A new report by research focused cryptocurrency company Clovr, has revealed a significant upsurge in the use of cryptocurrency in remittances across the globe. The study, which surveyed the responses of 707 people sought to delve into their remittance habits, uncovering among other things the destination of transfers, the purpose of the transfers as well as the mediums (including cryptocurrency) by which the money was sent.

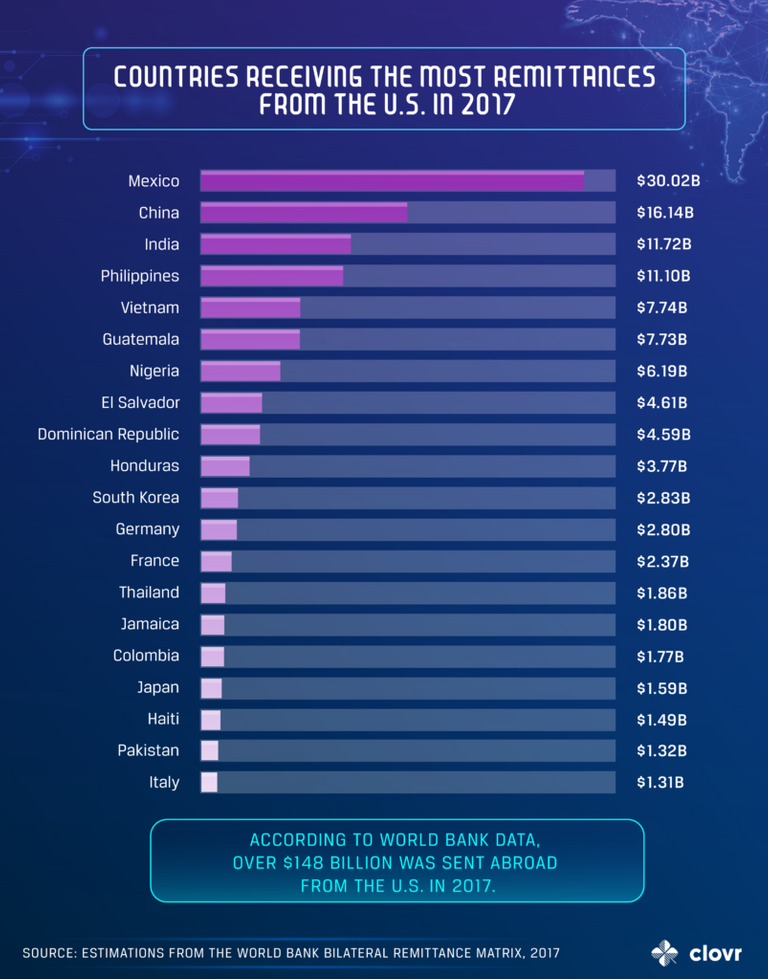

The survey revealed 20 countries receiving most remittances from the U.S. in 2017. The top ten countries represented on this list are in order, Mexico, China, India, Philippines, Vietnam, Guatemala, Nigeria, El Salvador, Dominican Republic and Honduras. Unsurprisingly, the breakdown of these remittances shows family taking the highest percentage at 76.8 percent.

Crypto’s Growing Influence and Possibility for Disruption

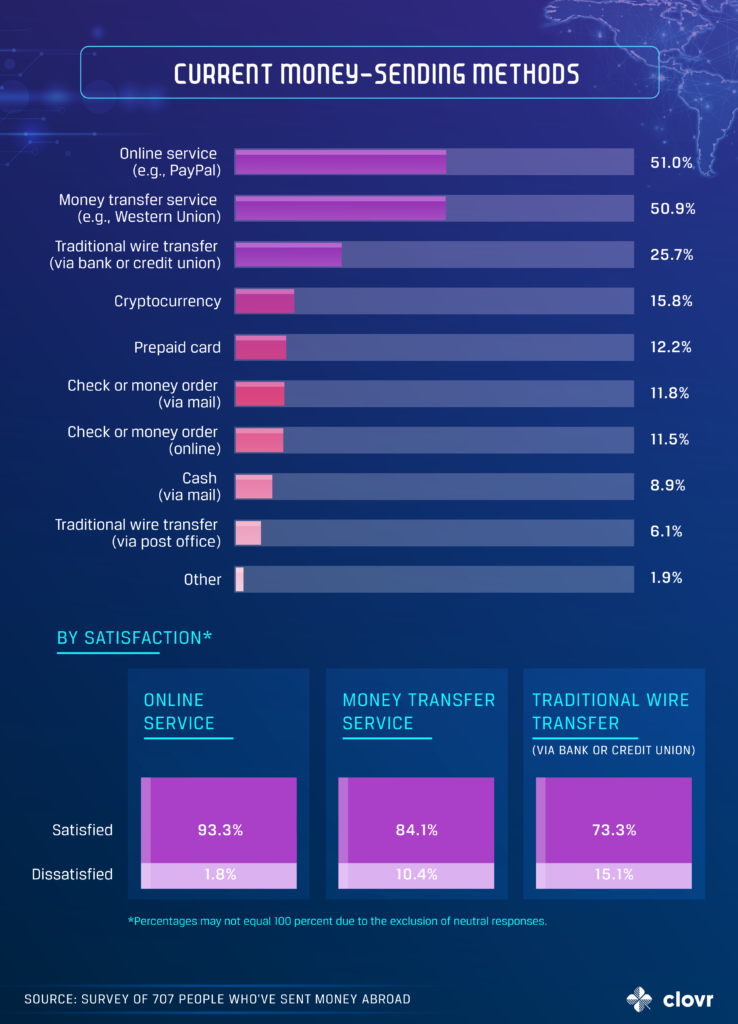

Clovr’s breakdown of money transfer methods shows that roughly half of all surveyed people indicated that they use PayPal and money transfer services like Western Union, compared to 15.8 percent who use cryptocurrency, 25.7 percent who use traditional bank wire transfers or credit union, 12.2 percent who use prepaid cards, 11.8 percent who use check or money order via mail, 11.5 percent who use check or money order online, 8.9 percent who use cash via mail, 6.1 percent who use traditional wire transfer via post office, and 1.9 percent who use other methods.

Source: Clovr

To illustrate the potential of cryptocurrency to create substantial disruption in the space due to its low cost and speed, the study revealed that in order to send $500 abroad, banks charge $52.05 on the average, compared to $30.75 for money transfer operators, $34.05 for the post office and $16 for mobile operators. Customer satisfaction was pegged at 93.3 percent for online services, 84.1 percent at money transfer services and 73.3 percent with traditional wire transfer, via bank or credit union.

Source: Clovr

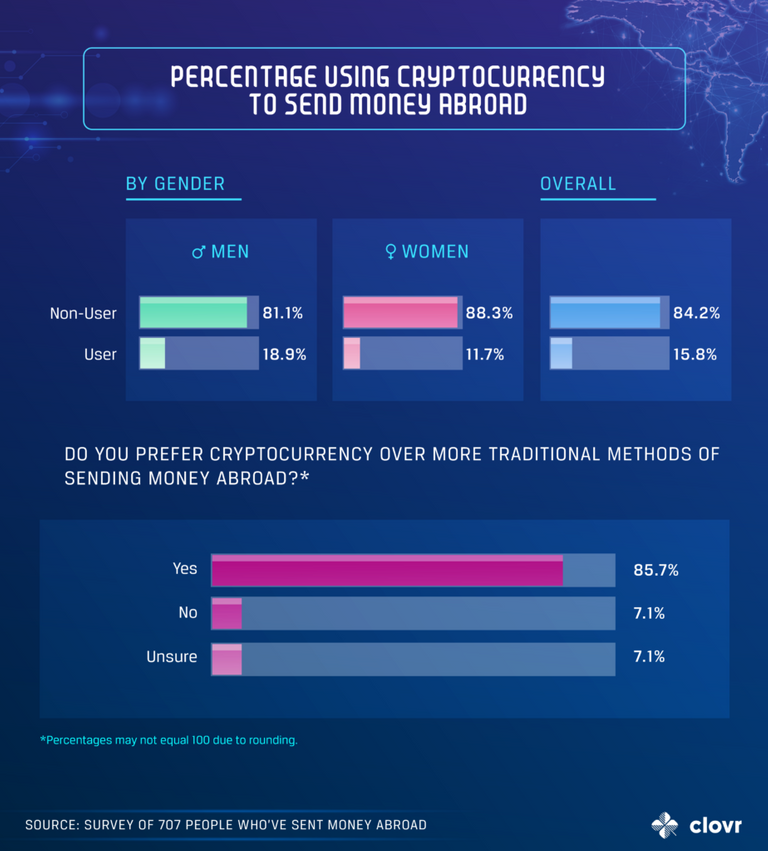

In line with other existing data on cryptocurrency use, the study shows a significant gender knowledge gap on the subject of cryptocurrencies among non-users as men continue to dominate crypto adoption. The study concludes that the money transfer industry is “ripe for disruption” through the introduction of cryptocurrency-based solutions, which could potentially offer a cheaper and faster way to transfer funds.

An excerpt from the report reads:

People sending money home after they’ve migrated from other countries to the United States is a practice that will likely continue far into the future… As individuals look to make sure that as much of every dollar they send can make it back – as close to a one-to-one match as possible – digital payment options, like those presented by cryptocurrencies, can pique the interest of customers.

The full Clovr report is available here.

Featured image from Shutterstock.

Link of article https://www.ccn.com/exploding-cryptocurrency-use-in-remittances-from-us-15-8-now-using-cryptocurrency/

Source

Copying/Pasting full or partial texts without adding anything original is frowned upon by the community. Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Too bad this has no effect on exchange rate

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://finance.yahoo.com/news/exploding-cryptocurrency-remittances-us-15-170032504.html

Congratulations @mrutopian! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: