It's been a couple months and I though now would be a good time to do a little catch-up with what I'm doing and what has happened since my first post about mining and trading.

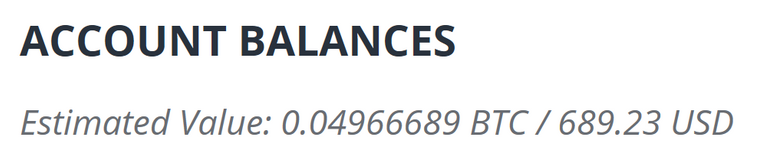

First off I'd like to say...wow what a past few weeks! The market fluctuations have taken me past my $1000 benchmark (that I had hoped for in 6 months, not 3 1/2) and back down to around $700, but that's my fault (will expand later in this post).

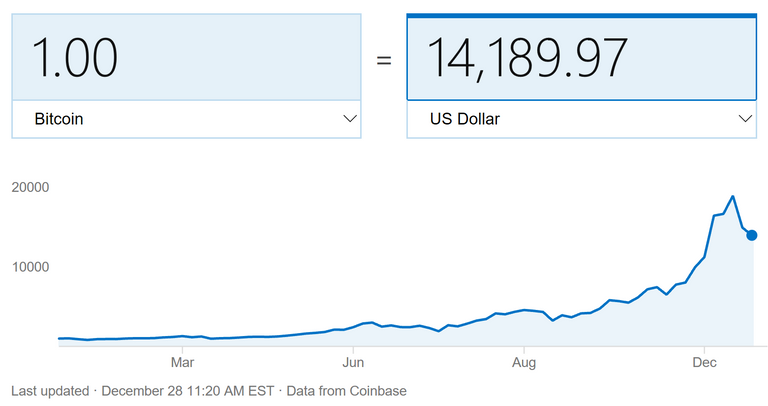

Seeing Bitcoin skyrocket to nearly double what analysts forecasted for its spring value (est $10,000.00 USD) was a bit alarming and reassuring at the same time. It is steadily increasing in value and, even after a rally and a reset, it is still on the move upward. My gut says it will only see below $12k on a quick dip/reset and will back in the neighborhood of $20k within a few months. Long term? I won't venture to guess as I'm a reformed day-trading crypto hopper, but I feel like any entry at any price right now (and no one can deny that its current price of $13-14k is a good entry point) is a good move of the long run. Some recent articles suggest that BTC will reach astronomical levels ($60-80k+) in the new year, but I would expect more modest results with a few heavy pull-backs throughout the year.

Being tapped into the crypto-world has disconnected me from the mainstreams perception and acceptance of it, but I was recently reminded by a friend how it is gaining household popularity. Contrary to the "big boys" of finance still giving their public "nay" (while, I'm convinced, they are investing and trading cryptos behind their backs) the world is warming up to the concept and the market is definitely seeing an influx from legitimate interest if nothing else. Just last night I was trying to help a friend set up an account on bittrex.com and we were surprised to learn that they were not accepting new accounts at that time. Wait, what!?!? Am I playing on a platform that can't handle it's expansion? Calm down, calm down...this is a good sign. Growing pains due to rapid expansion is always a good sign of a market. If there are so many people trying to get into investing in Cryptocurrencies I'm OK with that. Coinbase, one of the other large platforms, is known for its instability due to operating-near-capacity issue. I'm ok with the one I've chosen not taking on new members so that the vested members can still play without (major) interruption. I will say I do notice the socket connection lagging a bit more recently, but I can deal with it.

Ethereum following the Bit-curve is very nice to see for me, being an ETH miner, but to all ETH investors the same. Going from a projected monthly mining income of $90-110 to $210-240 has been a pretty, well, sweet deal. The increase in difficulty has been more than offset by the increase in value, so, I will keep mining it. I see it being a long while before ETH is no longer profitable to mine. Just a quick recap of my rig- I am using 3 - RX480 8GB cards that I modded the bios and am running tweaked drivers with Afterburner to regulate the fan speeds and clocks. I installed Arctic Accelero Twin Turbo II coolers on them to keep them cool and efficient, but they took a good bit of customizing with the Dremel so be forewarned if you so choose to maximize your cooling power with these awesome air cooling systems. All said, I'm averaging 82Mh/s at an easy 510 Watts of juice. Had I left all of the ETH I mined in my wallet for safe keeping I would be in a much better position if value were everything, but I did set into this with trading in mind and all good education comes at a cost.

Where to start... candlesticks. I was first introduced to candlestick charts when learning investing in stocks years ago. After I spent months perfecting my eye with the art-of-the-stick I realized something... it didn't work with what I was investing in. The only corner of the market that it did work in was something I toyed with for a total of about a week, on and off... day trading penny stocks. If you're the type to go to Vegas and put all of your money on black you should try it sometime. Needless to say I was a little disheartened to make the realization that all of the effort put into it would mean nothing with how I wanted to invest in the stock market. HOWEVER... I was pleased to learn that, for the most part, it does work with cryptocurrencies. Yes, I'm saying it... investing in cryptocurrencies is much akin to day trading penny stocks. Am I saying they are the same thing? Absolutely not. Do they function, for the most part, the same? Why yes they do.

