1999 was a "Stock Bubble" created by an expansion of financial assets.

2009 was a "Real-Estate Bubble" created by an expansion of the money supply from the worlds central banks and their cheap money.

At some point, maybe 2019, we will see the culmination of the "Everything Bubble" created by the worlds central banks and their flooding of all markets with cheap money. The true consequences of quantitative easing or money printing have yet to be felt by the world's economies.

A lot of commentators and analysts say that crypto currencies and gold are in bubbles. Well, if they are, I don't know what that says about the rest of the worlds markets.

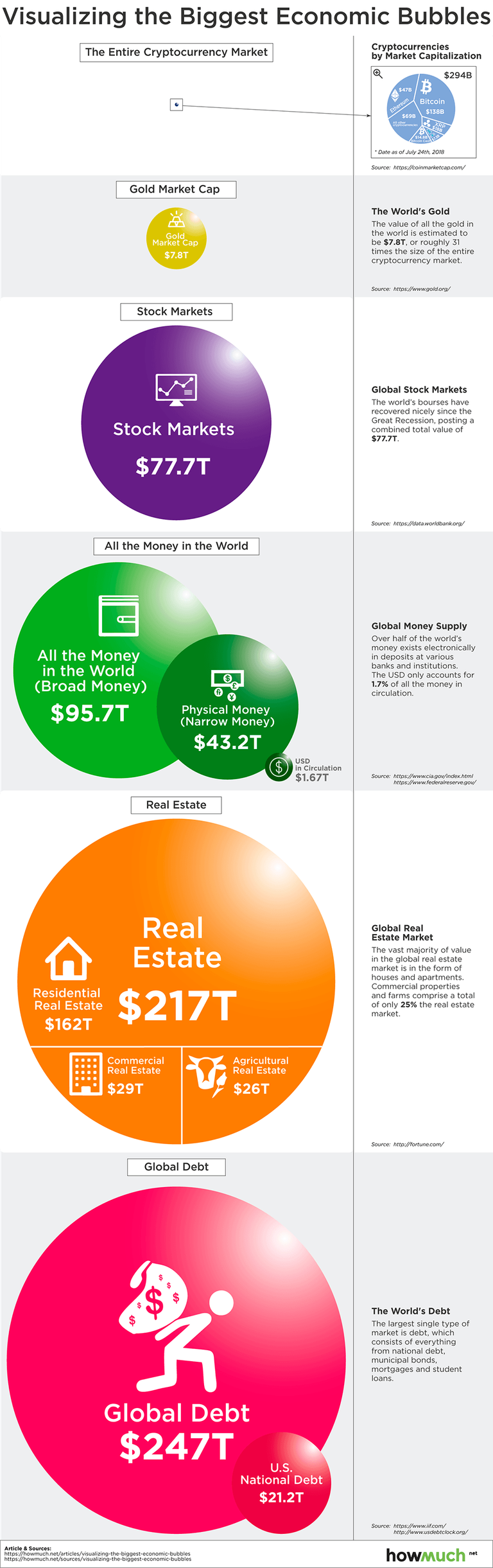

On top of global debt, add the estimated $1 quadrillion+ global derivatives market and its easy to see where the true bubbles are at. It keeps the size of the crypto bubble in perspective. The cryptocurrency market is certainly one of the fastest-growing asset classes in the world. But to keep it all in perspective, the entire crypto market is worth only a tiny fraction of the gold market, which is itself only worth about 10% of the entire world’s stock markets.

Meanwhile, the massive global real-estate market is valued at $217 trillion, which is still less than the largest single type of market: debt. The global debt market is valued at $247 trillion.

As these markets begin to implode, the residual capital has to go somewhere in a flight to safety. Theres only several places it can go....destroyed, cash, precious metals, and maybe crypto although its an asset that has never truly gone through a full credit cycle and its violent swings make me doubtful it is a safe haven. Its just too new and untested.

I am Lord @matthewwarn and I have Stackitis...but there are worse problems to have in life. Like an endless stream of debt and speculation.

To invest in Mene24k Gold Jewelry click Here

To open your own BitShares account, click Here

To open your own Binance account, click Here

That’s why I’m always confused when people say crypto is a bigger bubble than the .com bubble. It’s not even close. I think crypto will have a much bigger bubble than .com before another crash.

I tend to agree with you. I think we are still way early in the cycle and these are micro-bubbles in a much larger cycle

Great article mw! Here’s another number to consider: at $1 per satoshi the bitcoin mrkt cap would be 2.1 quadrillion dollars, or, a little over half of the whole enchilada... 😳😁😜🤑🍆

I do like Mexican!

Great analysis. Crypto is so small compared with othet asset classes. Followed.

Good visual info to use in front of the crypto skeptics.

Thanks for sharing dude

Its really tiny by comparison and I don't think most people see it.

Awesome post. The cryptocurrency market is tiny compared to other markets. I think we've still got a long way to go.