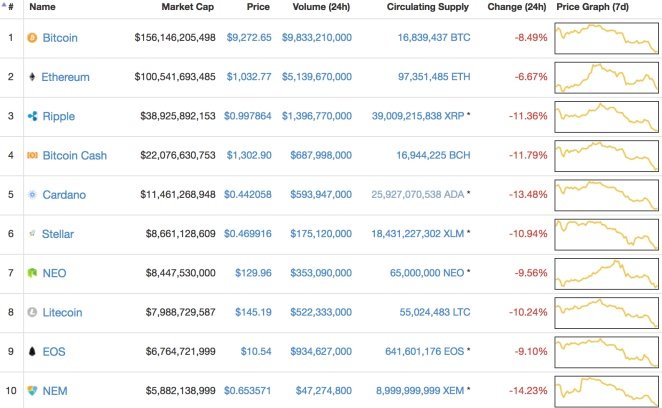

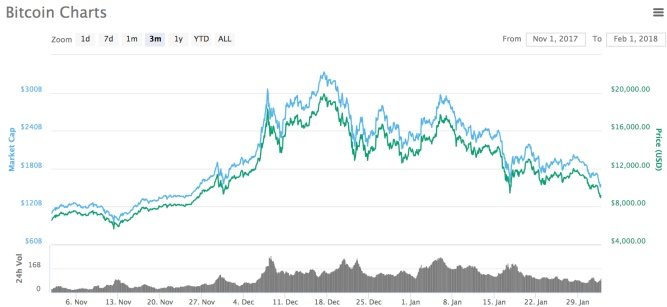

The Crypto financial specialists are seeing red this week.Bitcoin dove to two-month lows on Thursday, plunging underneath $9,000 out of the blue since November. At the season of composing, Bitcoin had skiped move down to the $9,200 level, down from week after week highs simply above $12,000. This week has seen coins no matter how you look at it in the red — a sign that financial specialists are escaping to fiat monetary standards this time as opposed to swapping into altcoins as we've found in the current past.

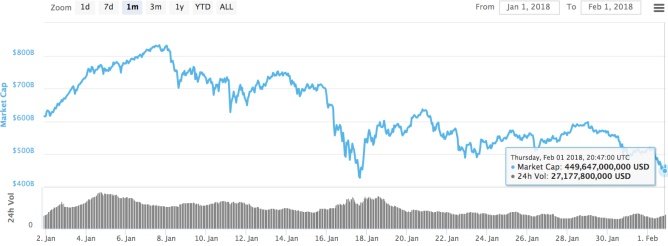

At the season of composing, the aggregate cryptographic money showcase top tipped the scales at $459 billion, down from January highs around $830 billion. It's a withdrawal no doubt, yet not a low throughout the previous 30 days (that low went ahead January 18).

Is this the dramatic finish for Bitcoin? For cryptos? Indeed, no, presumably not. Get your head screwed on right and you'll see that (regardless) numerous coins have seen exceptional development over the most recent a half year to a year, even with Bitcoin's cost split from occasion highs nearer to $20,000. On this day a year ago, Bitcoin was sitting lovely at $982. At the stature of December's fever, most sensible crypto-watchers could concur that the cost was overheated and there was just a single route for it to go for the time being. In any case, in the thick of the present remedy, Bitcoin's more drawn out term development is impossible to say.

Digital currency stalwarts anticipating that the cost should skip back, even somewhat, will see these failing numbers as the ideal section point for getting in low and augmenting picks up. Late theorists who got in amid the mass crypto insanity of the Christmas season aren't probably going to have such enduring hands, a factor that is likely adding to the slide.