Let us force ourselves out of this cryptobubble and take an outsiders stance, what are these things REALLY? Yes, blockchain is a thing and the names and logos they bare make it easy for us to distinguish one from another, but, comparing to the stock market, are these companies that hold actual value given by metrics that gauge all companies on and off the exchange? Hmmm.... well maybe lets look at the penny stock realm a little closer. Does anyone that day trades penny stocks actually care what the company does, its history and what its pipeline/projections look like? Nope. They are in it for the "wam bam thank-you-aaaand there's the next" experience; the quick flip. Many huge, quick flips that amount to money and that, in essence, is the name of the game. But is that all there is to cryptocurrencies? Lets view from the macro for a moment.

Value is often equated to a measure of money. In order to exchange it fairly it has to be. Different metrics can be used to come to it's supposed "value" but it is a conceived thing. We can view any country's currency the same way. Most are paper and non-precious metals that are given a value by a regulatory agency. There is a common understanding as to what each denomination should be able to fetch from the market, given the objects purpose and quality. Supply and demand will drive the value up and down- supply dries up for a necessity and its demand will increase with it's value in tail. If an item is found in surplus the market will make distinctions as to what it is worth and, being the buyers market, the value will tend to decrease. Without this system it is pure speculation and emotion that drives the perceived value of any given object. And that lack of a backbone is what I see with the crypto-market. By no means do I mean that it is something to only be day traded, because I see the value of the crypto market being a very real, longstanding thing, there just isn't any data to compare it to because it is still a unique concept in its infancy. That said I feel that long positions are not a bad idea for those with extra pocket change that are interested in making more than a savings account or accepted investing practices would yield, if they look at the money put in as already gone. For those risk seekers I say learn charting. It is the best way (and only way that I know of) to take something that has no calculated value and project its worth. Until there is more of a driving media presence that skews the emotional state that is cryptocurrency it is the way to do it.

How much have I lost in order to gain this experience? Honestly, a whopping $192.36 in electricity. Considering the fact that, given my learning and emotion-breaking hurdles, my portfolio currently sits at...

One mistake that I made (like most that I actually make) was not going with my gut. My gut told me to not reinvest the BTC from the nights sales on Christmas morning. I thought about it and the charts were calling for a correction. In haste I decided to just keep feeding the machine and double my usual amount into two positions that general trending (light, broad and general chart analysis) made seem like a logical choice. Not so much. That one bad choice with two bad positions cost me roughly 32% in 3 days. How will I void this in the future? I WILL NOT make any moves without having the time to sit and actually decide the best course of action. Simply repeating on habit is not a sound strategy- calculate every move or it will cost you.

I found that creating my own hybrid-approach and automating my moves with sell limit triggers is the most consistent way to keep it growing. Finding a reasonable margin is what you need to work on. They are going to be different with each coin you move into, so learning charting is invaluable when learning what a realistic and probable spike will look like. In the beginning I set unrealistic benchmarks that cost me many 10-20% spikes that would have added up to much more than the gross spike that triggered the sale. But, again, different coins will have different personalities and learning what is what will help in predicting if it is a triggerable coin, one to hold onto or one to try one of my methods on. Understand that it's personality can change in an instant and its personality can flip in an instant. Case an point - I found the HempCoin THC a couple months ago and started studying it. It would plateau around .00000200BTC and spike anywhere from 20-60% consistently. That worked for a while, until Dec 1 2017 to be exact. I happened to check my account and noticed it was gone and a nice little chunk of bitcoin was waiting for me to reinvest it. I saw what I would consider an anomaly (to my system, of course) and thought to myself "nah, I'll wait this one out. It's inflating and when it pops I'll hop back on its horse." Well, folks, I'm still waiting for that horse to come back to the ranch because after it steadily trotted around .00000700BTC for 3 weeks it shot up to almost .00004000BTC and has been hanging shakily between .00002500-.00003000BTC. There was no way to predict that change in personality, but it taught me to modify an old stock investing strategy and implement it, in reverse, to help ride that horse out of town, so to speak.

Trigger Tip: When setting your trigger don't set one, set 2.

When moving into positions in stocks it is a good practice to make 3 moves into it, over time. I'm hijacking that song of 3 moves and playing it in reverse to help avoid missing out on a huge gain. Had I cut my moves into thirds I would still have 1/3 of my original position that would equate to 4090% of my original move. How I am applying this in current moves is as follows-

I find coin "X" and glance at it's chart. Its history has proven to have the qualities that I look for in a good short term prospect. Once I find the value that I project it to hit in a spike (in 5 days or less) I set 1/3 of the total to that at a limit sell. For the next third I double that first target and set it for limit sell. The last third I leave open without a limit sell trigger set. (Side note- safe practice is to set this chunk and all long positions in a wallet. We like to think that our passwords keep our trading accounts safe, but if you don't plan on trading it, put it away. You can always send it back to your trading account if you want to flip it.) Had I used this method I would have put in the .01BTC, cashed out .00816BTC and now held .1363BTC worth of THC today. Now this is not something you should expect to have repeat itself often, but when it happens you'll be glad you tried it. It's also a nice way to build many micro-positions across the board and stabilize your portfolio overall.

Bitcoin - 19dhtebhWNQjjvaaSapw4bZry8buohSaoP

Ethereum - 0x4ba6FC1dd8293081c5B915124ddf13F2425D7D35

Litecoin - LcPfAUNKJ7jr3gnmmMVqET2ode7LDLLrsH

BitcoinCash - 1KTEYYg43awQq9bBRs1zL8Xbm3RrdktnT6

Congratulations @mcmm! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @mcmm! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!