What is blockchain?

In the non-blockchain world, we keep separate records of transactions. If you write your friend a check, you balance your own checkbook and your friend does the same when they deposit it. But things can go wrong. They might forget to update their checkbook ledger. And each bank has no way to know immediately if the person has enough in their bank account to cover it.

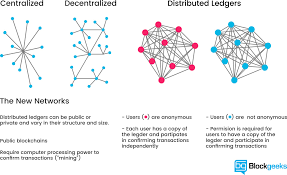

With a blockchain, instead of two separate checkbooks with two records of debits and credits, you'd both look at the same ledger of transactions. It's private (encrypted, in computer-speak), and decentralized, so neither of you controls the ledger.

This "distributed ledger" operates on consensus. Both of you can look at the ledger. Each transaction gets put into a block. If you both say that block is valid and correct, it's added to a chain. And that chain is protected by sophisticated cryptography: No one can change the chain after the fact.

Now imagine this in a more complex form. This is what gets people in finance and technology excited.

Say you want to buy a stock. Right now, your bank, brokerage, the stock exchange, and the company you're buying all have separate, private records of transactions. They can't see each other's ledgers. Nor can they verify that everything is accurate for all involved.

With blockchain, they can all be on the same page - literally.

Your bank can verify that you have enough money to transfer to your brokerage. That transfer is added to the ledger of transactions that everyone involved can see. Then your broker executes a trade for 100 shares. That gets added to the blockchain, too. Everyone involved verifies it's legitimate.

The exchange receives the order - also added and verified. And then the company's shares end up in your account. You could see the record of all the shares you buy and sell in the permanent record. If you decide to sell the shares later, that transaction gets added to the blockchain.

And because it's a consensus model in which every party confirms a transaction, "it gets more secure the more people you add" to the blockchain, Brody said. "When a transaction is completed, everyone has to get a copy of the transaction."

That's blockchain in its purest form. In reality, however, different companies are experimenting with different forms. A blockchain used in financial services could be private, or a hybrid model between the decentralized vision and a more traditional centralized model that bankers are used to. A regulator, for instance, could hold the key to a blockchain, and some companies are thinking about how to maintain a middleman.

Mysterious beginnings

No one knows who invented blockchain. The idea for it came from a paper published online nine years ago that unveiled bitcoin, the digital currency. The author, Satoshi Nakamoto, is thought to be using a pseudonym. The true identity remains a mystery, and there's debate over whether it was created by an individual or group..

At first, bitcoin got all the attention. The idea of a secure, private currency, divorced from a specific government, captured the imaginations of technologists, libertarians, and people concerned about the power of big banks and government regulation. Bitcoin transactions occur peer-to-peer, meaning no government or third party is involved.

Today, bitcoin and blockchain still attract privacy-minded and anti-government types. But it also increasingly appeals to people like Grainne McNamara. She spent years building out the technology at banks like Morgan Stanley and Goldman Sachs. Now she's a leader of PricewaterhouseCooper's blockchain for financial services. And that means she spends a lot of time attending and hosting blockchain conferences.

MARKETS

Blockchain could soon power stock markets, music sales, and health records — here's how it works

Dan BobkoffTina Wadhwa Nov 27, 2017, 11:15 AM ET

ASX Australia Stock Exchange Trader

APASX

Wall Street's biggest institutions are obsessed with blockchain, the technology that powers bitcoin.

Blockchain essentially unifies records simultaneously, speeding things up and also ensuring that everyone has the same information at the same time.

Australia's stock exchange operator is working on a trade settlement system using the technology and should decide by the end of 2017 if it will be implemented.

Blockchain's champions say the technology could be used to tackle everything from music piracy to sex trafficking.

It could also be a way to improve record keeping in healthcare, giving doctors, insurance companies and hospitals access to the same, up-to-date information at all times.

It's a technology conceived by the mysterious creator of bitcoin - the digital currency championed by a motley crew of privacy-obsessed libertarians, social activists, and some criminals.

Now the idea of blockchain has gripped Wall Street's biggest institutions.