So what's making the slide start with? Obviously, nobody thing can be rebuked for Bitcoin's present downturn, yet late restlessness around a subpoena for Bitfinex and worries around Tether — a sort of digital currency partner to USD that matches the dollar coordinated — most likely factor in. Late news that Facebook would boycott promotions for ICOs most likely didn't help either. What's more, it appears like each day another Ponzi plot gets busted, tossing yet more uncertainty on the believability of a lot of not exactly genuine ICOs. Indeed, even past news cycle highs and lows, Bitcoin has seen a couple of mid-January plunges previously, however 2017's Bitcoin conduct positively parted from any occasional examples of the past.

In any case, these developing agonies are a long way from shocking. As digital currencies develop — expecting they keep on doing so — administrative "awful" news will turn out to be more typical. Nations over the globe will keep on struggling to oblige their residents' sudden enthusiasm for computerized monetary forms. In a few nations, just like the instance of India, that is turning out to be a crackdown on ill-conceived action that may likewise influence genuine exchanges. Obviously, features like these move a feeling of premonition among digital money devotees pondering which nation will be beside descended hard. Dread, maybe defended fear for some examiners with bounty to lose, increases each new administrative disclosure. Be that as it may, for cryptographic forms of money to become out of the present trick loaded disorganized period, an exhaustive house keeping is solid.

Bitcoin and different digital forms of money have additionally looked less receptive to positive news in the last 50% of January contrasted with their relative lightness amid December's bewildering highs. At that point, each and every positive news blip appeared to push the costs higher.

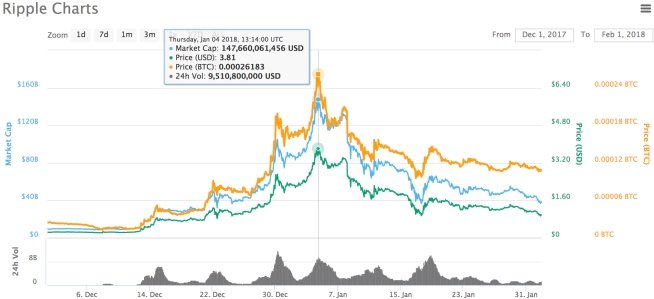

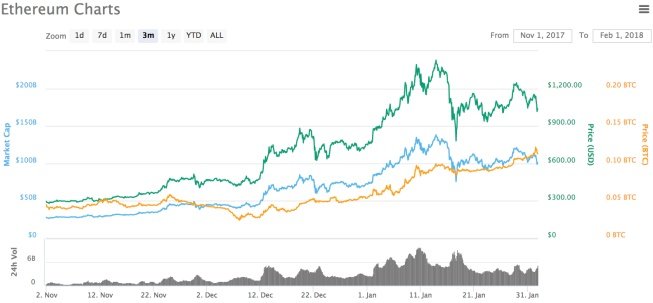

Bitcoin aside, some altcoins may very well alter from overheated, overhyped December highs. Swell is a decent case of this, drifting around $1 Thursday, a value that is five times its November esteem and just looks awful after XRP flew a bit excessively near the sun with sudden early January highs above $3. Ethereum is additionally faring really well, everything considered, down from untouched highs above $1,400 however holding the vast majority of its recently fabricated an incentive in the wake of multiplying in cost from December costs around $500.

It'll be fascinating to perceive what occurs as we move into one week from now's Senate Banking Committee hearings on digital currency. Titled "Virtual Currencies: The Oversight Role of the U.S. Securities and Exchange Commission and the U.S. Item Futures Trading Commission," the open hearings will air on February 6 at 10:00 Eastern time. It's conceivable that the forthcoming talk in Congress has merchants apprehensive, at the end of the day factors from everywhere throughout the globe consolidate to influence the market each day.

Follow @ Mowais843

If you follow ,upvote ,comment and resteem me I will do same

Nie piece od work,

in cryptocurrency markets there is a rule that whatever goes up then it goes down and repeat. Many factors can influence on bitcoin as we could see when the China and Korea banned exchanges in crypto. Then they said that there is no ban at all - the whole red market started normalizing. It was only a politics matter. I hope it will rise again for its ATH.

what do you think?