The fact that there have been irrational market fixations in the past has often been pointed out. One of the best examples is the tulip craze. This was a short lived period in Europe - Holland in particular – that lasted from 1634-1637. At the peak, a single bulb could be sold for an astronomical amount. After the crash bulbs were worth no more than onions. This is why so many illustrations after the bust show people either eating or dumping tulip bulbs. The craze was related to scarcity and clearly not utility in any sense. Tulips were introduced into Europe in the 1590s. The Dutch soon gained control of the market. Shortly after a virus killed many tulips. At the same time the virus offered the promise of new and exciting color forms. Tulip collecting became a hobby of the aristocracy, and many rushed to invest. The craze reached such a level that prices rose precipitously every month. Finally the market was saturated, and there were more sellers than buyers. Panic sales led to losses of fortune. Those who had staked everything on Tulips were destroyed. The whole of Northern Europe was plunged into a depression.

There are many lessons to learn from bubbles of the past. Of course the tulip craze seems silly today. The craze was driven by speculators who could have probably cared less about gardening. They were interested in pure profit, and while the trend was going up there was profit to be made. No one could predict when the crash would occur. Just like crashes before and after the date was a surprise. People in the past were not stupid, but just like today they did not know when to get out of the market.

The reason why tulips were a craze was that by the time the market crashed, there was a realization that ultra-luxury goods like rare plants only appealed to a small share of the market. Simply put, there is no way to compare tulips with crypto currency. The technology of crypto currency is here to stay. There will no doubt be market corrections, even upheavals, but the technology will adapt with time. Once a new technology like water power is introduced there is no going back. By the time the power of steam was being harnessed in Europe, patents allowed individuals to profit from their inventions. As with water power, there was no going back. The big difference is that individual investors can profit from their inventions.

The same will be true of those who create and legally protect crypto currencies. Investors who pick the correct things to invest in, just like investors who got into railways and computers early on, can also make money. Buying and holding a tulip bulb requires gardening skill. Crypto currency in comparison is easy to hoard (with appropriate security measures). Sometimes, in order to profit, you cannot just relax and smell the flowers, you just have to take a risk.

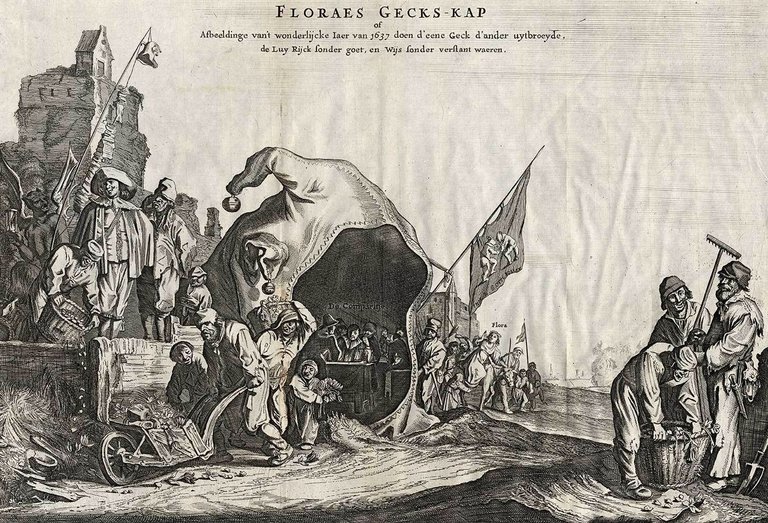

Image from a print titled: “Contemplation on Tulip investing in 1637” from the book The Great Mirror of Folly, Amsterdam, 1720. The images are easy to interpret. There is a large Fool’s cap and many unhappy people getting rid of tulip bulbs.

nice post :)