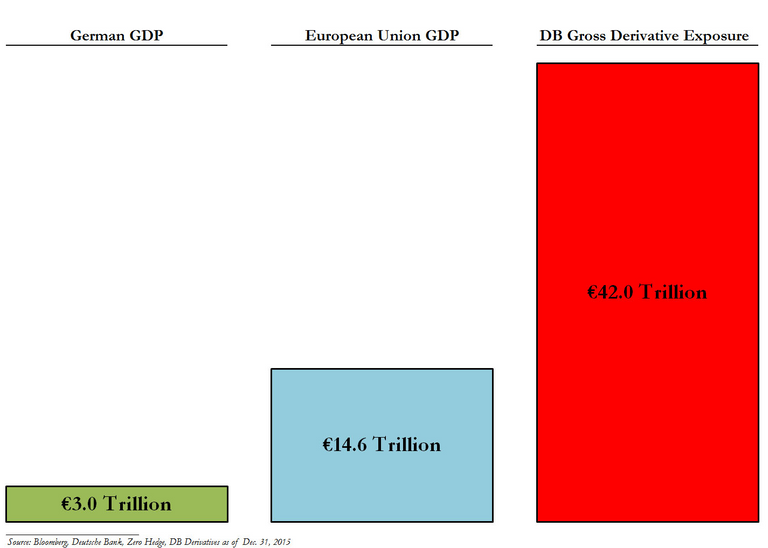

And now for the cream! This is a what Deutsche Bank has on its derivatives book!

If this thing gets unwound in a shock, it will reverberate far and wide. We have to keep in mind that every derivative position has a counterparty who holds the other side of each bet on their balance sheets. And because of the inconvenience to Balance sheet optics to mark assets to market, most of these instruments are marked at 100% nominal value.

souce material for Deutsche Bank

Back to catalysts for Crypto

- In this post I wanted to touch some potential catalysts in play in the Bitcoin market. I maybe went further than I expected.

- These are just the largest of the catalysts I could identify. There are more and more every day.

- None of these catalysts is short term or being addressed or alleviated.

- As leakage (fiat to crypto) becomes more prominent, we will see governments and financial authorities try to stem it in their own ham sifted ways. Recall executive order 6102

I will quite my rant here before you either fall asleep or puke on the ground.

I have my popcorn cooked and am watching with a particularly poignant schadenfreude as this show gets going. So many of us have been staring at the teetering edifice and wondering when it will topple. Now we are finally seeing it lean precipitously and we can feel it in our bones that this is probably it.

As always guys, leave comments, have fun and trade safe.

Disclaimer: This post is not financial advice. Before investing any funds do your own research and make your own decisions. Cryptocurrencies are highly speculative.

And finally: Do not invest money you are not comfortable losing.

Help me to make more content like this.

Upvote me, comment and resteem.

Thanks

Big report, you covered everything, there's a lot going on right now, exciting time to be alive/awake, thanks for all the work you do out here.

Thanks. Im sure I did not cover everything. You are right, there is so much happening. Its hard to keep track.

I feel bad for the rational and awake people in the US with this buffoon steering their country even faster toward the cliff.