Its enthusiasts think it could change the world. Sure, it would make contracts more enforceable and speed up the settlement of stock trades - hence the interest from big banks. But some see it going much further, cracking down on sex trafficking, music piracy, and child labor.

And the key to all that - what attracts these different factions - is something that, on the surface at least, sounds rather banal: a digital ledger, like the one in your checkbook.

"Blockchain is a truly extraordinary technology that does really mundane things," said Paul Brody, Ernst & Young's global blockchain leader.

But for all the promise, these big questions remain: Who will foot the bill, and is it really as secure as supporters say?

What is blockchain?

In the non-blockchain world, we keep separate records of transactions. If you write your friend a check, you balance your own checkbook and your friend does the same when they deposit it. But things can go wrong. They might forget to update their checkbook ledger. And each bank has no way to know immediately if the person has enough in their bank account to cover it.

checkbook, checks, writing a check

Flickr / oblivion9999

With a blockchain, instead of two separate checkbooks with two records of debits and credits, you'd both look at the same ledger of transactions. It's private (encrypted, in computer-speak), and decentralized, so neither of you controls the ledger.

This "distributed ledger" operates on consensus. Both of you can look at the ledger. Each transaction gets put into a block. If you both say that block is valid and correct, it's added to a chain. And that chain is protected by sophisticated cryptography: No one can change the chain after the fact.

Now imagine this in a more complex form. This is what gets people in finance and technology excited.

Say you want to buy a stock. Right now, your bank, brokerage, the stock exchange, and the company you're buying all have separate, private records of transactions. They can't see each other's ledgers. Nor can they verify that everything is accurate for all involved.

With blockchain, they can all be on the same page - literally.

Your bank can verify that you have enough money to transfer to your brokerage. That transfer is added to the ledger of transactions that everyone involved can see. Then your broker executes a trade for 100 shares. That gets added to the blockchain, too. Everyone involved verifies it's legitimate.

The exchange receives the order - also added and verified. And then the company's shares end up in your account. You could see the record of all the shares you buy and sell in the permanent record. If you decide to sell the shares later, that transaction gets added to the blockchain.

And because it's a consensus model in which every party confirms a transaction, "it gets more secure the more people you add" to the blockchain, Brody said. "When a transaction is completed, everyone has to get a copy of the transaction."

That's blockchain in its purest form. In reality, however, different companies are experimenting with different forms. A blockchain used in financial services could be private, or a hybrid model between the decentralized vision and a more traditional centralized model that bankers are used to. A regulator, for instance, could hold the key to a blockchain, and some companies are thinking about how to maintain a middleman.

Mysterious beginnings

No one knows who invented blockchain. The idea for it came from a paper published online nine years ago that unveiled bitcoin, the digital currency. The author, Satoshi Nakamoto, is thought to be using a pseudonym. The true identity remains a mystery, and there's debate over whether it was created by an individual or group.

At first, bitcoin got all the attention. The idea of a secure, private currency, divorced from a specific government, captured the imaginations of technologists, libertarians, and people concerned about the power of big banks and government regulation. Bitcoin transactions occur peer-to-peer, meaning no government or third party is involved.

Goldman Sachs recruiting video

YouTube/Goldman SachsGoldman Sachs

Today, bitcoin and blockchain still attract privacy-minded and anti-government types. But it also increasingly appeals to people like Grainne McNamara. She spent years building out the technology at banks like Morgan Stanley and Goldman Sachs. Now she's a leader of PricewaterhouseCooper's blockchain for financial services. And that means she spends a lot of time attending and hosting blockchain conferences.

At one, a speaker showed a picture of a shed in his presentation. McNamara remembers him jokingly saying, "Take the bankers behind the shed and kill them." He didn't know his audience.

McNamara was sitting next to former bankers, who found the whole thing humorous, she said.

Despite the shed metaphor, "it's a peaceful cohabitation," McNamara told Business Insider. "People genuinely appreciate the disruptive element to spawn innovation."

Very simple, his name is Satoshi Nakamoto, Father of Blockchain Technology!!!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.businessinsider.com/what-is-blockchain-2016-10