Hello everyone! It's already Saturday, and I have posted this late(like I usually do) but welcome to another Finance Friday Series! Still we see some despair on the crypto markets, and we're still unsure if it did really hit it's bottom! I was really scared that the June close would be possible to reach at sub $5k. Who knows? The market moves where it deems to. Now, let's talk about a debatable topic about investing. Should one take the risk of taking a loan in order to invest?

Leverage

use borrowed capital for (an investment), expecting the profits made to be greater than the interest payable.

In investments, leveraging is effectively used by large institutions like banks and some traders who already have a long and huge experience in the market. This increases their potential return of investments. On the contrary, this also increases their risk of exposure in the market, and of course, when someone gets a loan, he's obliged to pay interest on the amount he borrowed. The main difference between large institutions and you is that they hardly ever get liquidated.

Is it worth the risk?

Cryptocurrencies are known to be the most volatile assets currently available. We have seen Bitcoin go up to twenty times of its yearly open last year, and currently it has dropped close to 70% of its all-time high. If you're investing your own money in these markets, you're already exposed in huge risks. Then, borrowing money in order to invest would even be riskier, some people would say it's suicide.

This is my personal opinion, please really read the disclaimer I put in the bottom of this post. I believe, if managed responsibly, leveraging or borrowing money for investing in the cryptocurrency economy could be worth the risk; provided you know how to use it. If we visit some social media posts, and even here on Steemit, a lot of people took out their savings, 401k and sorts of to invest in crypto when the prices were soaring up. And we could see a lot of them,if not all, lost tons money.

I was one of the guys who took a loan last year to invest in crypto. I took a $200 loan( it was my first few months on my job), and bought Bitcoin when it was at $3000. Lucky, right? Actually no. Given I was really a plebe in the markets, I lost it all. When it hit $3000, it dropped back down to about $1,800 before going on the new highs, and I longed XRP. That loan was payable within 3 months, with an interest of about 20% per month. Because of that bad decision I missed the rally and bought back at the ATH.

I lost money when I loaned for investments, but why do I still think that it's good? Because back then, I had the slightest clue of what I was doing. I was one of them who just thought that the market would never go down, and it burned me real bad. Now that I have more knowledge in the markets work, I could probably use this strategy more effectively. A little disclaimer again, I didn't ask for a new loan to invest these days. It's money I can afford to lose.

Source

How to benefit from it then?

Two weeks ago, I've discussed about hedging and how to protect yourself when the bear market attacks. If you don't have any money anymore to put in the market without selling some of your assets, a loan would save you from taking all those losses. Risk management is the key on how to really make money on every investment, whether it could be the traditional stocks or crypto.

For example, I have bought $500 worth back when bitcoin was $10,000. What I have put is what I could only afford to lose. But I believe that the markets have a higher probability that it will go lower, but Ethereum had reached its bottom(remember when BTC drops most alts will follow, this is just an example). I don't want to sell my Bitcoin, because if I am wrong it could possibly be a high rally. In this case, I could take a loan of about $250 to put in Ethereum(this is my preferable ratio, if I can afford to lose $500, it'll be lesser if its not my money). If I was right, that bitcoin drops and Ethereum rallies, then I have protected atleast half of my investments on the drop. If I was wrong, then I just lost some of the $250 but I have gained some of those losses in the increase in value of my BTC holdings. The point is protecting yourself from greater risk, not taking more of it. If you take a loan and put the same position, then surely you'll lose money like I did.

Another would be indirect borrowing of money, or what we call leverage trading. I know experienced traders who actually earn more when the market drops than when it goes up. The main point is taking positions against your current one. BitMEX offers inverse perpetual swaps on bitcoin. Meaning your collateral is bitcoin, but your positions are priced on the dollar. You can take a 'short' position when you believe the prices go down, to protect your assets on drops. I did this myself from $7.7k down to $7.3k and cashed out right away. I had a 4x position so it made me close to $5-10. Not much but I like to do low leverages rather than going big and getting bust right away.

Source

Always be careful in investing, and if you're uncomfortable, DO NOT DO IT

Just a little end message. Remember we're dealing with real money. If you're uncomfortable on taking losses, then this one really is not for you. Taking a loan for investment is an effective strategy, but it is unadvisable, specially to the new ones in the market. Always do your due diligence. Specially this is a new and unregulated market. Zero value could still be a possibility.

And please, always check the fees associated with your loans/leverages. You might think you were in profit, but you'll be going to get shocked when those kick in

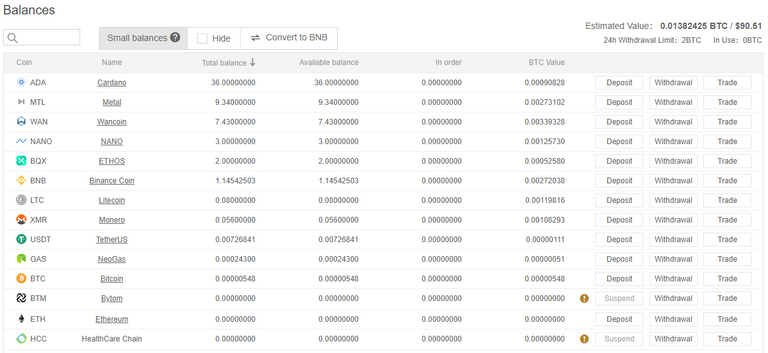

The Portfolio

Actually, I just left it as is. I thought of depositing more on this account, but I believe I'm doing better in writing blog posts here on Steemit, so I just bought Steem and maybe I'll do it on the end of the month. Too late to Tether now. I'll be back on trading actively maybe on the next quarter.

Here's my weekly progress in this series:

Initial investment = 0.01 BTC/$68 (estimate)

Previous week value = 0.01562401 BTC / $118.51

Current week value =0.01382425 / $90.51

Weekly Gains = -11.51% / -23.62%

Total Gains = 38.24% / 33.10%

Interested in trading and haven't traded yet? Try Binance. They trade STEEM too!

You can buy some altcoins not listed on Binance at Kucoin!(Please always check the url and don't get phished!)

Feeling ballsy and wanna do leverage? Save 50% in trading fees! BitMEX allows up to 100x! Don't get burned though, or else the bot will quote your order.

Wanna try Options Trading? Spectre.ai offers options trading with traditional currencies using the Ethereum blockchain! You can try the demo too!

Disclaimer: All information found here, including any ideas, opinions, views, or cryptocurrency picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as an investment signal or a personal investment advice. I am not your financial advisor. Do your own diligence. Investing in cryptocurrencies involves financial risk. Please consult a licensed investment advisor before investing.

Missed the previous weeks? Here's the list

Week 1 | Week 6

Week 2 | Week 7

Week 3 | Week 8

Week 4 | Week 9

Week 5

Banner made from bannersnack.com

Images used have their corresponding sources at the bottom of each one.

I would never take loan for crypto.

It's each one's preference. But it really is risky.

Coins mentioned in post: