Something of interest

Another primary source we have today, don't listen to watch the commentary without reading this or at least giving the graphics a skim ;)

https://virtualmarkets.ag.ny.gov/

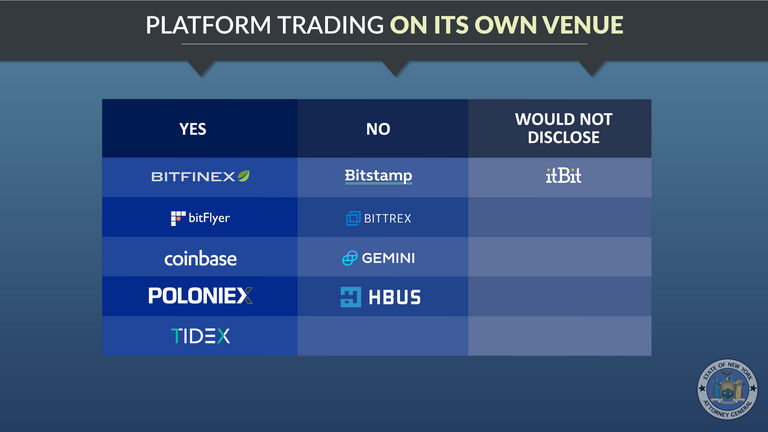

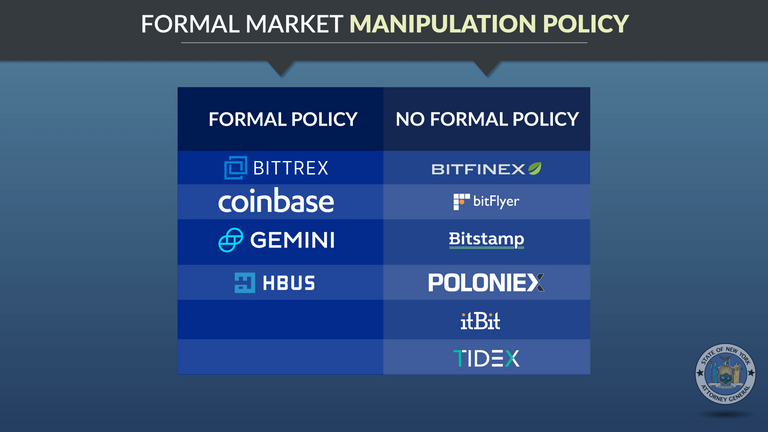

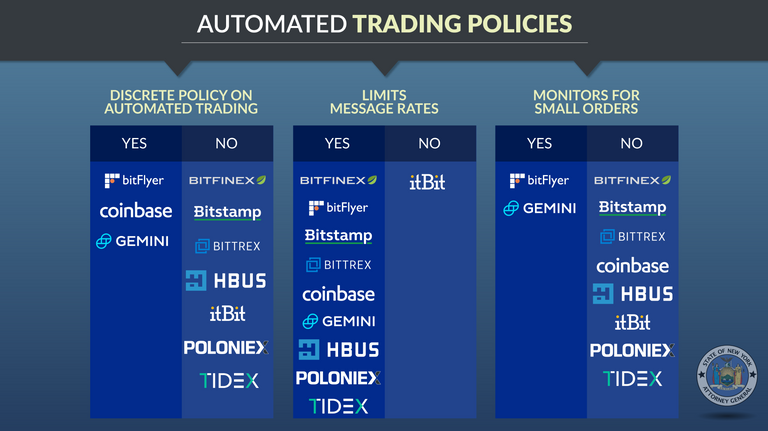

Most of it is pretty much a "No shit" for the people who've been in the space for a while. But there are a few things of note, not least of all that if you assume a certain amount of these numbers are under self-reported by the exchanges, I don't feel REAL great about trading against the exchange on a lot of these to the tune of at least 20% of the exchanges volume in the case of coinbase / gdax, or ones without manipulation policies or ones with bot activity...well guess what that exchange doesn't exist. I'd bet that number of % volume is actually a bit higher, and minimally it tells you why that ~$6000 line is being defended in a strong manner since the beginning of the year. It also is kind of no surprise that the exchanges would be investing in bitcoin themselves speculatively as well... I guess you're natural assumption would be that they would be trading on their own exchange. The other part that is interesting is declaration of bot activity. And the names aren't surprising but they are presented for you.

The Various Business Lines and Operational Roles of Trading Platforms Create Potential Conflicts of Interest. Virtual asset trading platforms often engage in several lines of business that would be restricted or carefully monitored in a traditional trading environment. Platforms often serve (i) as venues of exchange, operating the platform on which buyers and sellers trade virtual and fiat currencies; (ii) in a role akin to a traditional broker-dealer, representing traders and executing trades on their behalf; (iii) as money-transmitters, transferring virtual and fiat currency and converting it from one form to another; (iv) as proprietary traders, buying and selling virtual currency for their own accounts, often on their own platforms; (v) as owners of large virtual currency holdings; and, in some cases, (vi) as issuers of a virtual currency listed on their own and other platforms, with a direct stake in its performance. Additionally, platform employees – who may have access to information about customer orders, new currency listings, and other non-public information – often hold virtual currency and trade on their own or competing platforms. Each role has a markedly different set of incentives, introducing substantial potential for conflicts between the interests of the platform, platform insiders, and platform customers.

Trading Platforms Have Yet to Implement Serious Efforts to Impede Abusive Trading Activity. Though some virtual currency platforms have taken steps to police the fairness of their platforms and safeguard the integrity of their exchange, others have not. Platforms lack robust real-time and historical market surveillance capabilities, like those found in traditional trading venues, to identify and stop suspicious trading patterns. There is no mechanism for analyzing suspicious trading strategies across multiple platforms. Few platforms seriously restrict or even monitor the operation of "bots" or automated algorithmic trading on their venue. Indeed, certain trading platforms deny any responsibility for stopping traders from artificially affecting prices. Those factors, coupled with the concentration of virtual currency in the hands of a relatively small number of major traders, leave the platforms highly susceptible to abuse. Only a small number of platforms have taken meaningful steps to lessen those risks.

Protections for Customer Funds Are Often Limited or Illusory. Generally accepted methods for auditing virtual assets do not exist, and trading platforms lack a consistent and transparent approach to independently auditing the virtual currency purportedly in their possession; several do not claim to do any independent auditing of their virtual currency holdings at all. That makes it difficult or impossible to confirm whether platforms are responsibly holding their customers’ virtual assets as claimed. Customers are highly exposed in the event of a hack or unauthorized withdrawal. While domestic or foreign deposit insurance may compensate customers for certain losses of stolen or misappropriated fiat currency, no similar compensation is available for virtual currency losses. There are serious questions about the scope and sufficiency of the commercial insurance that certain platforms purport to carry to cover virtual asset losses. Other platforms do not insure against virtual asset losses at all.

My highlights: