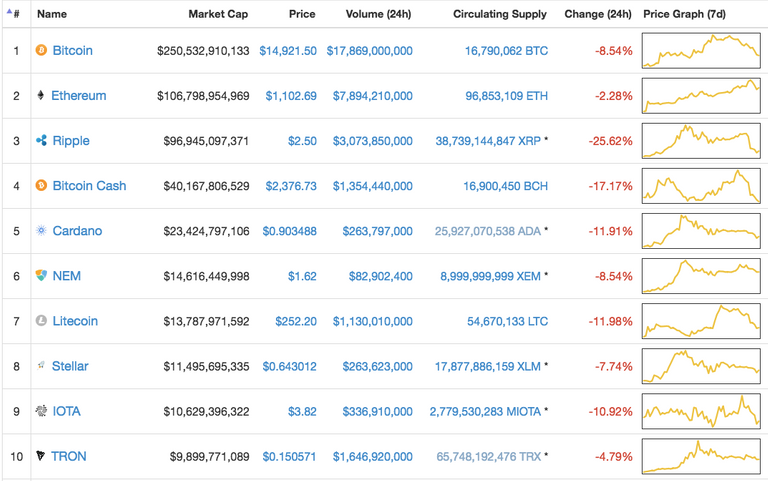

Today the Crypto market has seen a major pullback. Almost the whole market is in the red and has seen a massive dump in terms of total market cap, going down from yesterdays all time high of around $850 billion to lows of $650 billion while recovering to around $730 billion at the time of writing. As seen in the picture below, the entire top 10 pulled back by up to 25 percent. Is this the start of the long feared bubble pop or just another random crypto downward movement?

The answer is none of the above! Here is what really happened:

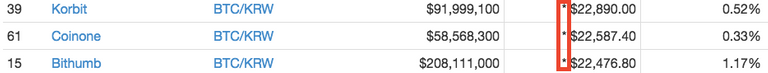

If you look closely at the individual prices on coinmarketcap.com, you can see an asterisk in front of the prices of all South Korean exchanges:

Scrolling all the way down to the bottom of the page, it turns out that the asterisk means that prices are excluded from the average.

This morning, CoinMarketCap decided to exclude Korean exchanges from the calculation of the average price of all coins, as those exchanges traded on average with an over 20% premium compared to most other exchanges. In combination with a rather high volume, this manipulated the average price and resulted in different prices than the one that non-Korean investors could sell their coins for.

By doing this, the total market cap shown on the website decreased by around $70 billion instantly and on top of that even more due to investors starting to panic sell because the saw the fast decline. This sent the entire market cap down another $100 billion, but the market recovered fast as investors started to realize what really happened.

While the panic selling could have been avoided by issuing a warning prior to excluding South Korean exchanges, this will most likely have no further impact on the Crypto market. In my opinion it is very likely that the CoinMarketCap team did not realize what a huge influence their website has on coin holders investment decisions.

Their decision certainly makes sense, as prices in Korea are very high because arbitrage remains a very hard thing to do when dealing with the currency of Korea, the Korean Won. This has to do with South Koreans strict anti money laundering policies which make it very hard to convert KRW into USD and vice versa.

Thank you for pointing out these important facts @memekings. They are important to understand the current market sentiment and to estimate further price action. Keep us updated with this great content, I am looking forward to following you!

I was really excited about prices as yesterday, but today I felt terrible. Thanks for clarifying things a bit.

Resteemed

Thank you!

Thanks for the info, was in a bit of a panic until I read your post (that being said, I panic easily). Followed and looking forward to reading your future posts :)

Thanks!